Indie hacking involves entrepreneurs building self-sustaining businesses independently, emphasizing bootstrapping and creative problem-solving without external funding. In contrast, venture capital relies on attracting significant investment to scale rapidly, often demanding equity and growth strategies aligned with investor expectations. Explore the key differences and benefits of indie hacking versus venture capital to determine the best path for your entrepreneurial journey.

Why it is important

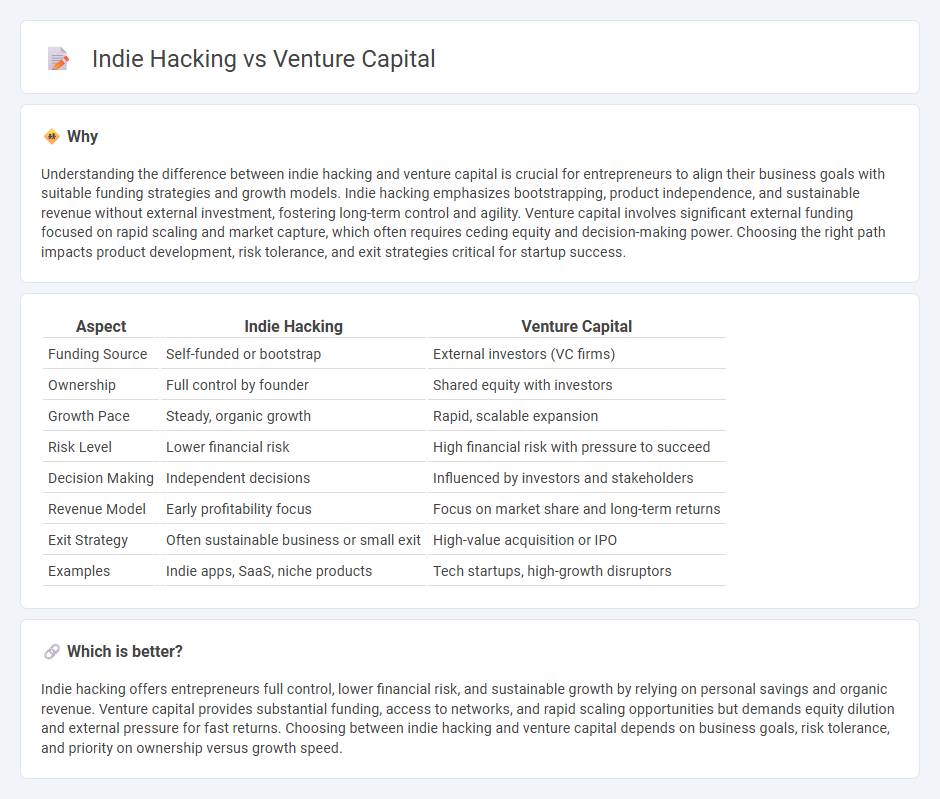

Understanding the difference between indie hacking and venture capital is crucial for entrepreneurs to align their business goals with suitable funding strategies and growth models. Indie hacking emphasizes bootstrapping, product independence, and sustainable revenue without external investment, fostering long-term control and agility. Venture capital involves significant external funding focused on rapid scaling and market capture, which often requires ceding equity and decision-making power. Choosing the right path impacts product development, risk tolerance, and exit strategies critical for startup success.

Comparison Table

| Aspect | Indie Hacking | Venture Capital |

|---|---|---|

| Funding Source | Self-funded or bootstrap | External investors (VC firms) |

| Ownership | Full control by founder | Shared equity with investors |

| Growth Pace | Steady, organic growth | Rapid, scalable expansion |

| Risk Level | Lower financial risk | High financial risk with pressure to succeed |

| Decision Making | Independent decisions | Influenced by investors and stakeholders |

| Revenue Model | Early profitability focus | Focus on market share and long-term returns |

| Exit Strategy | Often sustainable business or small exit | High-value acquisition or IPO |

| Examples | Indie apps, SaaS, niche products | Tech startups, high-growth disruptors |

Which is better?

Indie hacking offers entrepreneurs full control, lower financial risk, and sustainable growth by relying on personal savings and organic revenue. Venture capital provides substantial funding, access to networks, and rapid scaling opportunities but demands equity dilution and external pressure for fast returns. Choosing between indie hacking and venture capital depends on business goals, risk tolerance, and priority on ownership versus growth speed.

Connection

Indie hacking and venture capital intersect as indie hackers often start bootstrapped projects that, upon demonstrating strong market validation, attract venture capital investments to scale growth rapidly. Venture capital provides the financial resources and strategic support needed for indie hackers to accelerate product development, expand their teams, and access broader networks. This connection enables early-stage startups to transition from self-funded experimentation to structured growth phases backed by institutional funding.

Key Terms

Funding

Venture capital offers significant funding sources, often enabling startups to scale rapidly with millions in investment from institutional investors and venture capital firms. Indie hacking revolves around self-funding or bootstrapping, relying on personal savings, customer revenue, and small-scale investments to maintain control and reduce financial risk. Explore key differences in funding strategies and growth potential to determine the best path for your startup.

Ownership

Venture capital funding often requires startups to give up significant ownership stakes in exchange for large capital investments, impacting founders' control over their companies. Indie hacking allows entrepreneurs to maintain full ownership and control by relying on personal savings, revenue, or small-scale funding without external investors. Explore deeper insights on how ownership dynamics shape startup growth and decision-making strategies.

Scalability

Venture capital emphasizes rapid scalability through significant funding rounds, enabling startups to expand quickly and capture large market shares. Indie hacking prioritizes sustainable growth by leveraging limited resources, often relying on organic methods like bootstrapping and direct customer engagement. Explore further to understand which growth strategy aligns best with your entrepreneurial goals.

Source and External Links

What is Venture Capital? - Venture capital is a type of financing that supports high-growth startups and turns ideas into transformative products and services, providing critical risk capital and strategic support that helps companies grow and create jobs over a long timeframe, typically through dedicated partnership agreements.

Fund your business | U.S. Small Business Administration - Venture capital is funding given in exchange for equity and active involvement in the company, focusing on high-growth firms, involving higher risk but with potentially higher returns and typically requiring entrepreneurs to share ownership and control.

What is venture capital? - Silicon Valley Bank - Venture capital provides early-stage companies with equity investments, taking minority stakes and accepting high risk in hopes of outsized returns, fueling innovation and economic growth despite the possibility of losing the full investment on most deals.

dowidth.com

dowidth.com