Micro private equity focuses on investing in smaller, often under-the-radar businesses with high growth potential, while traditional private equity targets larger, more established firms with proven market positions. Entrepreneurs seeking tailored capital solutions may find micro private equity offers more flexible, hands-on support compared to the structured approach of traditional private equity. Explore the key differences and advantages of each to determine the best fit for your entrepreneurial venture.

Why it is important

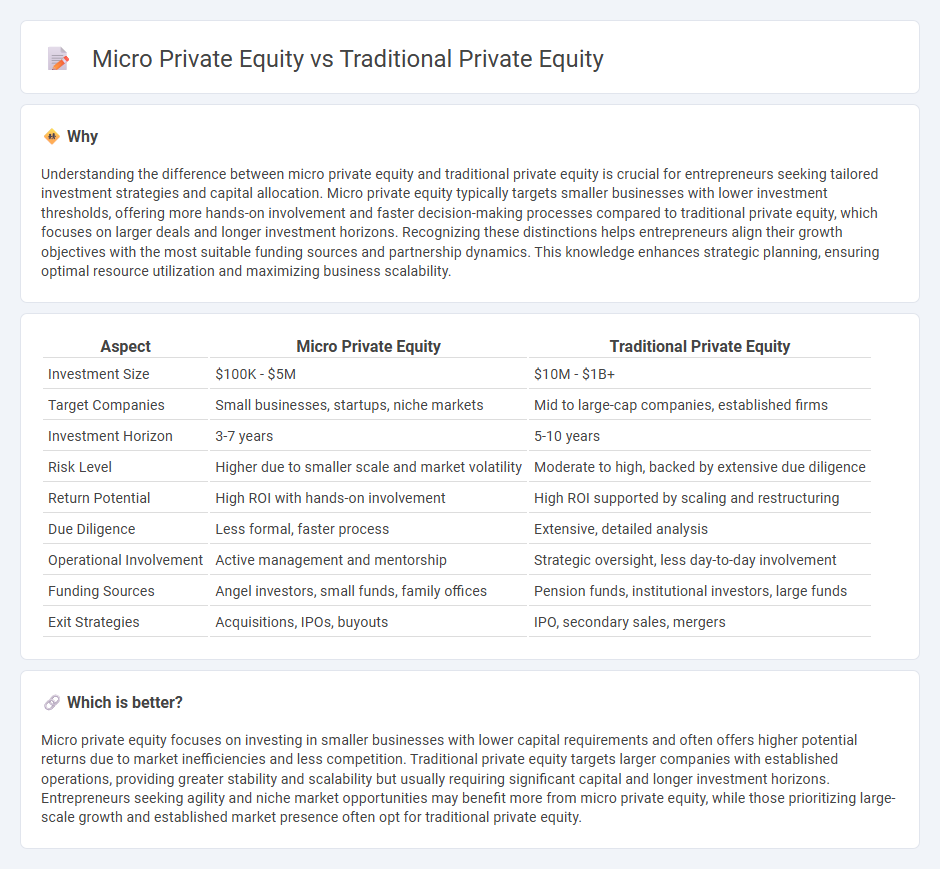

Understanding the difference between micro private equity and traditional private equity is crucial for entrepreneurs seeking tailored investment strategies and capital allocation. Micro private equity typically targets smaller businesses with lower investment thresholds, offering more hands-on involvement and faster decision-making processes compared to traditional private equity, which focuses on larger deals and longer investment horizons. Recognizing these distinctions helps entrepreneurs align their growth objectives with the most suitable funding sources and partnership dynamics. This knowledge enhances strategic planning, ensuring optimal resource utilization and maximizing business scalability.

Comparison Table

| Aspect | Micro Private Equity | Traditional Private Equity |

|---|---|---|

| Investment Size | $100K - $5M | $10M - $1B+ |

| Target Companies | Small businesses, startups, niche markets | Mid to large-cap companies, established firms |

| Investment Horizon | 3-7 years | 5-10 years |

| Risk Level | Higher due to smaller scale and market volatility | Moderate to high, backed by extensive due diligence |

| Return Potential | High ROI with hands-on involvement | High ROI supported by scaling and restructuring |

| Due Diligence | Less formal, faster process | Extensive, detailed analysis |

| Operational Involvement | Active management and mentorship | Strategic oversight, less day-to-day involvement |

| Funding Sources | Angel investors, small funds, family offices | Pension funds, institutional investors, large funds |

| Exit Strategies | Acquisitions, IPOs, buyouts | IPO, secondary sales, mergers |

Which is better?

Micro private equity focuses on investing in smaller businesses with lower capital requirements and often offers higher potential returns due to market inefficiencies and less competition. Traditional private equity targets larger companies with established operations, providing greater stability and scalability but usually requiring significant capital and longer investment horizons. Entrepreneurs seeking agility and niche market opportunities may benefit more from micro private equity, while those prioritizing large-scale growth and established market presence often opt for traditional private equity.

Connection

Micro private equity and traditional private equity both invest in private companies to generate returns, but micro private equity targets smaller businesses with enterprise values typically under $50 million, focusing on highly fragmented markets. Both strategies deploy capital through structured buyouts, aiming to improve operational efficiency and drive growth, leveraging hands-on management expertise. This connection allows micro private equity to serve as a feeder into traditional private equity by scaling companies to sizes attractive for larger buyouts and institutional investments.

Key Terms

Deal Size

Traditional private equity firms typically target deal sizes ranging from $100 million to several billion dollars, focusing on established companies with significant market presence. Micro private equity deals generally involve investments under $50 million, concentrating on smaller, often family-owned or niche businesses with high growth potential. Explore more about how deal size shapes investment strategies in private equity sectors.

Investment Horizon

Traditional private equity funds typically maintain an investment horizon of five to ten years, aiming for significant value creation through operational improvements and strategic growth before exit. Micro private equity, by contrast, often has a shorter investment horizon of three to seven years, focusing on niche markets or smaller businesses with quicker turnaround potential. Explore deeper insights into how these differing timelines impact fund strategy and returns.

Operational Involvement

Traditional private equity firms typically invest larger sums in established companies, focusing on financial restructuring and strategic growth with limited day-to-day operational involvement. Micro private equity targets smaller businesses, often emphasizing hands-on operational improvements and active management to drive value creation. Explore the distinct operational approaches and impacts of these investment strategies to understand their unique advantages.

Source and External Links

An Introduction to Private Equity Basics - Traditional private equity involves equity or equity-like investments in private companies with portfolio companies held for years and exited through sales or IPOs; this asset class is illiquid and distinct from traditional public stock or bond investments.

Private Equity: Definition & How it Works - Traditional private equity firms raise funds to acquire majority stakes in companies, often using leverage, aiming to improve business performance and exit profitably via sales or IPOs, following the leveraged buyout model.

Private equity - Wikipedia - Traditional private equity originated in the 1970s as an institutional asset class where investors allocate capital indirectly via funds managed by general partners to pursue risk-adjusted returns superior to public equity markets.

dowidth.com

dowidth.com