Acquihires involve companies purchasing startups primarily to recruit skilled teams, focusing on talent acquisition rather than product or market expansion. Corporate venture capital (CVC) entails established corporations investing in startups to gain strategic market insights, foster innovation, and access new technologies. Explore the differences between acquihire and corporate venture capital to optimize your entrepreneurial growth strategy.

Why it is important

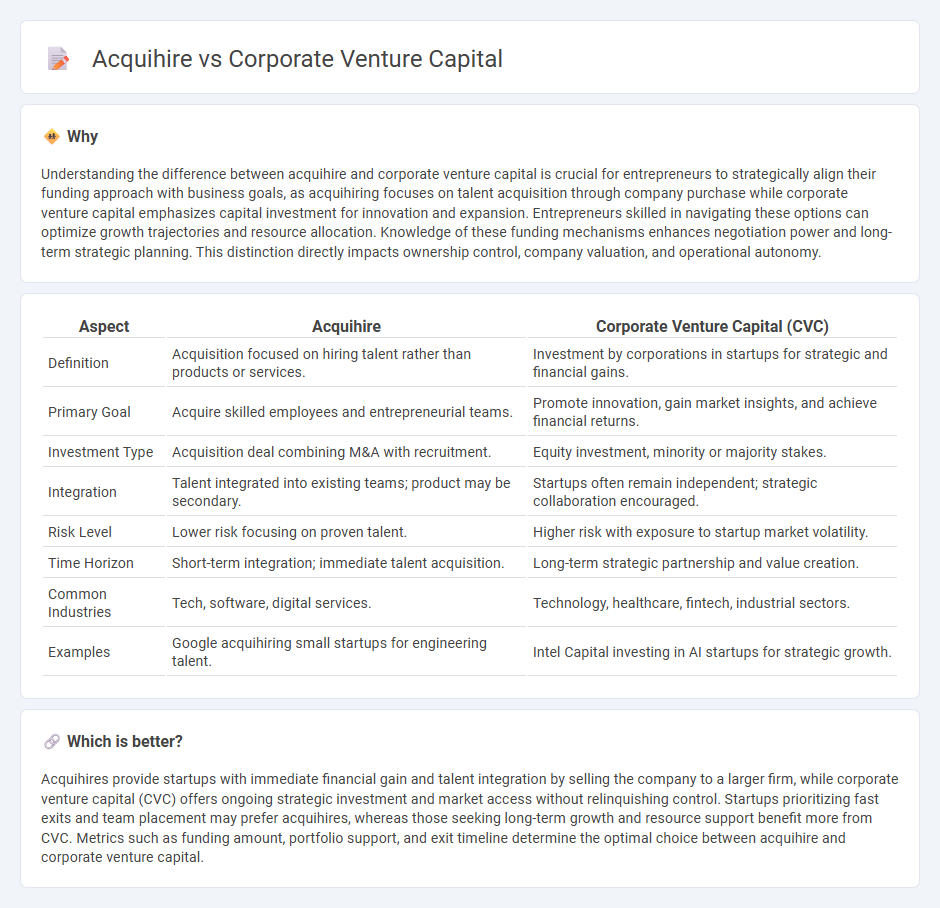

Understanding the difference between acquihire and corporate venture capital is crucial for entrepreneurs to strategically align their funding approach with business goals, as acquihiring focuses on talent acquisition through company purchase while corporate venture capital emphasizes capital investment for innovation and expansion. Entrepreneurs skilled in navigating these options can optimize growth trajectories and resource allocation. Knowledge of these funding mechanisms enhances negotiation power and long-term strategic planning. This distinction directly impacts ownership control, company valuation, and operational autonomy.

Comparison Table

| Aspect | Acquihire | Corporate Venture Capital (CVC) |

|---|---|---|

| Definition | Acquisition focused on hiring talent rather than products or services. | Investment by corporations in startups for strategic and financial gains. |

| Primary Goal | Acquire skilled employees and entrepreneurial teams. | Promote innovation, gain market insights, and achieve financial returns. |

| Investment Type | Acquisition deal combining M&A with recruitment. | Equity investment, minority or majority stakes. |

| Integration | Talent integrated into existing teams; product may be secondary. | Startups often remain independent; strategic collaboration encouraged. |

| Risk Level | Lower risk focusing on proven talent. | Higher risk with exposure to startup market volatility. |

| Time Horizon | Short-term integration; immediate talent acquisition. | Long-term strategic partnership and value creation. |

| Common Industries | Tech, software, digital services. | Technology, healthcare, fintech, industrial sectors. |

| Examples | Google acquihiring small startups for engineering talent. | Intel Capital investing in AI startups for strategic growth. |

Which is better?

Acquihires provide startups with immediate financial gain and talent integration by selling the company to a larger firm, while corporate venture capital (CVC) offers ongoing strategic investment and market access without relinquishing control. Startups prioritizing fast exits and team placement may prefer acquihires, whereas those seeking long-term growth and resource support benefit more from CVC. Metrics such as funding amount, portfolio support, and exit timeline determine the optimal choice between acquihire and corporate venture capital.

Connection

Acquihire involves established companies acquiring startups primarily to gain skilled talent, which often complements corporate venture capital (CVC) strategies focused on investing in innovative startups to foster growth and gain market insights. CVC arms provide strategic funding and mentorship, increasing the startup's value and making it an attractive target for an acquihire. This synergy accelerates corporate innovation by integrating entrepreneurial talent and cutting-edge technologies within established organizations.

Key Terms

Strategic Investment

Corporate venture capital (CVC) involves strategic investments by established companies into startups, aiming to foster innovation, gain market insights, and access emerging technologies. Acquihire focuses on acquiring startups primarily for their talent rather than products, enabling companies to quickly expand skilled teams. Explore the advantages and strategic implications of both corporate venture capital and acquihire to enhance your business growth strategies.

Talent Acquisition

Corporate venture capital (CVC) focuses on strategic investments in startups to gain market insights and drive innovation, while acquihires prioritize acquiring talent by purchasing companies primarily for their skilled employees. CVC aims to create long-term value through financial returns and industry partnerships, whereas acquihires provide immediate access to specialized teams to accelerate internal projects. Explore how these approaches shape talent acquisition strategies in the corporate ecosystem.

Intellectual Property

Corporate venture capital (CVC) focuses on strategic investments in startups to gain access to innovative technologies and intellectual property (IP) that align with the corporation's long-term goals. Acquihires prioritize acquiring talent by purchasing startups primarily for their skilled employees rather than their IP assets or product lines. Explore the differences in how IP is valued and leveraged in CVC and acquihire strategies to optimize your corporate growth approach.

Source and External Links

Corporate Venturing - Definition, Benefits, Examples - Corporate venture capital (CVC) is the practice where large companies directly invest corporate funds into external startup companies to gain competitive advantages and access new innovations, usually combining financial and strategic goals.

Corporate Venture Capital vs Traditional VCs: Key Differences and Benefits - CVCs invest in startups aligned with their strategic interests, differing from traditional venture capital by emphasizing both financial returns and competitive advantage, and typically involving close operational collaboration with the startup.

Corporate venture capital - Wikipedia - Corporate venture capital is a subset of venture capital where corporate funds are invested directly into startups, with the corporate investor often providing management and marketing expertise to gain specific competitive advantages.

dowidth.com

dowidth.com