Entrepreneurship often contrasts passive income streams with service-based income, highlighting different approaches to financial growth and workload management. Passive income, generated through assets like rental properties or digital products, requires upfront effort but minimal ongoing involvement, while service-based income depends continuously on active time and expertise, such as consulting or freelancing. Explore these income models in depth to optimize your entrepreneurial ventures and achieve sustainable financial success.

Why it is important

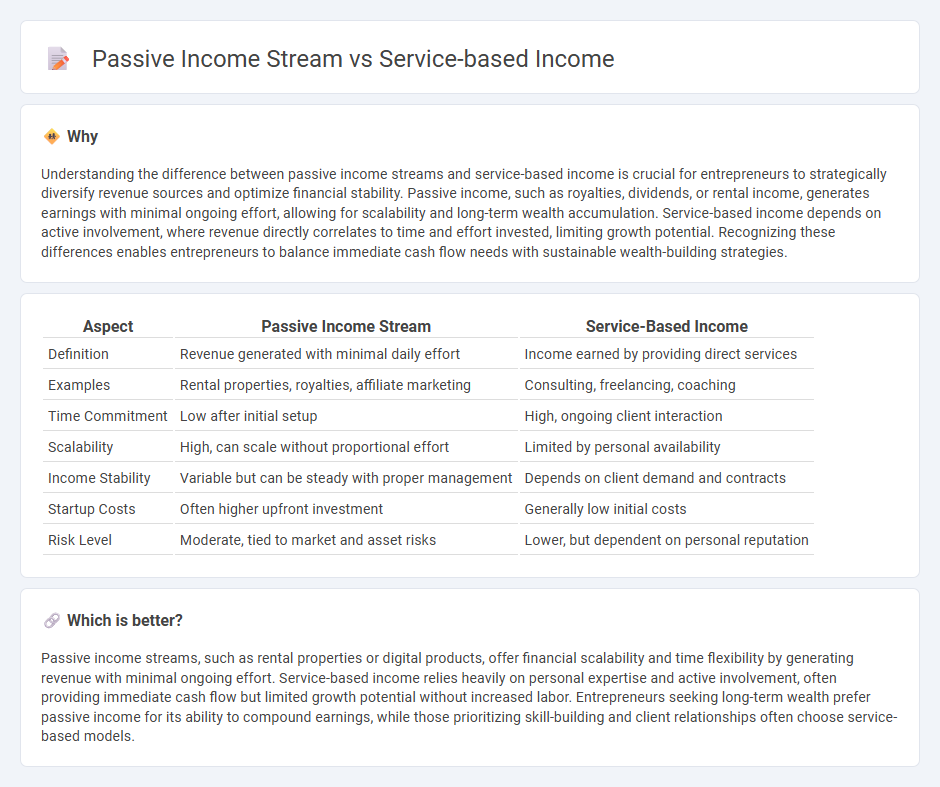

Understanding the difference between passive income streams and service-based income is crucial for entrepreneurs to strategically diversify revenue sources and optimize financial stability. Passive income, such as royalties, dividends, or rental income, generates earnings with minimal ongoing effort, allowing for scalability and long-term wealth accumulation. Service-based income depends on active involvement, where revenue directly correlates to time and effort invested, limiting growth potential. Recognizing these differences enables entrepreneurs to balance immediate cash flow needs with sustainable wealth-building strategies.

Comparison Table

| Aspect | Passive Income Stream | Service-Based Income |

|---|---|---|

| Definition | Revenue generated with minimal daily effort | Income earned by providing direct services |

| Examples | Rental properties, royalties, affiliate marketing | Consulting, freelancing, coaching |

| Time Commitment | Low after initial setup | High, ongoing client interaction |

| Scalability | High, can scale without proportional effort | Limited by personal availability |

| Income Stability | Variable but can be steady with proper management | Depends on client demand and contracts |

| Startup Costs | Often higher upfront investment | Generally low initial costs |

| Risk Level | Moderate, tied to market and asset risks | Lower, but dependent on personal reputation |

Which is better?

Passive income streams, such as rental properties or digital products, offer financial scalability and time flexibility by generating revenue with minimal ongoing effort. Service-based income relies heavily on personal expertise and active involvement, often providing immediate cash flow but limited growth potential without increased labor. Entrepreneurs seeking long-term wealth prefer passive income for its ability to compound earnings, while those prioritizing skill-building and client relationships often choose service-based models.

Connection

Passive income streams often complement service-based income by providing financial stability and scalability for entrepreneurs. Service-based businesses can leverage passive income through digital products, memberships, or automated client acquisition systems. This connection allows entrepreneurs to diversify revenue, reduce reliance on active labor, and increase overall profitability.

Key Terms

Active Involvement

Service-based income requires active involvement, relying heavily on time and effort to deliver expertise, consulting, or freelance work. Passive income streams generate earnings with minimal ongoing activity, such as investments, rental properties, or digital products. Explore strategies to balance these income types and maximize financial growth.

Scalability

Service-based income relies heavily on time and expertise, limiting scalability as revenue often correlates directly with hours worked. Passive income streams, such as royalties, investments, or automated digital products, offer higher scalability by generating revenue with minimal ongoing effort. Explore effective strategies to maximize your income scalability through passive income models.

Automation

Service-based income typically requires active involvement, with revenue generated through delivering expertise or labor, often limiting scalability without additional effort. Passive income streams, enhanced by automation technologies such as AI-powered workflows and digital marketing tools, enable earnings with minimal ongoing input, maximizing efficiency and growth potential. Explore advanced automation strategies to transform your income sources and achieve financial freedom.

Source and External Links

4 Types of Income You Can Create in Your Service Based Business - Service-based income includes active income from one-on-one client work and leveraged income from group services like coaching or workshops, allowing for scalable earnings beyond trading time for money.

What Is Service Revenue And How To Calculate It? - Service revenue is income earned from providing intangible services such as consulting, maintenance, or marketing, and it can be a primary or supplementary source of income with potential for recurring revenue streams.

What is Service Revenue? - DealHub - Service revenue refers to net income derived from services rather than product sales, common examples include consulting fees, software implementation, and marketing services, crucial for understanding a business's financial health.

dowidth.com

dowidth.com