Micro private equity involves raising external capital to acquire and grow small businesses, leveraging investor funds and professional management for accelerated expansion and risk sharing. Self-funded search requires entrepreneurs to independently finance their search and acquisition process, maintaining full control but assuming higher personal financial risk. Explore the advantages and challenges of each approach to determine the best path for your entrepreneurial journey.

Why it is important

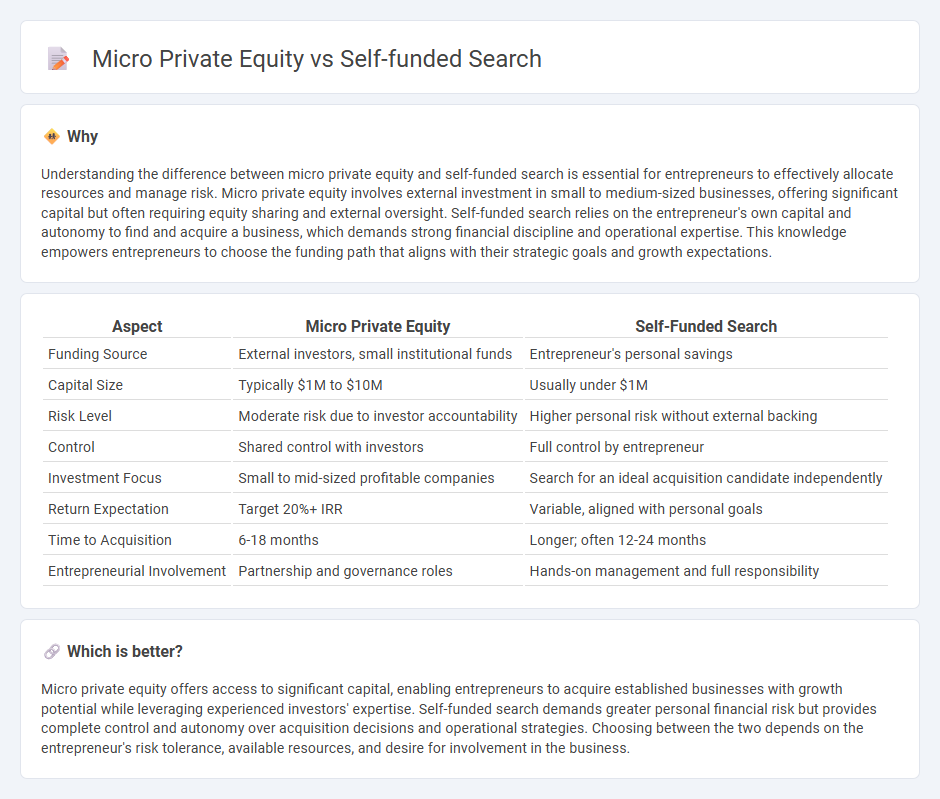

Understanding the difference between micro private equity and self-funded search is essential for entrepreneurs to effectively allocate resources and manage risk. Micro private equity involves external investment in small to medium-sized businesses, offering significant capital but often requiring equity sharing and external oversight. Self-funded search relies on the entrepreneur's own capital and autonomy to find and acquire a business, which demands strong financial discipline and operational expertise. This knowledge empowers entrepreneurs to choose the funding path that aligns with their strategic goals and growth expectations.

Comparison Table

| Aspect | Micro Private Equity | Self-Funded Search |

|---|---|---|

| Funding Source | External investors, small institutional funds | Entrepreneur's personal savings |

| Capital Size | Typically $1M to $10M | Usually under $1M |

| Risk Level | Moderate risk due to investor accountability | Higher personal risk without external backing |

| Control | Shared control with investors | Full control by entrepreneur |

| Investment Focus | Small to mid-sized profitable companies | Search for an ideal acquisition candidate independently |

| Return Expectation | Target 20%+ IRR | Variable, aligned with personal goals |

| Time to Acquisition | 6-18 months | Longer; often 12-24 months |

| Entrepreneurial Involvement | Partnership and governance roles | Hands-on management and full responsibility |

Which is better?

Micro private equity offers access to significant capital, enabling entrepreneurs to acquire established businesses with growth potential while leveraging experienced investors' expertise. Self-funded search demands greater personal financial risk but provides complete control and autonomy over acquisition decisions and operational strategies. Choosing between the two depends on the entrepreneur's risk tolerance, available resources, and desire for involvement in the business.

Connection

Micro private equity involves investing in small, often family-owned businesses with growth potential, closely aligning with self-funded search where entrepreneurs independently finance the acquisition process. Self-funded searchers target businesses that fit specific investment criteria, reducing reliance on external capital and allowing for agile decision-making in niche markets. This synergy facilitates efficient capital deployment and hands-on management, driving value creation in underexplored sectors.

Key Terms

Bootstrapping

Self-funded search relies heavily on bootstrapping by using personal savings and minimal external capital to acquire and operate a business, emphasizing lean strategies and organic growth. Micro private equity typically involves managing a fund that pools capital from limited partners to invest in lower middle-market companies, allowing for more substantial financial resources but less founder control. Explore the detailed advantages and challenges of bootstrapping in self-funded searches to determine the best path for entrepreneurial success.

Equity Ownership

Self-funded search involves entrepreneurs using personal capital to identify and acquire a single company, retaining majority equity ownership and control throughout the process. Micro private equity firms manage pooled funds to invest in multiple smaller companies, resulting in shared equity among limited partners and general partners. Discover more insights on the strategic differences in equity structures between these investment approaches.

Deal Sourcing

Self-funded search funds primarily leverage personal networks and proprietary sector expertise to identify unique deal opportunities often overlooked by traditional channels. Micro private equity firms utilize a broader network of intermediaries, proprietary databases, and analytics tools to source a diverse pipeline of small to mid-market acquisitions. Discover the strategic nuances and advantages of each approach in deal sourcing to enhance your investment decisions.

Source and External Links

Self-funded vs. Traditional Search Funds: What's the Difference? - Self-funded searchers use their own or close network's money for the search, tend to make smaller acquisitions with a majority equity stake, and bear more financial risk compared to traditional searchers who raise institutional funds and take smaller equity stakes.

How Much to Budget for a Self-Funded Search - Self-funded searchers should budget about $100K-$125K in liquidity for local searches and $200K-$225K for national searches to cover search, deal, and equity costs over a typical timeline of up to 23 months.

Self-Funded Search Study - SIG Partners - The first dedicated study collecting data and insights from active and former self-funded searchers to inform the self-funded search community and compare to traditional search fund data.

dowidth.com

dowidth.com