Exit planning focuses on preparing a business for sale or transfer to maximize valuation and ensure smooth ownership transition. Scaling strategy aims at expanding operations, increasing market share, and driving sustainable growth for long-term success. Discover how mastering both approaches can empower entrepreneurial decision-making.

Why it is important

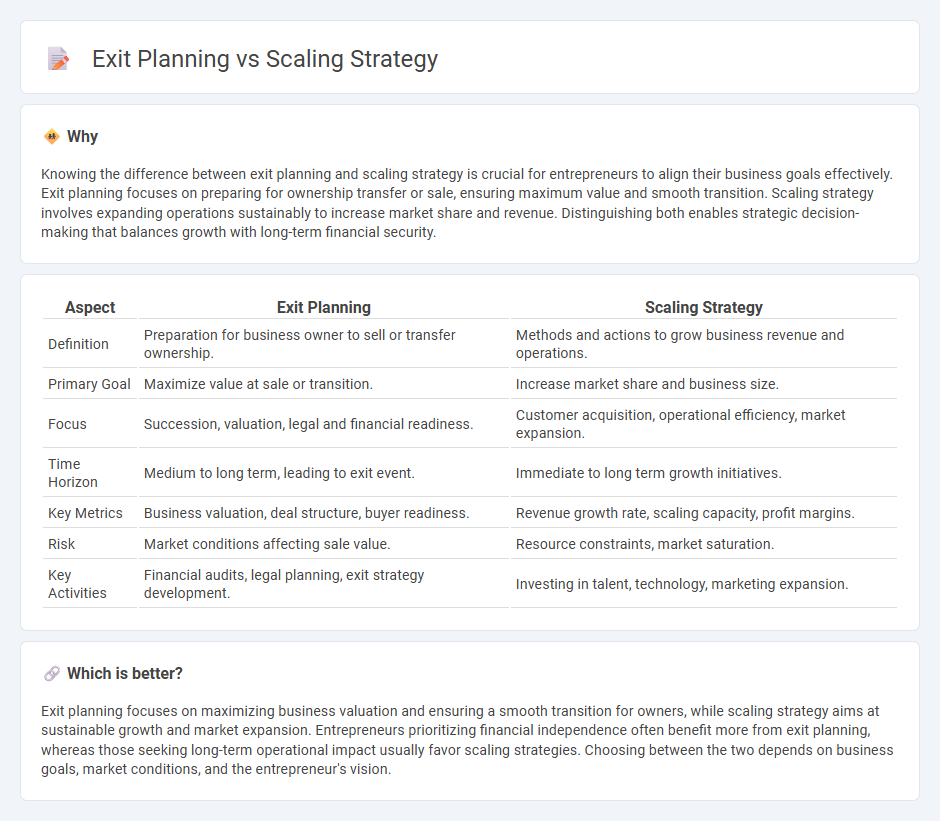

Knowing the difference between exit planning and scaling strategy is crucial for entrepreneurs to align their business goals effectively. Exit planning focuses on preparing for ownership transfer or sale, ensuring maximum value and smooth transition. Scaling strategy involves expanding operations sustainably to increase market share and revenue. Distinguishing both enables strategic decision-making that balances growth with long-term financial security.

Comparison Table

| Aspect | Exit Planning | Scaling Strategy |

|---|---|---|

| Definition | Preparation for business owner to sell or transfer ownership. | Methods and actions to grow business revenue and operations. |

| Primary Goal | Maximize value at sale or transition. | Increase market share and business size. |

| Focus | Succession, valuation, legal and financial readiness. | Customer acquisition, operational efficiency, market expansion. |

| Time Horizon | Medium to long term, leading to exit event. | Immediate to long term growth initiatives. |

| Key Metrics | Business valuation, deal structure, buyer readiness. | Revenue growth rate, scaling capacity, profit margins. |

| Risk | Market conditions affecting sale value. | Resource constraints, market saturation. |

| Key Activities | Financial audits, legal planning, exit strategy development. | Investing in talent, technology, marketing expansion. |

Which is better?

Exit planning focuses on maximizing business valuation and ensuring a smooth transition for owners, while scaling strategy aims at sustainable growth and market expansion. Entrepreneurs prioritizing financial independence often benefit more from exit planning, whereas those seeking long-term operational impact usually favor scaling strategies. Choosing between the two depends on business goals, market conditions, and the entrepreneur's vision.

Connection

Exit planning and scaling strategy are intricately connected as effective scaling increases a company's valuation, making the business more attractive to potential buyers or investors during the exit process. A well-executed scaling strategy ensures sustainable growth and operational efficiency, which directly impacts the timing and success of exit options like acquisitions, mergers, or IPOs. Entrepreneurs who integrate exit planning with scaling efforts can maximize returns by aligning business growth milestones with exit market conditions and buyer expectations.

Key Terms

Growth Metrics

Growth metrics such as customer acquisition rate, monthly recurring revenue (MRR), and churn rate are essential indicators in scaling strategy to drive sustainable expansion and market penetration. In contrast, exit planning prioritizes valuation multiples, EBITDA margin, and cash flow projections to maximize business worth for potential buyers or investors. Explore detailed frameworks and key performance indicators to optimize your approach effectively.

Valuation

Scaling strategy emphasizes increasing a company's operational capacity and market reach to boost revenue and enhance overall valuation through sustainable growth metrics. Exit planning concentrates on optimizing valuation by preparing financial statements, managing liabilities, and aligning business structures to attract potential buyers or investors. Explore effective approaches to balance scaling and exit strategies for maximizing your company's market value.

Acquisition

A scaling strategy emphasizes expanding a company's market share, revenue, and operational capacity to enhance its valuation before acquisition. Exit planning centers on preparing the business for a smooth transition to new ownership, targeting optimal deal terms and maximizing returns during the acquisition process. Discover more about aligning scaling tactics with exit planning for successful acquisitions.

Source and External Links

Step 2: Specify the scaling strategy - AWS Auto Scaling - AWS Auto Scaling offers three main scaling strategies: optimize for availability (maintain 40% utilization), balance availability and cost (50% utilization), and optimize for cost (70% utilization), plus the option to create custom strategies by adjusting target utilization or metrics for automatic resource scaling.

Recommendations for designing a reliable scaling strategy - A reliable scaling strategy involves understanding different load patterns (static, dynamic regular/predictable, dynamic irregular/unpredictable) and scheduling or setting autoscale thresholds accordingly, with continuous monitoring and tuning of scaling events to improve effectiveness.

From start-up to centaur: Leadership lessons on scaling - McKinsey - Scaling a business requires combining multiple growth strategies, such as going upmarket, adapting organizational processes, and investing in capabilities like sales and compliance, to avoid growth plateaus and continuously accelerate expansion.

dowidth.com

dowidth.com