Indie hackers build businesses by bootstrapping, relying on personal savings, and focusing on sustainable growth without external funding. Venture-backed founders secure funding from investors to scale rapidly and capture market share quickly, often prioritizing aggressive expansion strategies. Explore the distinct advantages and challenges of each approach to find the best path for your startup ambitions.

Why it is important

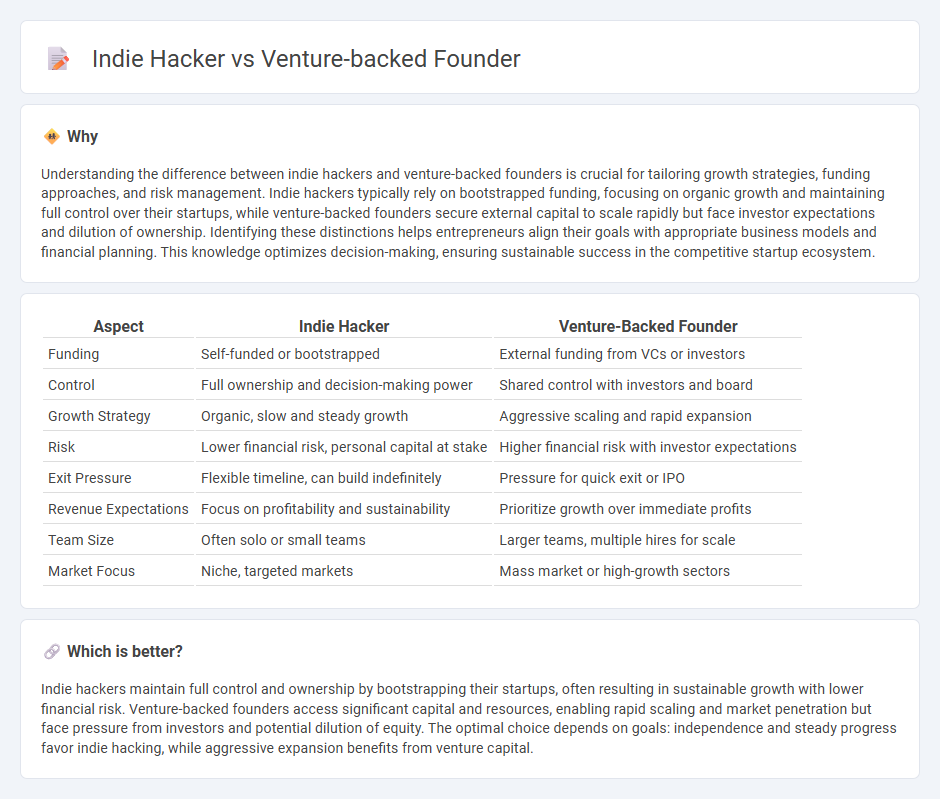

Understanding the difference between indie hackers and venture-backed founders is crucial for tailoring growth strategies, funding approaches, and risk management. Indie hackers typically rely on bootstrapped funding, focusing on organic growth and maintaining full control over their startups, while venture-backed founders secure external capital to scale rapidly but face investor expectations and dilution of ownership. Identifying these distinctions helps entrepreneurs align their goals with appropriate business models and financial planning. This knowledge optimizes decision-making, ensuring sustainable success in the competitive startup ecosystem.

Comparison Table

| Aspect | Indie Hacker | Venture-Backed Founder |

|---|---|---|

| Funding | Self-funded or bootstrapped | External funding from VCs or investors |

| Control | Full ownership and decision-making power | Shared control with investors and board |

| Growth Strategy | Organic, slow and steady growth | Aggressive scaling and rapid expansion |

| Risk | Lower financial risk, personal capital at stake | Higher financial risk with investor expectations |

| Exit Pressure | Flexible timeline, can build indefinitely | Pressure for quick exit or IPO |

| Revenue Expectations | Focus on profitability and sustainability | Prioritize growth over immediate profits |

| Team Size | Often solo or small teams | Larger teams, multiple hires for scale |

| Market Focus | Niche, targeted markets | Mass market or high-growth sectors |

Which is better?

Indie hackers maintain full control and ownership by bootstrapping their startups, often resulting in sustainable growth with lower financial risk. Venture-backed founders access significant capital and resources, enabling rapid scaling and market penetration but face pressure from investors and potential dilution of equity. The optimal choice depends on goals: independence and steady progress favor indie hacking, while aggressive expansion benefits from venture capital.

Connection

Indie hackers and venture-backed founders share a core entrepreneurial drive to create scalable technology startups, often beginning with minimal resources and a strong market vision. Both rely on iterative product development, user feedback, and growth hacking techniques to validate business models, though venture-backed founders typically access significant capital to accelerate expansion. Their interconnected ecosystem fosters innovation, where indie hackers may evolve into venture-backed founders as they attract investment to scale proven concepts.

Key Terms

Venture-backed founder:

Venture-backed founders prioritize rapid scaling and securing significant capital from investors to accelerate growth, often sacrificing early profitability for market dominance. They navigate complex funding rounds, equity dilution, and investor relations while building scalable operations. Discover more about the strategic decisions and growth tactics unique to venture-backed founders.

Equity Financing

Venture-backed founders secure substantial equity financing through institutional investors like venture capitalists, enabling rapid scaling and extensive market reach. Indie hackers rely on self-funding or small-scale investments, maintaining full ownership but facing slower growth and limited capital access. Discover the strategic advantages and challenges of each equity financing approach to choose the best path for your startup.

Scale

Venture-backed founders prioritize rapid growth and scalability fueled by substantial external capital and investor support, enabling aggressive market expansion and product development. Indie hackers emphasize sustainable, organic growth relying on bootstrapped resources, maintaining full control over business decisions and customer relationships. Explore deeper insights into scalability strategies and growth models for both entrepreneur types.

Source and External Links

How Do Startup Founders Fare as Venture Capitalists? | NBER - Successful founders of venture-backed startups are more likely to become venture capitalists and tend to have higher investment success rates than professional VCs who were not founders, with nearly 7% of VCs having founded venture-capital-funded startups.

Deep Dive: Founders turned VCs - VC Stack - Around 7% of venture capitalists were previously founders of venture-backed startups, and successful founder-VCs outperform other investors, often transitioning after successful exits, particularly among male and white founders.

Founder Ownership in VC-Backed Companies - Substack - Founder ownership is diluted after raising venture capital, with solo founders now comprising 35% of startups, though they face more challenges securing VC funding compared to multi-founder teams favored by investors for risk mitigation and complementary skills.

dowidth.com

dowidth.com