Sweat equity marketplaces connect founders with skilled collaborators who contribute time and expertise in exchange for ownership stakes, enabling startups to grow without immediate capital investment. Accelerators provide structured programs offering mentorship, resources, and funding opportunities to rapidly scale early-stage ventures through a fixed-term curriculum. Explore the advantages and dynamics of sweat equity marketplaces versus accelerators to determine the best fit for your entrepreneurial journey.

Why it is important

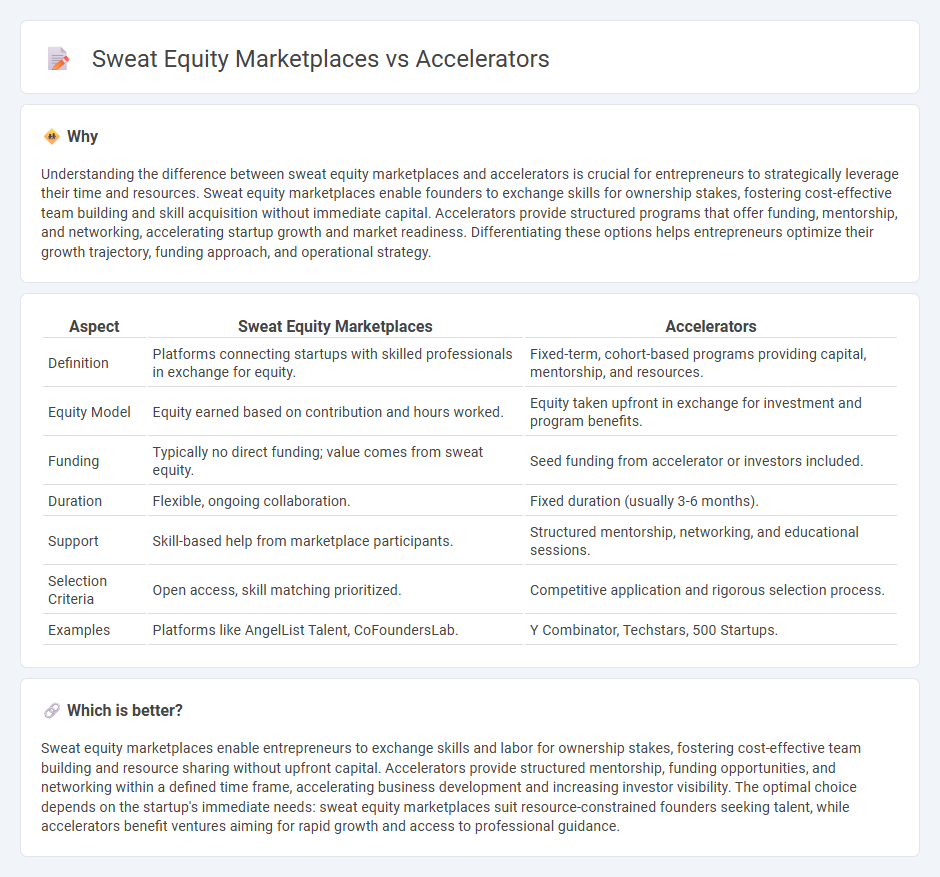

Understanding the difference between sweat equity marketplaces and accelerators is crucial for entrepreneurs to strategically leverage their time and resources. Sweat equity marketplaces enable founders to exchange skills for ownership stakes, fostering cost-effective team building and skill acquisition without immediate capital. Accelerators provide structured programs that offer funding, mentorship, and networking, accelerating startup growth and market readiness. Differentiating these options helps entrepreneurs optimize their growth trajectory, funding approach, and operational strategy.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Accelerators |

|---|---|---|

| Definition | Platforms connecting startups with skilled professionals in exchange for equity. | Fixed-term, cohort-based programs providing capital, mentorship, and resources. |

| Equity Model | Equity earned based on contribution and hours worked. | Equity taken upfront in exchange for investment and program benefits. |

| Funding | Typically no direct funding; value comes from sweat equity. | Seed funding from accelerator or investors included. |

| Duration | Flexible, ongoing collaboration. | Fixed duration (usually 3-6 months). |

| Support | Skill-based help from marketplace participants. | Structured mentorship, networking, and educational sessions. |

| Selection Criteria | Open access, skill matching prioritized. | Competitive application and rigorous selection process. |

| Examples | Platforms like AngelList Talent, CoFoundersLab. | Y Combinator, Techstars, 500 Startups. |

Which is better?

Sweat equity marketplaces enable entrepreneurs to exchange skills and labor for ownership stakes, fostering cost-effective team building and resource sharing without upfront capital. Accelerators provide structured mentorship, funding opportunities, and networking within a defined time frame, accelerating business development and increasing investor visibility. The optimal choice depends on the startup's immediate needs: sweat equity marketplaces suit resource-constrained founders seeking talent, while accelerators benefit ventures aiming for rapid growth and access to professional guidance.

Connection

Sweat equity marketplaces and accelerators connect by offering startups critical non-monetary resources such as mentorship, skill-sharing, and strategic guidance in exchange for equity stakes. Accelerators often leverage sweat equity marketplaces to source talented professionals contributing expertise during early growth phases, enhancing startup scalability and valuation. This symbiotic relationship fosters a collaborative ecosystem where founders access vital human capital without immediate cash outlays, accelerating business development and investment readiness.

Key Terms

Mentorship

Accelerators provide structured mentorship programs with experienced industry experts guiding startups through intensive, time-bound phases, fostering rapid growth and market readiness. Sweat equity marketplaces connect founders with mentors offering flexible, on-demand advice in exchange for equity, enabling longer-term collaborations tailored to specific needs. Explore how these mentorship models impact startup success and investment opportunities.

Equity Exchange

Equity exchange platforms enable startups to trade ownership stakes for resources, similar to accelerators that provide funding, mentorship, and networks in exchange for equity. Unlike traditional accelerators, sweat equity marketplaces emphasize flexible, often skill-based contributions rather than structured programs or fixed investment amounts. Explore how equity exchange marketplaces revolutionize startup growth by facilitating diverse equity-for-service transactions.

Startup Support

Accelerators provide structured programs including mentorship, funding, and networking opportunities to rapidly scale startups. Sweat equity marketplaces connect entrepreneurs with skilled professionals who contribute work in exchange for ownership stakes, offering flexible, resource-efficient collaboration. Explore the differences further to determine which startup support model suits your growth strategy best.

Source and External Links

Top accelerators that produce leading startups - Affinity - Accelerators are intensive, fixed-term programs providing startups with mentorship, capital, and resources to quickly scale their businesses and typically receive equity in exchange.

Startup accelerator - Wikipedia - Seed accelerators are cohort-based programs offering mentorship and education, culminating in pitch events, differing from incubators in funding, equity stakes, and competitive open applications.

The 60 Best Startup Incubators & Accelerators in the USA for 2025 - Accelerators focus on rapid growth of startups with a developed MVP, offering funding, mentorship, networking, and often physical workspace for entrepreneurs seeking to scale.

dowidth.com

dowidth.com