Exit as a Service (EaaS) offers entrepreneurs a structured, strategic approach to divesting business assets, aiming to maximize value through planned transitions such as mergers, acquisitions, or sales. Liquidation involves the rapid selling of assets, often resulting in lower returns but providing immediate cash flow during financial distress. Explore our detailed analysis to understand which exit strategy best aligns with your entrepreneurial goals and business lifecycle.

Why it is important

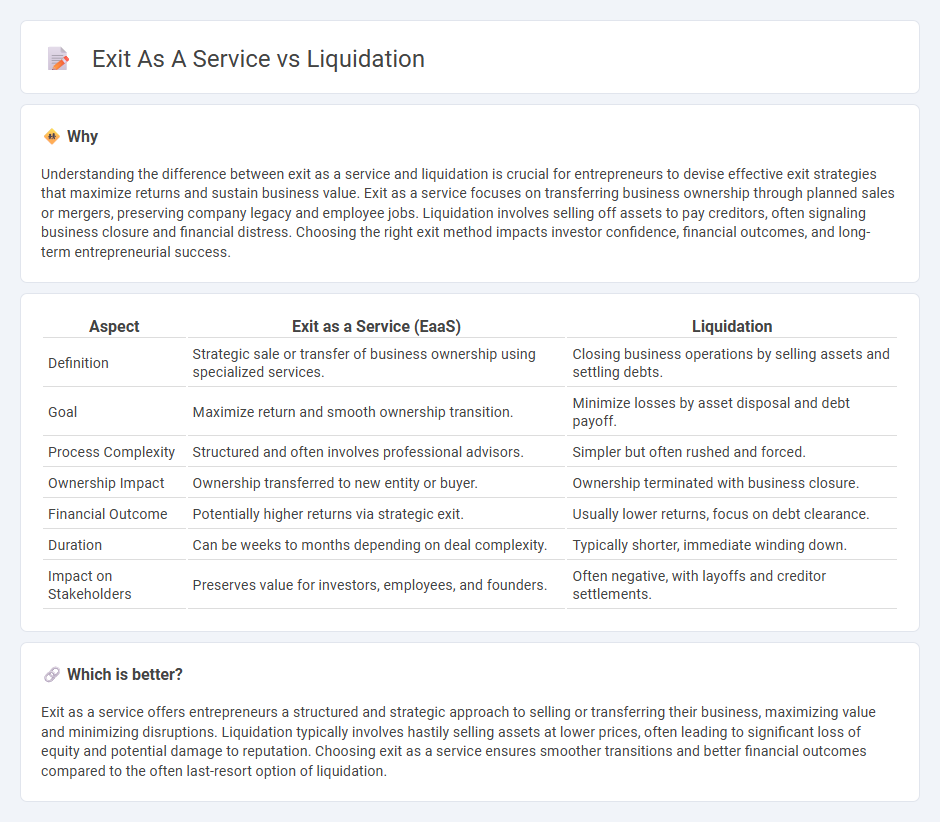

Understanding the difference between exit as a service and liquidation is crucial for entrepreneurs to devise effective exit strategies that maximize returns and sustain business value. Exit as a service focuses on transferring business ownership through planned sales or mergers, preserving company legacy and employee jobs. Liquidation involves selling off assets to pay creditors, often signaling business closure and financial distress. Choosing the right exit method impacts investor confidence, financial outcomes, and long-term entrepreneurial success.

Comparison Table

| Aspect | Exit as a Service (EaaS) | Liquidation |

|---|---|---|

| Definition | Strategic sale or transfer of business ownership using specialized services. | Closing business operations by selling assets and settling debts. |

| Goal | Maximize return and smooth ownership transition. | Minimize losses by asset disposal and debt payoff. |

| Process Complexity | Structured and often involves professional advisors. | Simpler but often rushed and forced. |

| Ownership Impact | Ownership transferred to new entity or buyer. | Ownership terminated with business closure. |

| Financial Outcome | Potentially higher returns via strategic exit. | Usually lower returns, focus on debt clearance. |

| Duration | Can be weeks to months depending on deal complexity. | Typically shorter, immediate winding down. |

| Impact on Stakeholders | Preserves value for investors, employees, and founders. | Often negative, with layoffs and creditor settlements. |

Which is better?

Exit as a service offers entrepreneurs a structured and strategic approach to selling or transferring their business, maximizing value and minimizing disruptions. Liquidation typically involves hastily selling assets at lower prices, often leading to significant loss of equity and potential damage to reputation. Choosing exit as a service ensures smoother transitions and better financial outcomes compared to the often last-resort option of liquidation.

Connection

Exit as a Service (EaaS) and liquidation are connected through their roles in enabling entrepreneurs and investors to efficiently conclude business ventures. EaaS offers strategic frameworks and support for startups seeking structured exits, including sales, mergers, or liquidations, ensuring optimized value realization. Liquidation serves as a specific exit route within EaaS, involving asset sales to pay creditors and dissolve the company when other exit options are unviable.

Key Terms

Asset Sale

Liquidation involves selling off assets to pay creditors and close a business, often at reduced values under time pressure, while exit as a service focuses on structured asset sales designed to maximize value and facilitate smoother transitions for stakeholders. Asset sales in exit as a service leverage strategic marketing and targeted buyer engagement to ensure optimal returns, contrasting with the rapid asset disposal typical of liquidation scenarios. Explore how tailored exit strategies through asset sales can enhance business value and stakeholder outcomes.

Business Continuity

Liquidation involves selling off a company's assets to pay creditors and close operations, often signaling the end of the business, while Exit as a Service (EaaS) provides strategic options for business continuity by facilitating smooth transitions such as mergers, acquisitions, or management buyouts. EaaS enables companies to preserve value, maintain operational stability, and support employee retention during ownership changes. Explore more to understand how Exit as a Service can safeguard your business's future.

Ownership Transfer

Liquidation involves selling off a company's assets to pay creditors, often resulting in the dissolution of ownership, while exit as a service facilitates a structured ownership transfer preserving business continuity and stakeholder value. Ownership transfer in exit as a service is optimized through strategic planning, legal frameworks, and valuation techniques to ensure a smooth transition to new owners or management. Explore how exit as a service can maximize ownership value and streamline transfer processes.

Source and External Links

Liquidation - Wikipedia - Liquidation is the accounting process of ending a company by redistributing its assets, involving duties like investigating misconduct, calling final meetings, and ultimately dissolving or striking off the company from the register.

liquidation | Wex | US Law | LII - Liquidation refers to converting a business's assets to cash and distributing them, commonly during a winding-up, and also describes settling debts or damages into cash value.

LIQUIDATION | definition in the Cambridge English Dictionary - Liquidation is the process of closing a business and selling its assets to pay debts, often resulting from financial distress such as losses or bankruptcy.

dowidth.com

dowidth.com