Tiny acquisitions involve purchasing small, established businesses to generate consistent cash flow and build a scalable portfolio, while digital product flipping focuses on buying underpriced digital assets like websites or apps, improving them, and selling at a profit. Both strategies enable entrepreneurs to capitalize on existing market demand without starting from scratch, leveraging operational efficiencies and market trends. Explore deeper insights into these entrepreneurial approaches to identify the best fit for your growth goals.

Why it is important

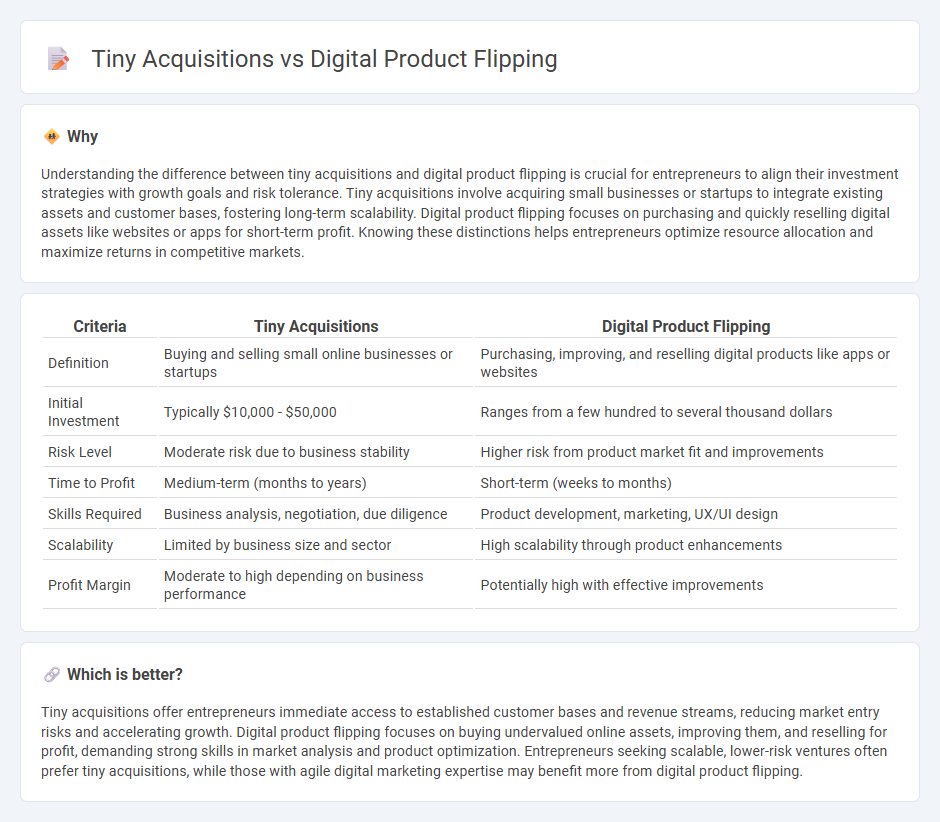

Understanding the difference between tiny acquisitions and digital product flipping is crucial for entrepreneurs to align their investment strategies with growth goals and risk tolerance. Tiny acquisitions involve acquiring small businesses or startups to integrate existing assets and customer bases, fostering long-term scalability. Digital product flipping focuses on purchasing and quickly reselling digital assets like websites or apps for short-term profit. Knowing these distinctions helps entrepreneurs optimize resource allocation and maximize returns in competitive markets.

Comparison Table

| Criteria | Tiny Acquisitions | Digital Product Flipping |

|---|---|---|

| Definition | Buying and selling small online businesses or startups | Purchasing, improving, and reselling digital products like apps or websites |

| Initial Investment | Typically $10,000 - $50,000 | Ranges from a few hundred to several thousand dollars |

| Risk Level | Moderate risk due to business stability | Higher risk from product market fit and improvements |

| Time to Profit | Medium-term (months to years) | Short-term (weeks to months) |

| Skills Required | Business analysis, negotiation, due diligence | Product development, marketing, UX/UI design |

| Scalability | Limited by business size and sector | High scalability through product enhancements |

| Profit Margin | Moderate to high depending on business performance | Potentially high with effective improvements |

Which is better?

Tiny acquisitions offer entrepreneurs immediate access to established customer bases and revenue streams, reducing market entry risks and accelerating growth. Digital product flipping focuses on buying undervalued online assets, improving them, and reselling for profit, demanding strong skills in market analysis and product optimization. Entrepreneurs seeking scalable, lower-risk ventures often prefer tiny acquisitions, while those with agile digital marketing expertise may benefit more from digital product flipping.

Connection

Tiny acquisitions allow entrepreneurs to quickly gain digital assets with established value, which can then be enhanced or repurposed through digital product flipping. This strategy leverages the transfer of small-scale online businesses or digital products to generate rapid returns by improving their market fit or scaling their reach. Both approaches optimize resource allocation and minimize risk while maximizing entrepreneurial growth opportunities in the digital economy.

Key Terms

Arbitrage

Digital product flipping involves purchasing and reselling online businesses or assets to capitalize on their increased valuation, emphasizing quick turnaround and higher profit margins through strategic improvements. Tiny acquisitions focus on buying small, established online businesses, often generating steady revenue streams with minimal management, highlighting long-term arbitrage opportunities by optimizing operational efficiencies. Explore how arbitrage strategies differ in digital product flipping and tiny acquisitions to optimize your portfolio growth.

Due Diligence

Digital product flipping requires thorough due diligence to evaluate the product's market demand, revenue consistency, and technical upkeep, ensuring a profitable resale. Tiny acquisitions demand detailed scrutiny of financial statements, customer retention, and growth potential to mitigate risks in small-scale business purchases. Explore more insights on optimizing due diligence strategies for both digital product flipping and tiny acquisitions to enhance your investment outcomes.

Valuation

Digital product flipping involves rapid buying and selling of digital assets such as apps, websites, or domains, emphasizing short-term profit gains, while tiny acquisitions focus on purchasing small, profitable businesses for steady income and growth. Valuation in digital product flipping often relies on metrics like traffic, revenue, and growth potential over a brief period, whereas tiny acquisitions assess long-term cash flow, customer base, and operational stability. Explore deeper insights into how valuation strategies differ and which approach aligns best with your investment goals.

Source and External Links

Q&A: "Can you buy and resell digital products??" | Side Hustle School - Digital product flipping involves buying, improving, and reselling digital assets like websites, domains, or digital products, providing opportunities for generating income with digital items instead of physical products.

Flipping Online Businesses: The Ultimate Guide | EmpireFlippers - Flipping digital products typically means purchasing existing online businesses or websites, enhancing them (e.g., by increasing traffic), and reselling at a profit, often within 10-18 months.

How To Make Money Online FAST With Digital Products ... - YouTube - Another angle on digital product flipping is buying private label rights (PLR) digital products to rebrand, improve, bundle, and resell without creating original content.

dowidth.com

dowidth.com