Entrepreneurship strategies such as acquihires and spin-offs serve distinct purposes in business growth and talent acquisition. An acquihire involves a company purchasing a startup primarily to gain its skilled team, while a spin-off creates an independent company from an existing division to foster innovation and market focus. Explore how these approaches can strategically impact your venture's expansion and competitive advantage.

Why it is important

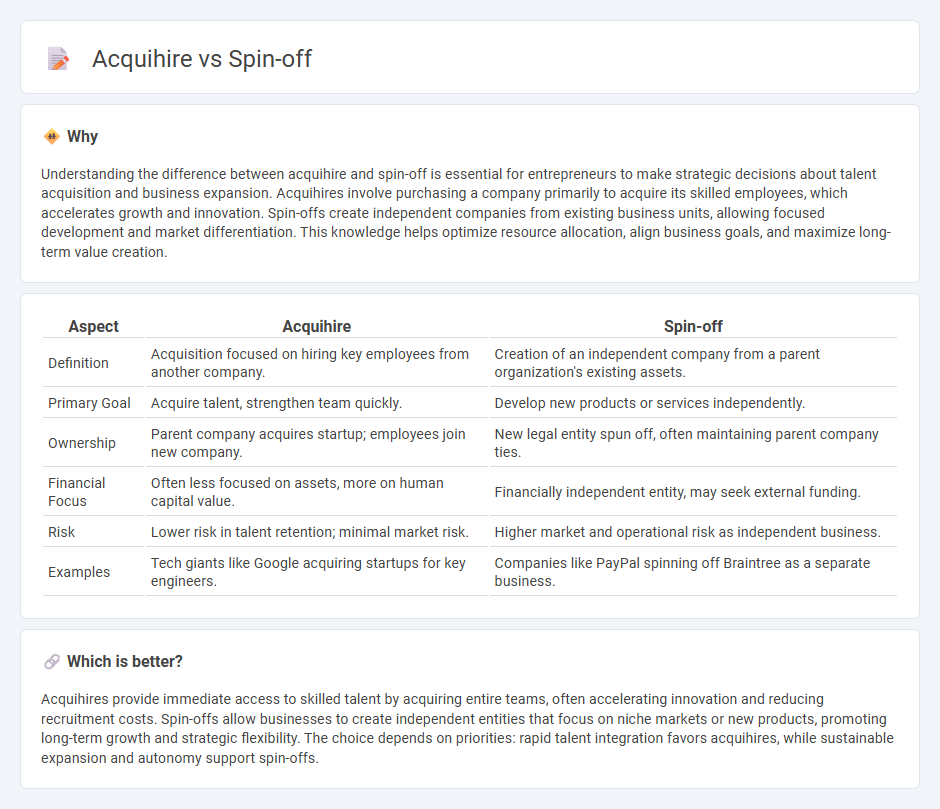

Understanding the difference between acquihire and spin-off is essential for entrepreneurs to make strategic decisions about talent acquisition and business expansion. Acquihires involve purchasing a company primarily to acquire its skilled employees, which accelerates growth and innovation. Spin-offs create independent companies from existing business units, allowing focused development and market differentiation. This knowledge helps optimize resource allocation, align business goals, and maximize long-term value creation.

Comparison Table

| Aspect | Acquihire | Spin-off |

|---|---|---|

| Definition | Acquisition focused on hiring key employees from another company. | Creation of an independent company from a parent organization's existing assets. |

| Primary Goal | Acquire talent, strengthen team quickly. | Develop new products or services independently. |

| Ownership | Parent company acquires startup; employees join new company. | New legal entity spun off, often maintaining parent company ties. |

| Financial Focus | Often less focused on assets, more on human capital value. | Financially independent entity, may seek external funding. |

| Risk | Lower risk in talent retention; minimal market risk. | Higher market and operational risk as independent business. |

| Examples | Tech giants like Google acquiring startups for key engineers. | Companies like PayPal spinning off Braintree as a separate business. |

Which is better?

Acquihires provide immediate access to skilled talent by acquiring entire teams, often accelerating innovation and reducing recruitment costs. Spin-offs allow businesses to create independent entities that focus on niche markets or new products, promoting long-term growth and strategic flexibility. The choice depends on priorities: rapid talent integration favors acquihires, while sustainable expansion and autonomy support spin-offs.

Connection

Acquihires and spin-offs both serve as strategic methods for companies to leverage talent and innovation for growth. Acquihires involve acquiring a startup primarily for its skilled team, integrating their expertise to enhance the acquiring company's capabilities. Spin-offs occur when a parent company creates a new independent entity to commercialize innovative ideas or business units, fostering entrepreneurship while maintaining strategic alignment.

Key Terms

Ownership Structure

Spin-offs create independent companies by separating from the parent organization, resulting in distinct ownership structures where existing shareholders typically receive shares in the new entity. Acquihires involve acquiring a company primarily for its talent, with ownership integrated into the acquiring firm, meaning employees typically become part of the acquirer's equity or compensation plans. Explore the nuances of ownership structures in spin-offs and acquihires to better understand their strategic impact.

Talent Acquisition

Spin-offs enable companies to capitalize on existing talent by creating independent entities that foster innovation and retain key employees. Acquihires prioritize acquiring skilled teams to quickly enhance internal capabilities and accelerate project development without the overhead of traditional recruitment. Explore the strategic benefits and implications of spin-offs versus acquihires in talent acquisition to optimize your hiring approach.

Intellectual Property Transfer

Spin-offs typically involve the transfer of substantial intellectual property (IP) assets, allowing the new entity to operate independently with proprietary technology or patents. Acquihires focus predominantly on acquiring talent rather than IP, with intellectual property often remaining with the original parent company. Explore the nuances of IP transfer strategies in spin-offs and acquihires to optimize your business decisions.

Source and External Links

Corporate spin-off - Wikipedia - A corporate spin-off is a type of corporate action where a company creates a separate independent business by splitting off a division or section, often retaining assets and employees, with shareholders receiving shares in the new company to invest independently of the parent firm.

Spin-off (media) | EBSCO Research Starters - In media, a spin-off is a new work derived from an existing film or TV series, typically focusing on a secondary character or specific aspect, allowing creators to explore narratives in greater detail and capitalize on the original's success.

What is a Spin-Off in Film & TV -- Definition & Examples - A spin-off in film and TV is a new series or film emerging from an existing one that explores the backstory or journey of a secondary character or storyline, driven by audience demand and creative opportunity.

dowidth.com

dowidth.com