Side Hustle Stack offers entrepreneurs practical strategies and actionable insights to grow multiple income streams simultaneously, focusing on flexibility and scalability in the early stages of business. Angel investing involves providing capital and mentorship to startups with high growth potential, emphasizing long-term financial returns and active involvement in company growth. Discover how each approach can uniquely accelerate your entrepreneurial journey.

Why it is important

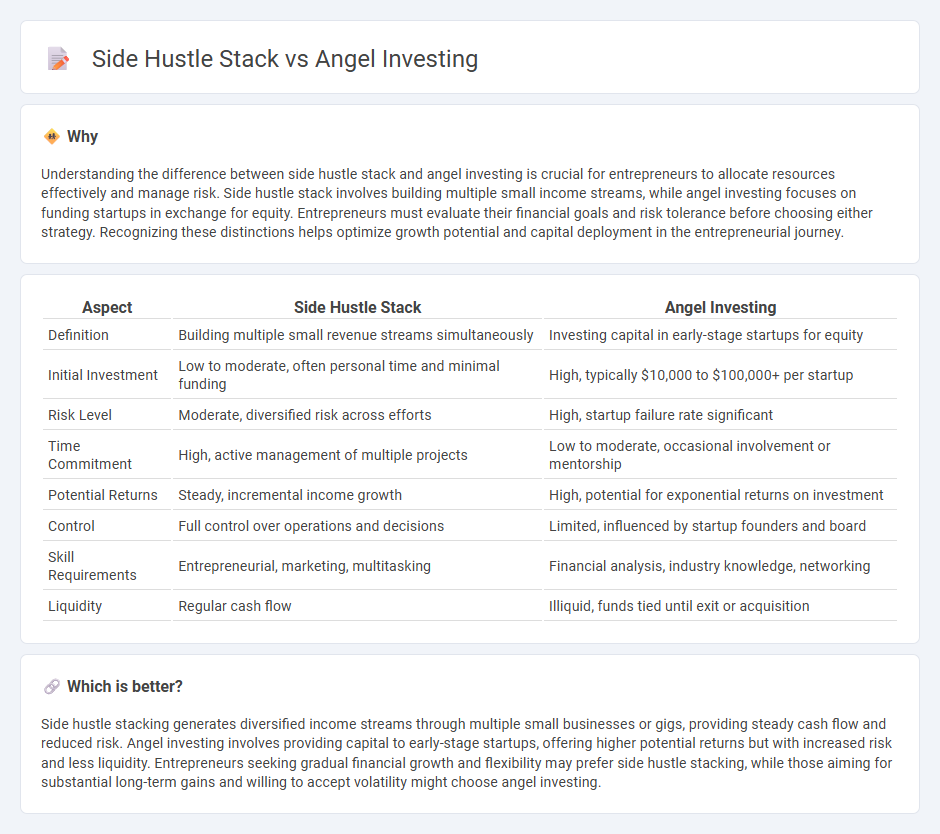

Understanding the difference between side hustle stack and angel investing is crucial for entrepreneurs to allocate resources effectively and manage risk. Side hustle stack involves building multiple small income streams, while angel investing focuses on funding startups in exchange for equity. Entrepreneurs must evaluate their financial goals and risk tolerance before choosing either strategy. Recognizing these distinctions helps optimize growth potential and capital deployment in the entrepreneurial journey.

Comparison Table

| Aspect | Side Hustle Stack | Angel Investing |

|---|---|---|

| Definition | Building multiple small revenue streams simultaneously | Investing capital in early-stage startups for equity |

| Initial Investment | Low to moderate, often personal time and minimal funding | High, typically $10,000 to $100,000+ per startup |

| Risk Level | Moderate, diversified risk across efforts | High, startup failure rate significant |

| Time Commitment | High, active management of multiple projects | Low to moderate, occasional involvement or mentorship |

| Potential Returns | Steady, incremental income growth | High, potential for exponential returns on investment |

| Control | Full control over operations and decisions | Limited, influenced by startup founders and board |

| Skill Requirements | Entrepreneurial, marketing, multitasking | Financial analysis, industry knowledge, networking |

| Liquidity | Regular cash flow | Illiquid, funds tied until exit or acquisition |

Which is better?

Side hustle stacking generates diversified income streams through multiple small businesses or gigs, providing steady cash flow and reduced risk. Angel investing involves providing capital to early-stage startups, offering higher potential returns but with increased risk and less liquidity. Entrepreneurs seeking gradual financial growth and flexibility may prefer side hustle stacking, while those aiming for substantial long-term gains and willing to accept volatility might choose angel investing.

Connection

Side hustle stacks enable entrepreneurs to diversify income streams and validate business ideas with minimal risk, creating a solid foundation for angel investing. Angel investors often seek founders with proven side hustle success, demonstrating market traction and operational capability. This synergy enhances funding opportunities, fueling startup growth and innovation.

Key Terms

Seed Capital

Angel investing involves providing seed capital to early-stage startups in exchange for equity, often requiring significant financial resources and a high risk tolerance. Side hustle stacks typically generate seed capital through multiple small-scale income streams, allowing entrepreneurs to self-fund their ventures without relinquishing ownership. Explore the strategic differences and benefits of each approach for funding your startup's growth.

Passive Income

Angel investing offers passive income through equity stakes in startups, often requiring significant capital and long-term commitment. Side hustle stacks create diversified income streams by combining multiple smaller ventures, providing flexible, scalable cash flow with lower initial risk. Explore effective strategies to balance both approaches for maximizing passive income potential.

Portfolio Diversification

Angel investing offers portfolio diversification by providing access to early-stage companies with high growth potential, contrasting with side hustle stacking, which diversifies income streams through multiple smaller-scale projects. While angel investments can yield significant returns and reduce risk across different sectors, side hustles often require active management and vary in income consistency. Explore these strategies in depth to optimize your financial portfolio diversification.

Source and External Links

Understanding angel financing and investing - Angel investors provide early-stage capital to startups in exchange for equity or convertible debt, often helping founders move beyond initial family funding toward professional financing while offering mentorship and business networks.

Angel Investors - Angel investors are wealthy individuals who invest their own money into startups for equity, expecting a significant return on investment, often around 30%, and they tend to be more patient and invest smaller amounts than venture capitalists.

Demystifying Angel Investing - Angel investing allows individuals to generate high returns, support regional economic growth by funding startups, and benefit from favorable tax incentives, with resources available through associations like the Angel Capital Association to support new investors.

dowidth.com

dowidth.com