Sweat equity marketplaces enable entrepreneurs to exchange expertise and labor for ownership stakes, fostering collaboration without the immediate need for cash investment. Peer-to-peer lending platforms connect borrowers directly with individual lenders, offering an alternative funding source that bypasses traditional financial institutions. Explore the advantages and challenges of these innovative financing methods to elevate your entrepreneurial journey.

Why it is important

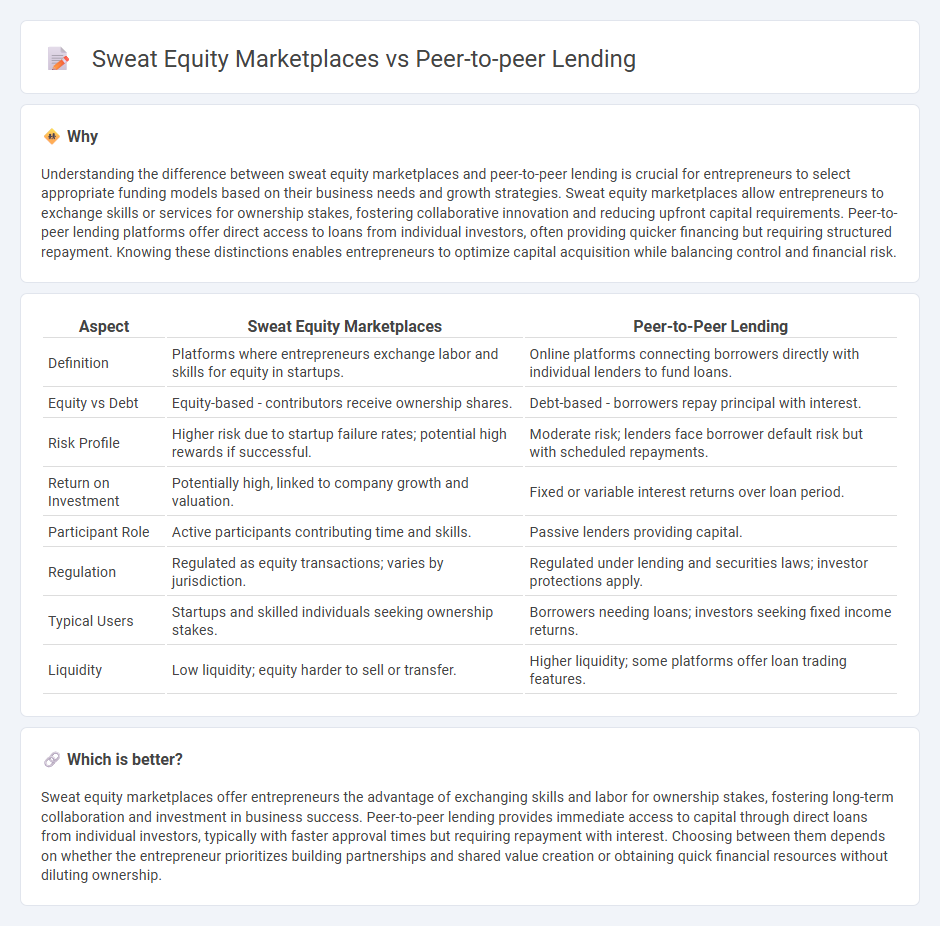

Understanding the difference between sweat equity marketplaces and peer-to-peer lending is crucial for entrepreneurs to select appropriate funding models based on their business needs and growth strategies. Sweat equity marketplaces allow entrepreneurs to exchange skills or services for ownership stakes, fostering collaborative innovation and reducing upfront capital requirements. Peer-to-peer lending platforms offer direct access to loans from individual investors, often providing quicker financing but requiring structured repayment. Knowing these distinctions enables entrepreneurs to optimize capital acquisition while balancing control and financial risk.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Peer-to-Peer Lending |

|---|---|---|

| Definition | Platforms where entrepreneurs exchange labor and skills for equity in startups. | Online platforms connecting borrowers directly with individual lenders to fund loans. |

| Equity vs Debt | Equity-based - contributors receive ownership shares. | Debt-based - borrowers repay principal with interest. |

| Risk Profile | Higher risk due to startup failure rates; potential high rewards if successful. | Moderate risk; lenders face borrower default risk but with scheduled repayments. |

| Return on Investment | Potentially high, linked to company growth and valuation. | Fixed or variable interest returns over loan period. |

| Participant Role | Active participants contributing time and skills. | Passive lenders providing capital. |

| Regulation | Regulated as equity transactions; varies by jurisdiction. | Regulated under lending and securities laws; investor protections apply. |

| Typical Users | Startups and skilled individuals seeking ownership stakes. | Borrowers needing loans; investors seeking fixed income returns. |

| Liquidity | Low liquidity; equity harder to sell or transfer. | Higher liquidity; some platforms offer loan trading features. |

Which is better?

Sweat equity marketplaces offer entrepreneurs the advantage of exchanging skills and labor for ownership stakes, fostering long-term collaboration and investment in business success. Peer-to-peer lending provides immediate access to capital through direct loans from individual investors, typically with faster approval times but requiring repayment with interest. Choosing between them depends on whether the entrepreneur prioritizes building partnerships and shared value creation or obtaining quick financial resources without diluting ownership.

Connection

Sweat equity marketplaces enable entrepreneurs to exchange skills and services for ownership stakes, fostering resource-efficient business growth without traditional capital. Peer-to-peer lending complements this by providing direct access to funding from individual investors, bypassing conventional financial institutions. These platforms collectively empower startups to combine skill-based contributions with flexible financing, enhancing liquidity and collaboration in the entrepreneurial ecosystem.

Key Terms

Disintermediation

Peer-to-peer lending platforms eliminate traditional financial intermediaries by directly connecting borrowers with individual lenders, thereby streamlining the funding process and reducing costs. Sweat equity marketplaces similarly remove middlemen by allowing contributors to invest time and skills instead of money, fostering transparent exchanges of value in startup ecosystems. Explore the nuanced benefits of disintermediation in these innovative marketplaces to optimize your investment strategy.

Value Exchange

Peer-to-peer lending platforms facilitate value exchange by connecting borrowers directly with individual lenders, promoting financial liquidity and interest-based returns. Sweat equity marketplaces enable contributors to exchange their skills and labor for ownership stakes or equity, fostering value through collaboration and shared growth potential. Explore how these innovative models redefine investment and partnership dynamics to unlock unique value opportunities.

Trust Mechanisms

Peer-to-peer lending platforms rely heavily on credit scoring algorithms and transparent borrower histories to establish trust between lenders and borrowers. Sweat equity marketplaces prioritize reputation systems, project audits, and collaborative feedback loops to ensure contributors' skills and time are securely valued and rewarded. Explore more about how these trust mechanisms impact participant engagement and platform success.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer lending connects borrowers with individual investors through specialized online platforms, bypassing traditional banks and offering flexible terms and potentially lower eligibility requirements compared to traditional loans.

Peer-to-peer lending - Wikipedia - P2P lending is an alternative financial service where individuals or businesses borrow and lend money via online intermediaries, with loans often unsecured and not protected by government insurance, and transactions facilitated by digital platforms that handle credit checks, payments, and compliance.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending allows people to lend money directly to individuals or businesses through online marketplaces, earning interest in return, but carries higher risks compared to traditional savings accounts as repayments depend on borrower reliability.

dowidth.com

dowidth.com