Passive income streams generate revenue with minimal ongoing effort, often through investments or rental properties, while leveraged income involves using resources like other people's time, money, or skills to scale earnings exponentially. Entrepreneurs who master leveraged income can accelerate business growth and maximize profits beyond traditional active work limits. Explore deeper insights into how these income strategies can transform your financial future.

Why it is important

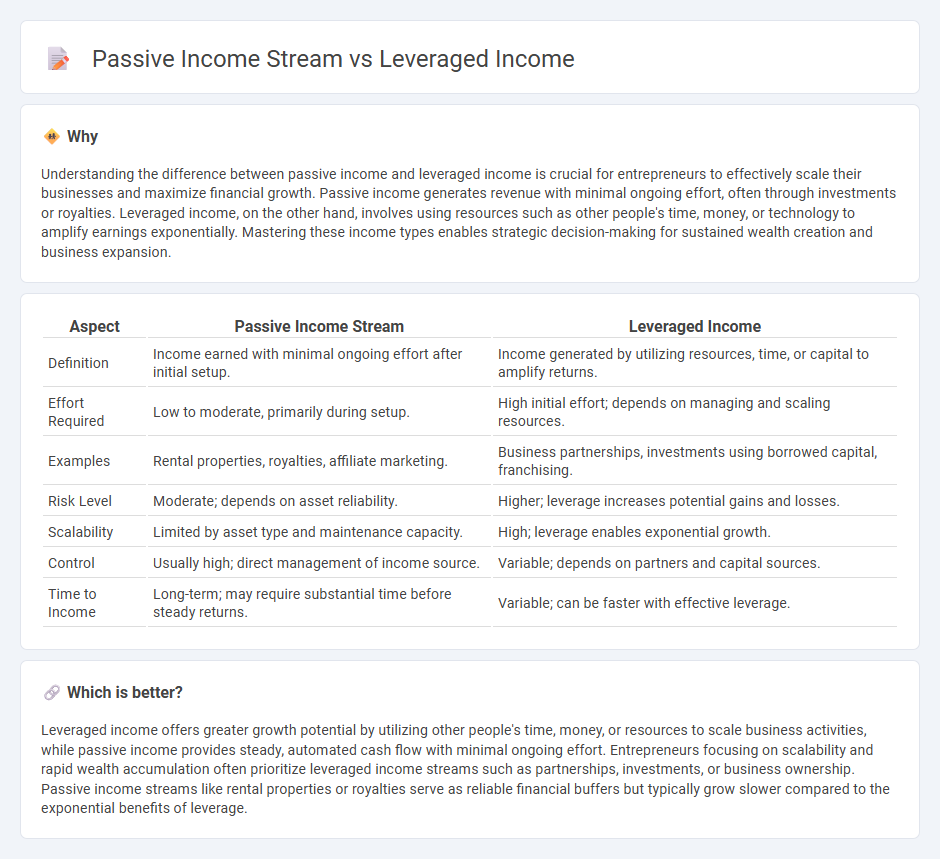

Understanding the difference between passive income and leveraged income is crucial for entrepreneurs to effectively scale their businesses and maximize financial growth. Passive income generates revenue with minimal ongoing effort, often through investments or royalties. Leveraged income, on the other hand, involves using resources such as other people's time, money, or technology to amplify earnings exponentially. Mastering these income types enables strategic decision-making for sustained wealth creation and business expansion.

Comparison Table

| Aspect | Passive Income Stream | Leveraged Income |

|---|---|---|

| Definition | Income earned with minimal ongoing effort after initial setup. | Income generated by utilizing resources, time, or capital to amplify returns. |

| Effort Required | Low to moderate, primarily during setup. | High initial effort; depends on managing and scaling resources. |

| Examples | Rental properties, royalties, affiliate marketing. | Business partnerships, investments using borrowed capital, franchising. |

| Risk Level | Moderate; depends on asset reliability. | Higher; leverage increases potential gains and losses. |

| Scalability | Limited by asset type and maintenance capacity. | High; leverage enables exponential growth. |

| Control | Usually high; direct management of income source. | Variable; depends on partners and capital sources. |

| Time to Income | Long-term; may require substantial time before steady returns. | Variable; can be faster with effective leverage. |

Which is better?

Leveraged income offers greater growth potential by utilizing other people's time, money, or resources to scale business activities, while passive income provides steady, automated cash flow with minimal ongoing effort. Entrepreneurs focusing on scalability and rapid wealth accumulation often prioritize leveraged income streams such as partnerships, investments, or business ownership. Passive income streams like rental properties or royalties serve as reliable financial buffers but typically grow slower compared to the exponential benefits of leverage.

Connection

Passive income streams generate revenue with minimal ongoing effort, often through investments, royalties, or automated businesses. Leveraged income amplifies earnings by utilizing systems, technology, or other people's time and resources to scale financial gains beyond direct labor. Together, they form a powerful strategy for entrepreneurs to build sustainable wealth and financial independence.

Key Terms

Scalability

Leveraged income involves using other people's time, money, or resources to amplify earnings, making it highly scalable by increasing output without a proportional increase in effort. Passive income streams generate revenue with minimal active involvement but often face scalability limits due to fixed assets or initial investment constraints. Explore detailed strategies to maximize scalability in both leveraged and passive income models.

Active Involvement

Leveraged income requires active involvement by utilizing resources such as time, money, or expertise to amplify earnings, often seen in business ownership or real estate investments where ongoing management is essential. Passive income streams generate earnings with minimal effort after the initial setup, including sources like dividends, rental income with property management, or royalties. Explore the differences and best strategies for maximizing your financial growth through active and passive income sources.

Recurring Revenue

Leveraged income generates revenue by utilizing existing assets or systems, often requiring upfront effort but producing ongoing returns, while passive income streams rely on minimal daily involvement with continuous cash flow. Recurring revenue models, such as subscription services or rental properties, exemplify both income types by providing stable, predictable earnings over time. Explore how leveraging recurring revenue can maximize your financial growth and security.

Source and External Links

Introduction to Leveraged Income: Earn Repeatedly from Your Past Work - Leveraged income is money earned repeatedly from initial work, often passively, enabling scalable and long-term wealth creation, such as through real estate investments or other passive income streams.

A Self-Made Millionaire Shares the Key to Earning - Leveraged income allows earning money exponentially by using methods like "one-to-many" leverage, where income grows beyond hours worked, such as group coaching instead of one-on-one sessions.

5 Leveraged Income Ideas for Online Course Creators - Examples of leveraged income include affiliate marketing, blogging, and selling digital products, which create recurring revenue streams with minimal ongoing effort after initial setup.

dowidth.com

dowidth.com