Embedded finance integrates financial services directly into non-financial platforms, streamlining payments and credit access for entrepreneurs within their usual workflows. Open banking leverages secure API sharing between banks and third-party providers, fostering innovation and personalized financial solutions for startups and small businesses. Discover how these transformative technologies can drive your entrepreneurial ventures forward.

Why it is important

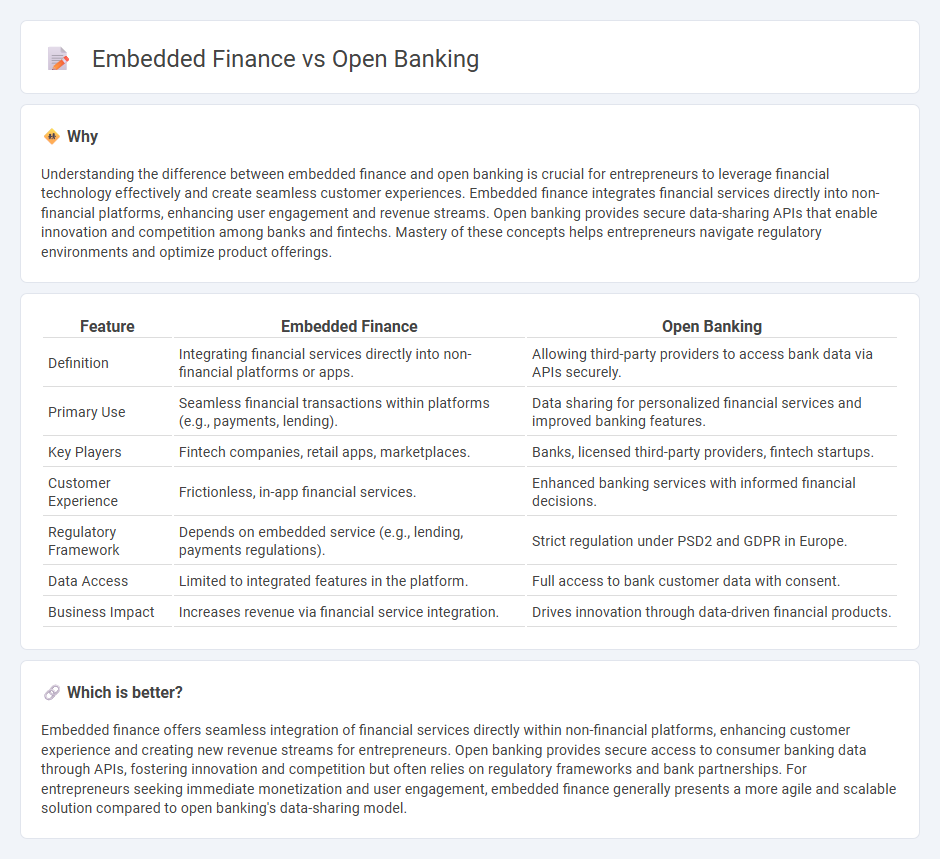

Understanding the difference between embedded finance and open banking is crucial for entrepreneurs to leverage financial technology effectively and create seamless customer experiences. Embedded finance integrates financial services directly into non-financial platforms, enhancing user engagement and revenue streams. Open banking provides secure data-sharing APIs that enable innovation and competition among banks and fintechs. Mastery of these concepts helps entrepreneurs navigate regulatory environments and optimize product offerings.

Comparison Table

| Feature | Embedded Finance | Open Banking |

|---|---|---|

| Definition | Integrating financial services directly into non-financial platforms or apps. | Allowing third-party providers to access bank data via APIs securely. |

| Primary Use | Seamless financial transactions within platforms (e.g., payments, lending). | Data sharing for personalized financial services and improved banking features. |

| Key Players | Fintech companies, retail apps, marketplaces. | Banks, licensed third-party providers, fintech startups. |

| Customer Experience | Frictionless, in-app financial services. | Enhanced banking services with informed financial decisions. |

| Regulatory Framework | Depends on embedded service (e.g., lending, payments regulations). | Strict regulation under PSD2 and GDPR in Europe. |

| Data Access | Limited to integrated features in the platform. | Full access to bank customer data with consent. |

| Business Impact | Increases revenue via financial service integration. | Drives innovation through data-driven financial products. |

Which is better?

Embedded finance offers seamless integration of financial services directly within non-financial platforms, enhancing customer experience and creating new revenue streams for entrepreneurs. Open banking provides secure access to consumer banking data through APIs, fostering innovation and competition but often relies on regulatory frameworks and bank partnerships. For entrepreneurs seeking immediate monetization and user engagement, embedded finance generally presents a more agile and scalable solution compared to open banking's data-sharing model.

Connection

Embedded finance integrates financial services directly into non-financial platforms, streamlining transactions and enhancing customer experiences, while open banking provides the secure data-sharing infrastructure that enables this integration. Entrepreneurship benefits from this connection by leveraging open banking APIs to develop innovative embedded finance solutions that offer seamless payment, lending, and insurance options within their platforms. This synergy accelerates product development, reduces operational costs, and drives customer engagement through personalized financial services.

Key Terms

API Integration

API integration plays a pivotal role in both open banking and embedded finance by enabling seamless data exchange and service connectivity between financial institutions and third-party providers. Open banking relies on standardized APIs to grant secure access to banking data, fostering innovation and competition, while embedded finance embeds financial services directly into non-financial platforms through tailored APIs, enhancing user experience and convenience. Explore the differences in API strategies and their impact on digital finance ecosystems to understand their distinct benefits and applications.

Data Sharing

Open banking centers on secure data sharing between banks and authorized third-party providers via APIs, boosting customer control over financial information. Embedded finance integrates financial services directly into non-financial platforms, utilizing shared data to offer seamless, context-specific user experiences. Explore how data sharing innovations drive the evolution of financial services to learn more.

Customer Experience

Open banking enhances customer experience by enabling seamless access to multiple financial services through secure API integrations with various banks, allowing users to manage accounts, payments, and financial data in one platform. Embedded finance integrates financial services directly into non-financial apps, offering instant credit, insurance, or payment options within the user's favorite platforms without redirecting them to traditional banking sites. Explore how these innovations reshape customer interactions and convenience across sectors by learning more about their applications and benefits.

Source and External Links

Open banking - Open banking allows customers to securely and electronically share their financial information with other banks or authorized financial organizations, facilitating more connected financial services.

What is open banking? A guide to the future of finance - Open banking uses standardized APIs to enable consumers to share banking and financial data securely with third-party providers, enhancing transparency, access to services, and innovation in financial ecosystems.

What is open banking? Your essential guide - Mastercard - Open banking transforms financial services by allowing consumers to control how their financial account data is shared with fintechs and other providers to gain more convenient and innovative financial experiences.

dowidth.com

dowidth.com