Side hustle stacks empower entrepreneurs to build multiple income streams with minimal upfront investment, leveraging skills and digital platforms for scalable growth. Venture capital funding provides startups with significant capital injections and expert guidance but requires equity sharing and high growth potential. Explore more to understand which funding path suits your entrepreneurial ambitions best.

Why it is important

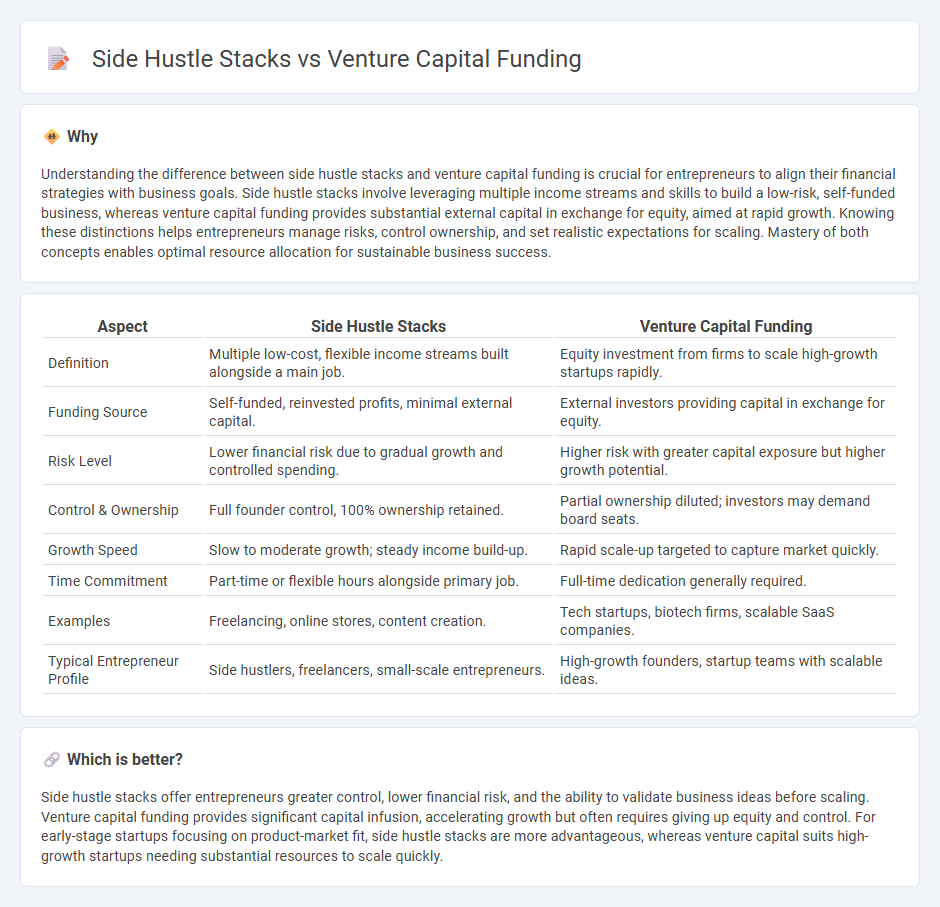

Understanding the difference between side hustle stacks and venture capital funding is crucial for entrepreneurs to align their financial strategies with business goals. Side hustle stacks involve leveraging multiple income streams and skills to build a low-risk, self-funded business, whereas venture capital funding provides substantial external capital in exchange for equity, aimed at rapid growth. Knowing these distinctions helps entrepreneurs manage risks, control ownership, and set realistic expectations for scaling. Mastery of both concepts enables optimal resource allocation for sustainable business success.

Comparison Table

| Aspect | Side Hustle Stacks | Venture Capital Funding |

|---|---|---|

| Definition | Multiple low-cost, flexible income streams built alongside a main job. | Equity investment from firms to scale high-growth startups rapidly. |

| Funding Source | Self-funded, reinvested profits, minimal external capital. | External investors providing capital in exchange for equity. |

| Risk Level | Lower financial risk due to gradual growth and controlled spending. | Higher risk with greater capital exposure but higher growth potential. |

| Control & Ownership | Full founder control, 100% ownership retained. | Partial ownership diluted; investors may demand board seats. |

| Growth Speed | Slow to moderate growth; steady income build-up. | Rapid scale-up targeted to capture market quickly. |

| Time Commitment | Part-time or flexible hours alongside primary job. | Full-time dedication generally required. |

| Examples | Freelancing, online stores, content creation. | Tech startups, biotech firms, scalable SaaS companies. |

| Typical Entrepreneur Profile | Side hustlers, freelancers, small-scale entrepreneurs. | High-growth founders, startup teams with scalable ideas. |

Which is better?

Side hustle stacks offer entrepreneurs greater control, lower financial risk, and the ability to validate business ideas before scaling. Venture capital funding provides significant capital infusion, accelerating growth but often requires giving up equity and control. For early-stage startups focusing on product-market fit, side hustle stacks are more advantageous, whereas venture capital suits high-growth startups needing substantial resources to scale quickly.

Connection

Side hustle stacks, the combination of multiple income-generating projects, often serve as proof of concept and traction for entrepreneurs seeking venture capital funding. Venture capitalists evaluate the scalability and market validation of these side hustles to determine investment potential, making side hustle stacks critical in early-stage funding decisions. Demonstrated revenue streams and user engagement from side hustles increase the likelihood of securing venture capital to scale the business rapidly.

Key Terms

**Venture capital funding:**

Venture capital funding provides startups with substantial financial resources in exchange for equity, enabling rapid scaling and market penetration. This influx of capital often comes with valuable mentorship, strategic guidance, and networking opportunities from experienced investors. Explore more about how venture capital funding can accelerate your business growth effectively.

Equity

Venture capital funding offers substantial equity investment from institutional investors, enabling rapid business scaling but often requiring significant ownership dilution. Side hustle stacks rely on personal resources or small-scale funding without sacrificing equity, maintaining full control but limiting growth potential. Explore the strategic equity trade-offs between venture capital and side hustles to optimize your business funding approach.

Term sheet

Term sheets in venture capital funding outline critical investment terms, including valuation, equity stakes, and investor rights, which significantly impact startup control and future financing. Side hustle stacks typically avoid such formal agreements, favoring flexible, incremental revenue without giving up equity or control. Explore the nuances of term sheets to understand how they shape startup growth and investment dynamics.

Source and External Links

Fund your business | U.S. Small Business Administration - Venture capital is funding given in exchange for equity and a role in the company, typically targeting high-growth startups with higher risks and potential returns, and investors often require board seats and rounds of financing tied to milestones.

Venture capital - Wikipedia - Venture capital is private equity financing for startups and early-stage companies, usually progressing through stages like pre-seed, early stage, growth capital, with exits via IPO, acquisition, or secondary sales.

What is venture capital? | SVB - Venture capital supports startups aiming for rapid growth, involving pitching, due diligence, negotiating term sheets for equity stakes, and structuring investments often in multiple rounds.

dowidth.com

dowidth.com