Decentralized autonomous organizations (DAOs) leverage blockchain technology to enable transparent, automated decision-making without centralized control, whereas joint ventures involve traditional collaboration between businesses sharing resources and responsibilities. DAOs prioritize decentralization and smart contracts for governance, while joint ventures rely on formal legal agreements and centralized management. Explore the distinct advantages and challenges of each model to understand their impact on modern entrepreneurship.

Why it is important

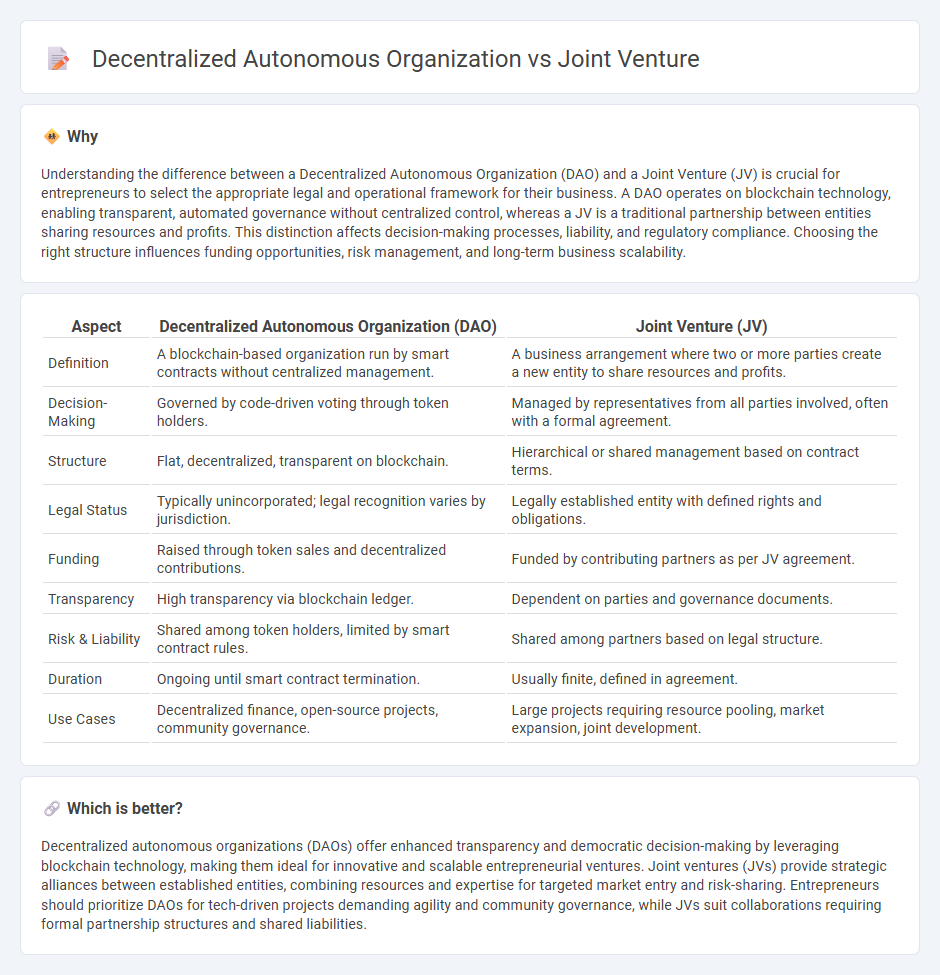

Understanding the difference between a Decentralized Autonomous Organization (DAO) and a Joint Venture (JV) is crucial for entrepreneurs to select the appropriate legal and operational framework for their business. A DAO operates on blockchain technology, enabling transparent, automated governance without centralized control, whereas a JV is a traditional partnership between entities sharing resources and profits. This distinction affects decision-making processes, liability, and regulatory compliance. Choosing the right structure influences funding opportunities, risk management, and long-term business scalability.

Comparison Table

| Aspect | Decentralized Autonomous Organization (DAO) | Joint Venture (JV) |

|---|---|---|

| Definition | A blockchain-based organization run by smart contracts without centralized management. | A business arrangement where two or more parties create a new entity to share resources and profits. |

| Decision-Making | Governed by code-driven voting through token holders. | Managed by representatives from all parties involved, often with a formal agreement. |

| Structure | Flat, decentralized, transparent on blockchain. | Hierarchical or shared management based on contract terms. |

| Legal Status | Typically unincorporated; legal recognition varies by jurisdiction. | Legally established entity with defined rights and obligations. |

| Funding | Raised through token sales and decentralized contributions. | Funded by contributing partners as per JV agreement. |

| Transparency | High transparency via blockchain ledger. | Dependent on parties and governance documents. |

| Risk & Liability | Shared among token holders, limited by smart contract rules. | Shared among partners based on legal structure. |

| Duration | Ongoing until smart contract termination. | Usually finite, defined in agreement. |

| Use Cases | Decentralized finance, open-source projects, community governance. | Large projects requiring resource pooling, market expansion, joint development. |

Which is better?

Decentralized autonomous organizations (DAOs) offer enhanced transparency and democratic decision-making by leveraging blockchain technology, making them ideal for innovative and scalable entrepreneurial ventures. Joint ventures (JVs) provide strategic alliances between established entities, combining resources and expertise for targeted market entry and risk-sharing. Entrepreneurs should prioritize DAOs for tech-driven projects demanding agility and community governance, while JVs suit collaborations requiring formal partnership structures and shared liabilities.

Connection

Decentralized autonomous organizations (DAOs) and joint ventures are connected through their shared emphasis on collaboration and shared ownership in entrepreneurial ventures. DAOs leverage blockchain technology to enable transparent governance and automated decision-making among participants, aligning with joint ventures' goals of pooling resources and expertise for mutual business objectives. Both structures facilitate decentralized control and risk-sharing, enhancing innovation and operational efficiency in entrepreneurial ecosystems.

Key Terms

Partnership Agreement

A Joint Venture (JV) typically involves a legally binding Partnership Agreement outlining roles, responsibilities, profit-sharing, and dispute resolution, tailored to a specific business objective. Decentralized Autonomous Organizations (DAOs) operate through smart contracts on a blockchain, minimizing traditional legal frameworks and instead enforcing rules and governance automatically via code. Explore the key distinctions in governance, legal enforceability, and operational transparency between JVs and DAOs to understand which structure fits your collaboration needs.

Smart Contracts

A joint venture is a legal business entity formed by two or more parties agreeing to undertake a specific project, with responsibilities and profits shared according to contract terms. A decentralized autonomous organization (DAO) operates on blockchain technology, using smart contracts to automate decision-making and governance without centralized control, ensuring transparency and security. Explore how smart contract integration differs between these structures to optimize collaboration and innovation.

Governance Structure

Joint ventures operate under a formal governance structure defined by contractual agreements between parties, specifying roles, responsibilities, decision-making processes, and profit sharing. Decentralized autonomous organizations (DAOs) utilize blockchain technology to enable member-driven governance through smart contracts, allowing transparent, automated decision-making without centralized control. Explore further insights on how governance models impact collaboration and innovation in these organizational forms.

Source and External Links

Joint Venture (JV) - Corporate Finance Institute - A joint venture is a commercial enterprise between two or more organizations combining resources to gain a tactical and strategic edge, sharing profits and losses while possibly entering new markets quickly through local partnerships.

joint venture | Wex | US Law | LII / Legal Information Institute - A joint venture is an agreement between parties combining capital, labor, skills, or assets for a single project or enterprise aimed at profit, with shared control and risk, distinct from partnerships or corporations.

Joint venture - Wikipedia - A joint venture is a business entity with shared ownership, returns, risks, and governance, formed for purposes such as accessing new markets, sharing investment risk, or pooling capabilities, and can be incorporated or unincorporated.

dowidth.com

dowidth.com