Bootstrapping empowers entrepreneurs to grow their startup using personal savings and revenue, maintaining full control and equity while minimizing external dependencies. Angel investor networks offer access to experienced investors who provide capital, mentorship, and valuable industry connections to accelerate business growth. Discover how choosing between bootstrapper toolkits and angel investors can shape your entrepreneurial journey.

Why it is important

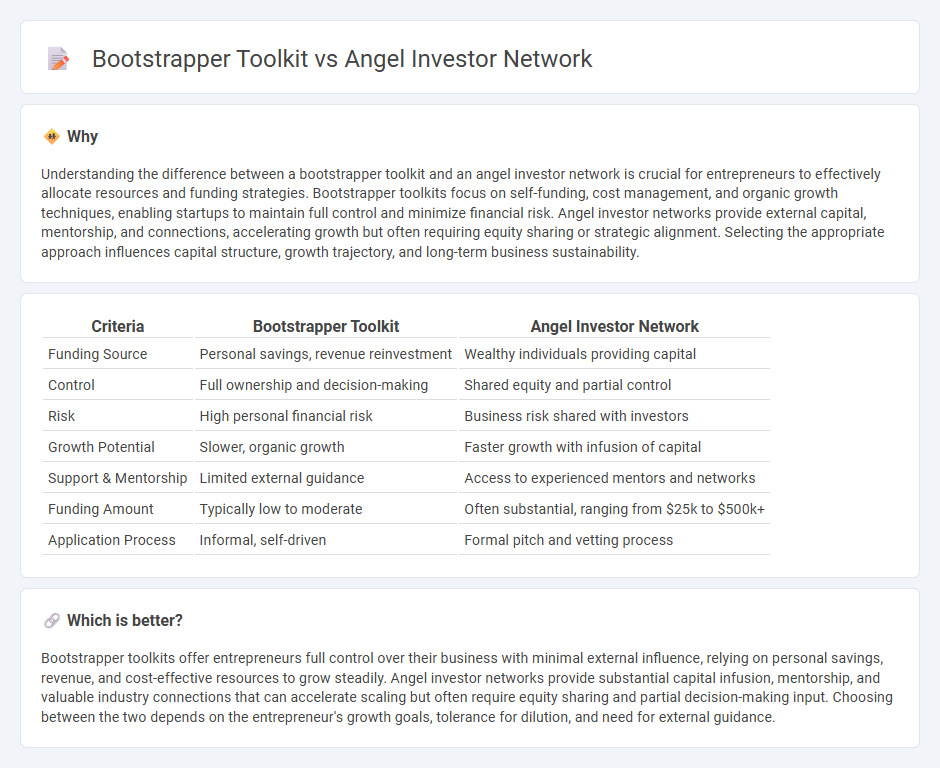

Understanding the difference between a bootstrapper toolkit and an angel investor network is crucial for entrepreneurs to effectively allocate resources and funding strategies. Bootstrapper toolkits focus on self-funding, cost management, and organic growth techniques, enabling startups to maintain full control and minimize financial risk. Angel investor networks provide external capital, mentorship, and connections, accelerating growth but often requiring equity sharing or strategic alignment. Selecting the appropriate approach influences capital structure, growth trajectory, and long-term business sustainability.

Comparison Table

| Criteria | Bootstrapper Toolkit | Angel Investor Network |

|---|---|---|

| Funding Source | Personal savings, revenue reinvestment | Wealthy individuals providing capital |

| Control | Full ownership and decision-making | Shared equity and partial control |

| Risk | High personal financial risk | Business risk shared with investors |

| Growth Potential | Slower, organic growth | Faster growth with infusion of capital |

| Support & Mentorship | Limited external guidance | Access to experienced mentors and networks |

| Funding Amount | Typically low to moderate | Often substantial, ranging from $25k to $500k+ |

| Application Process | Informal, self-driven | Formal pitch and vetting process |

Which is better?

Bootstrapper toolkits offer entrepreneurs full control over their business with minimal external influence, relying on personal savings, revenue, and cost-effective resources to grow steadily. Angel investor networks provide substantial capital infusion, mentorship, and valuable industry connections that can accelerate scaling but often require equity sharing and partial decision-making input. Choosing between the two depends on the entrepreneur's growth goals, tolerance for dilution, and need for external guidance.

Connection

Bootstrappers often rely on a specialized toolkit comprising lean methodologies, financial management apps, and growth hacking techniques to sustain early-stage ventures with minimal external funding. Angel investor networks provide crucial access to early capital and mentorship, complementing bootstrapped efforts by injecting resources that accelerate scaling while preserving founder control. This connection creates a hybrid funding approach, blending disciplined self-financing strategies with strategic external support to optimize startup growth trajectories.

Key Terms

Angel investor network:

Angel investor networks provide startups with crucial early-stage funding, connecting entrepreneurs to high-net-worth individuals interested in seed capital and mentorship. These networks often offer not only capital but also strategic guidance, industry connections, and validation that can accelerate growth. Explore more about how angel investor networks can transform your startup financing strategy.

Deal sourcing

Angel investor networks excel at deal sourcing by providing access to curated startups with high growth potential, leveraging their extensive professional connections and industry expertise. Bootstrappers rely on grassroots methods such as utilizing online platforms, attending local events, and leveraging personal networks to identify viable business opportunities. Explore effective deal sourcing strategies and tools tailored to your investment or entrepreneurial goals for deeper insights.

Due diligence

Angel investor networks prioritize comprehensive due diligence processes, evaluating startups based on market potential, financial projections, and founder credibility to mitigate investment risks. Bootstrappers rely on lean due diligence, often assessing product viability and cash flow sustainability due to limited resources and direct control over the business. Explore detailed strategies to optimize due diligence for both angel investors and bootstrapped entrepreneurs.

Source and External Links

Mississippi Angel Investor Network - A network of accredited investors providing seed and growth capital to Mississippi-based technology companies, facilitating early-stage funding and investor-entrepreneur connections.

IU Angel Network | Information For Investors - IU Ventures - A platform that connects Indiana University-related startups with investors through curated monthly investment opportunities and provides members tools for managing deal flow and investments.

Angel Networks - Faith Driven Investor - Angel investor groups focused on faith-driven entrepreneurs, such as Ambassadors Impact Network and Beyond Angel Network, combining capital investment with mentorship and shared values.

dowidth.com

dowidth.com