Pitch deck design visually communicates a startup's vision, value proposition, and business model to captivate investors and stakeholders. Financial projections detail quantifiable forecasts including revenue, expenses, and cash flow to demonstrate financial viability and growth potential. Explore how combining compelling visuals with robust financial data increases investor confidence and funding success.

Why it is important

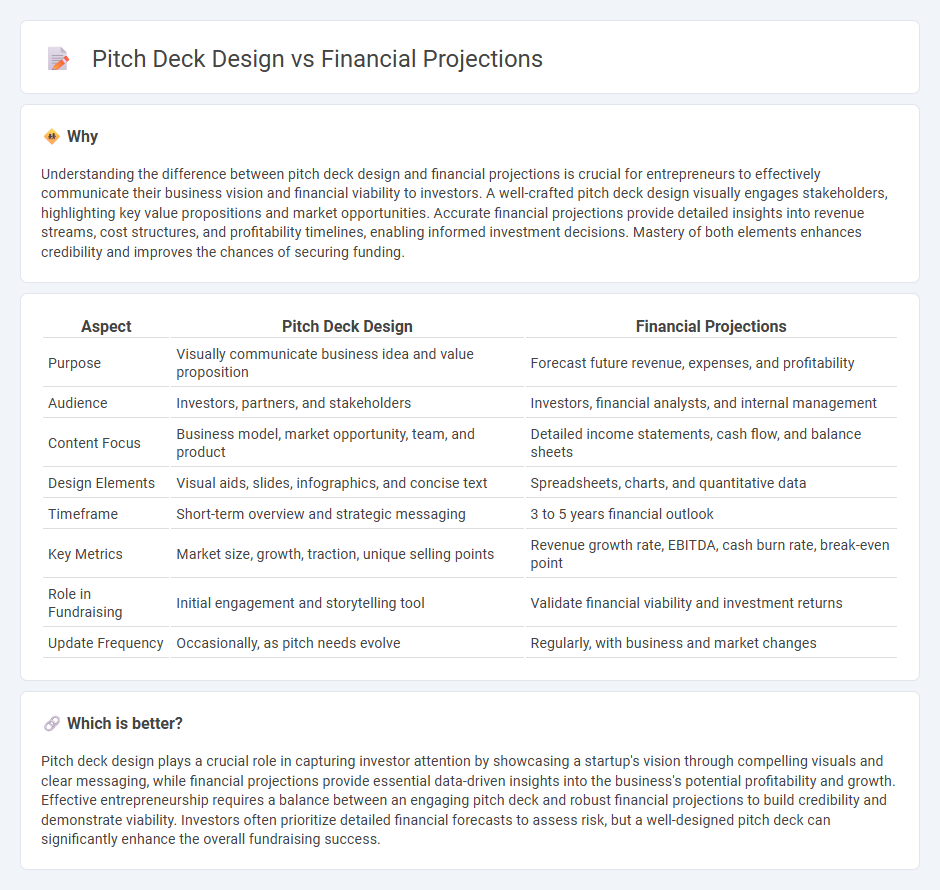

Understanding the difference between pitch deck design and financial projections is crucial for entrepreneurs to effectively communicate their business vision and financial viability to investors. A well-crafted pitch deck design visually engages stakeholders, highlighting key value propositions and market opportunities. Accurate financial projections provide detailed insights into revenue streams, cost structures, and profitability timelines, enabling informed investment decisions. Mastery of both elements enhances credibility and improves the chances of securing funding.

Comparison Table

| Aspect | Pitch Deck Design | Financial Projections |

|---|---|---|

| Purpose | Visually communicate business idea and value proposition | Forecast future revenue, expenses, and profitability |

| Audience | Investors, partners, and stakeholders | Investors, financial analysts, and internal management |

| Content Focus | Business model, market opportunity, team, and product | Detailed income statements, cash flow, and balance sheets |

| Design Elements | Visual aids, slides, infographics, and concise text | Spreadsheets, charts, and quantitative data |

| Timeframe | Short-term overview and strategic messaging | 3 to 5 years financial outlook |

| Key Metrics | Market size, growth, traction, unique selling points | Revenue growth rate, EBITDA, cash burn rate, break-even point |

| Role in Fundraising | Initial engagement and storytelling tool | Validate financial viability and investment returns |

| Update Frequency | Occasionally, as pitch needs evolve | Regularly, with business and market changes |

Which is better?

Pitch deck design plays a crucial role in capturing investor attention by showcasing a startup's vision through compelling visuals and clear messaging, while financial projections provide essential data-driven insights into the business's potential profitability and growth. Effective entrepreneurship requires a balance between an engaging pitch deck and robust financial projections to build credibility and demonstrate viability. Investors often prioritize detailed financial forecasts to assess risk, but a well-designed pitch deck can significantly enhance the overall fundraising success.

Connection

Pitch deck design plays a crucial role in effectively presenting financial projections by visually highlighting key metrics, growth potential, and revenue forecasts that investors prioritize. Clear and compelling financial data within a pitch deck builds credibility, facilitates understanding of the business model, and supports persuasive storytelling. Integrating accurate financial projections into the design enhances investor confidence and aids in securing funding.

Key Terms

**Financial Projections:**

Financial projections are critical for demonstrating a startup's potential profitability, cash flow, and growth trajectory through detailed income statements, balance sheets, and cash flow forecasts. Emphasizing accuracy and realistic assumptions in these projections builds investor confidence and guides strategic decisions. Explore expert insights on crafting precise financial forecasts that enhance your pitch deck's impact.

Revenue Forecast

Accurate financial projections are crucial in a pitch deck, with the revenue forecast serving as a key indicator of business viability and growth potential to investors. A well-designed pitch deck visually highlights revenue streams, growth assumptions, and market size, enhancing clarity and investor confidence. Explore comprehensive strategies to effectively integrate financial projections with pitch deck design to captivate potential stakeholders.

Cash Flow Statement

The Cash Flow Statement is a crucial component of financial projections, detailing the inflows and outflows of cash over a specific period to ensure business liquidity and operational stability. In pitch deck design, emphasizing clear and concise cash flow forecasts helps investors understand the startup's capacity to generate cash and manage expenses effectively. Explore how integrating detailed cash flow insights into your pitch deck can enhance investor confidence and funding opportunities.

Source and External Links

What are Financial Projections? - DealHub - Financial projections are forward-looking estimates of a company's financial performance, including revenue, expenses, cash flows, profit and loss, balance sheet, and break-even analysis usually spanning 1 to 5 years.

How to Make Financial Projections for Business - To create financial projections, start with sales projections based on past data or market research, then forecast expenses including a safety margin, accounting for possible unexpected costs for better accuracy.

6 steps to making financial projections for your new business - Financial projections for startups include forecasting cash inflows/outlays, income, and balance sheets to show investors how the business will grow, repay loans, and manage expenses, typically focusing on the first two years.

dowidth.com

dowidth.com