Alternative funding platforms provide diverse financing options such as peer-to-peer lending, invoice trading, and equity crowdfunding, enabling entrepreneurs to access capital beyond traditional loans. Crowdfunding specifically involves raising small amounts of money from a large number of people via online platforms, often rewarding contributors with products or shares. Discover how these innovative funding methods can empower your entrepreneurial journey.

Why it is important

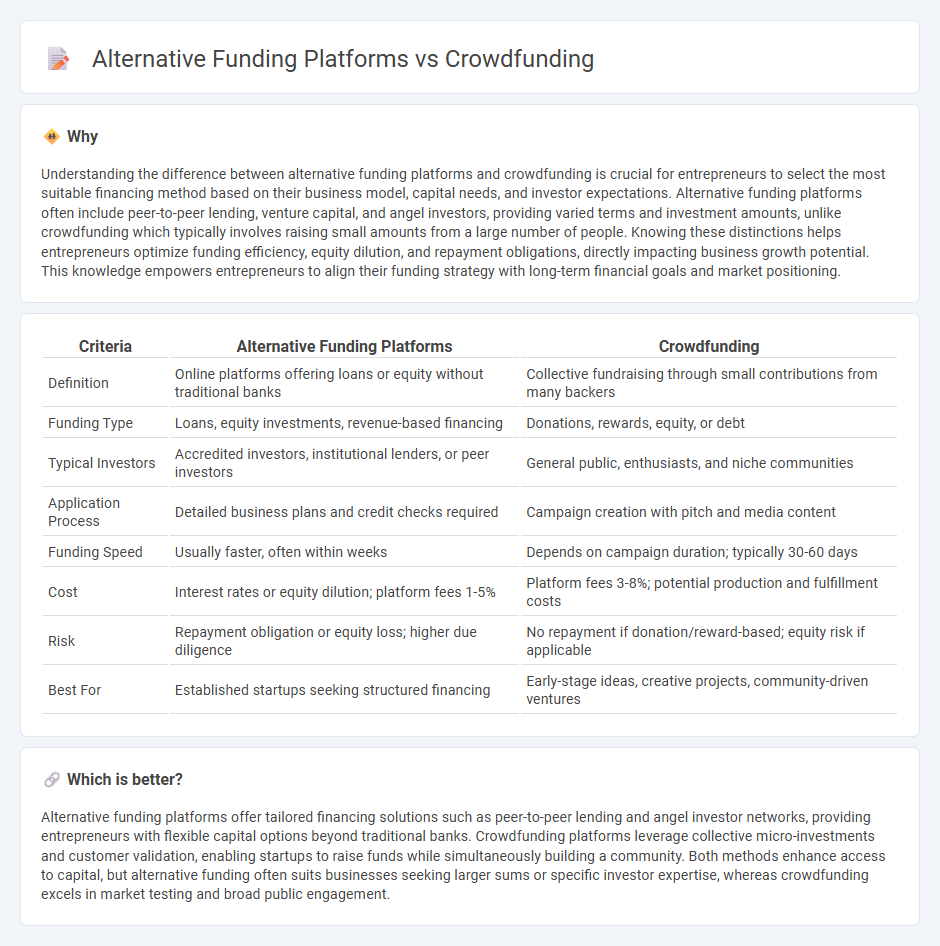

Understanding the difference between alternative funding platforms and crowdfunding is crucial for entrepreneurs to select the most suitable financing method based on their business model, capital needs, and investor expectations. Alternative funding platforms often include peer-to-peer lending, venture capital, and angel investors, providing varied terms and investment amounts, unlike crowdfunding which typically involves raising small amounts from a large number of people. Knowing these distinctions helps entrepreneurs optimize funding efficiency, equity dilution, and repayment obligations, directly impacting business growth potential. This knowledge empowers entrepreneurs to align their funding strategy with long-term financial goals and market positioning.

Comparison Table

| Criteria | Alternative Funding Platforms | Crowdfunding |

|---|---|---|

| Definition | Online platforms offering loans or equity without traditional banks | Collective fundraising through small contributions from many backers |

| Funding Type | Loans, equity investments, revenue-based financing | Donations, rewards, equity, or debt |

| Typical Investors | Accredited investors, institutional lenders, or peer investors | General public, enthusiasts, and niche communities |

| Application Process | Detailed business plans and credit checks required | Campaign creation with pitch and media content |

| Funding Speed | Usually faster, often within weeks | Depends on campaign duration; typically 30-60 days |

| Cost | Interest rates or equity dilution; platform fees 1-5% | Platform fees 3-8%; potential production and fulfillment costs |

| Risk | Repayment obligation or equity loss; higher due diligence | No repayment if donation/reward-based; equity risk if applicable |

| Best For | Established startups seeking structured financing | Early-stage ideas, creative projects, community-driven ventures |

Which is better?

Alternative funding platforms offer tailored financing solutions such as peer-to-peer lending and angel investor networks, providing entrepreneurs with flexible capital options beyond traditional banks. Crowdfunding platforms leverage collective micro-investments and customer validation, enabling startups to raise funds while simultaneously building a community. Both methods enhance access to capital, but alternative funding often suits businesses seeking larger sums or specific investor expertise, whereas crowdfunding excels in market testing and broad public engagement.

Connection

Alternative funding platforms and crowdfunding are intrinsically linked as they both provide innovative financing solutions beyond traditional venture capital or bank loans, enabling entrepreneurs to access diverse capital sources. Crowdfunding platforms, a subset of alternative funding, leverage collective contributions from individuals to finance startups or projects, thereby democratizing investment opportunities. These platforms enhance entrepreneurial growth by facilitating market validation and community engagement alongside financial support.

Key Terms

Equity Crowdfunding

Equity Crowdfunding allows investors to acquire shares in startups or small businesses through online platforms, offering a scalable alternative to traditional funding methods such as venture capital or bank loans. Platforms like SeedInvest, Crowdcube, and Republic provide businesses with access to a wider pool of investors while enabling contributors to share in the company's growth and potential profits. Explore more about the benefits and risks of Equity Crowdfunding to make informed funding decisions.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending enables individuals to borrow money directly from other individuals through online platforms, bypassing traditional financial institutions. This alternative funding method often offers lower interest rates and faster approval processes compared to crowdfunding, which typically raises funds through small contributions from a large number of people without requiring repayment. Explore the nuances of P2P lending platforms and their advantages to determine the best funding option for your needs.

Venture Capital

Venture capital offers startups substantial capital infusion in exchange for equity, making it a critical funding platform distinct from crowdfunding's reward-based or donation models. Unlike alternative funding platforms, venture capital firms provide strategic guidance and networking opportunities that accelerate business growth and market entry. Explore detailed comparisons to understand the optimal funding path for your startup's success.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is raising money for a project or venture by collecting small amounts from many people, usually online, without traditional financial intermediaries; it funds various projects including businesses, artistic efforts, and social causes.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding allows startups to raise money from a large network of individual contributors, often online via social media and platforms, enabling funding for business startups, product development, social causes, and individuals.

Crowdfunding explained - European Commission - Crowdfunding enables businesses and projects to collect funds from many people online, often used by startups and SMEs for alternative financing and to engage potential customers while gaining market insights.

dowidth.com

dowidth.com