Tiny acquisitions focus on purchasing small, profitable businesses to generate steady income and build equity with minimal risk, often leveraging existing operational structures. Lifestyle businesses prioritize personal freedom and work-life balance, typically growing slowly and maintaining owner control without aggressive scaling. Explore more insights to understand which entrepreneurial path suits your goals best.

Why it is important

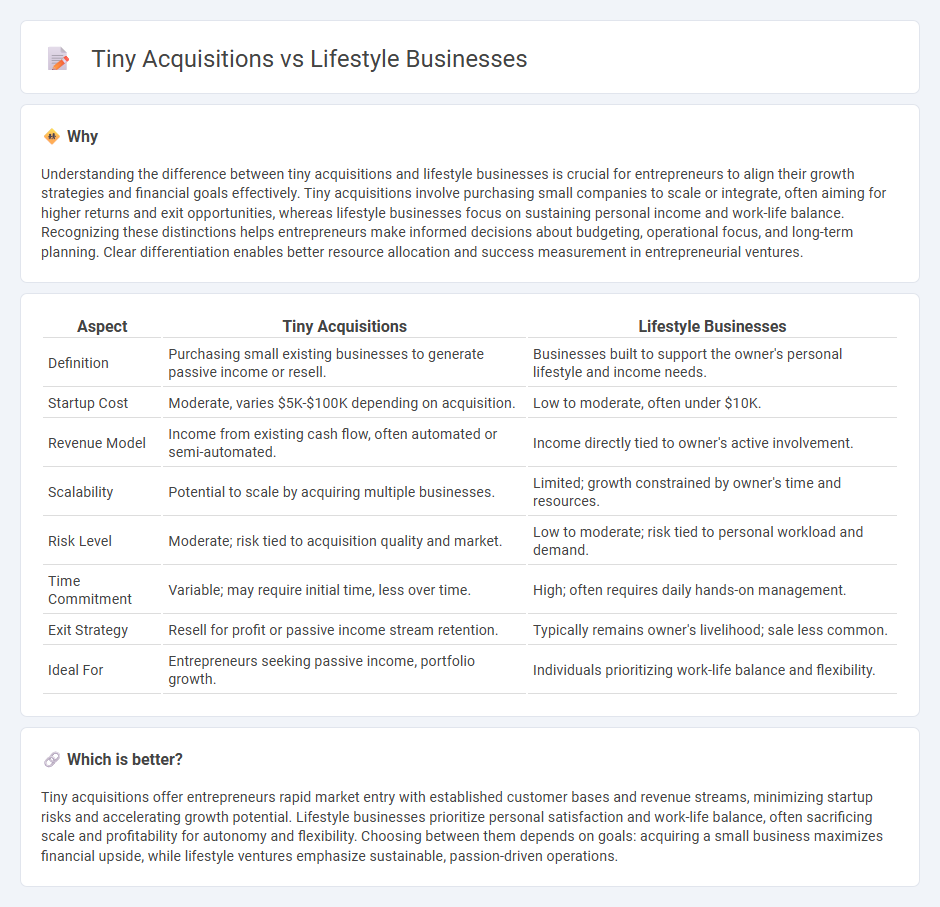

Understanding the difference between tiny acquisitions and lifestyle businesses is crucial for entrepreneurs to align their growth strategies and financial goals effectively. Tiny acquisitions involve purchasing small companies to scale or integrate, often aiming for higher returns and exit opportunities, whereas lifestyle businesses focus on sustaining personal income and work-life balance. Recognizing these distinctions helps entrepreneurs make informed decisions about budgeting, operational focus, and long-term planning. Clear differentiation enables better resource allocation and success measurement in entrepreneurial ventures.

Comparison Table

| Aspect | Tiny Acquisitions | Lifestyle Businesses |

|---|---|---|

| Definition | Purchasing small existing businesses to generate passive income or resell. | Businesses built to support the owner's personal lifestyle and income needs. |

| Startup Cost | Moderate, varies $5K-$100K depending on acquisition. | Low to moderate, often under $10K. |

| Revenue Model | Income from existing cash flow, often automated or semi-automated. | Income directly tied to owner's active involvement. |

| Scalability | Potential to scale by acquiring multiple businesses. | Limited; growth constrained by owner's time and resources. |

| Risk Level | Moderate; risk tied to acquisition quality and market. | Low to moderate; risk tied to personal workload and demand. |

| Time Commitment | Variable; may require initial time, less over time. | High; often requires daily hands-on management. |

| Exit Strategy | Resell for profit or passive income stream retention. | Typically remains owner's livelihood; sale less common. |

| Ideal For | Entrepreneurs seeking passive income, portfolio growth. | Individuals prioritizing work-life balance and flexibility. |

Which is better?

Tiny acquisitions offer entrepreneurs rapid market entry with established customer bases and revenue streams, minimizing startup risks and accelerating growth potential. Lifestyle businesses prioritize personal satisfaction and work-life balance, often sacrificing scale and profitability for autonomy and flexibility. Choosing between them depends on goals: acquiring a small business maximizes financial upside, while lifestyle ventures emphasize sustainable, passion-driven operations.

Connection

Tiny acquisitions often involve purchasing lifestyle businesses that prioritize personal freedom and manageable operations over rapid growth, making them ideal for entrepreneurs seeking sustainable income with low risk. These small-scale acquisitions allow entrepreneurs to leverage existing customer bases and streamlined processes, facilitating quick entry into the market without the need for extensive startup resources. The connection lies in the strategic alignment where lifestyle businesses serve as accessible, steady revenue sources that match the operational simplicity desired in tiny acquisitions.

Key Terms

Work-Life Balance

Lifestyle businesses prioritize sustainable income and flexible schedules, enabling founders to maintain strong work-life balance without high growth pressure. Tiny acquisitions involve purchasing small companies with established operations, offering passive income but requiring strategic management to avoid burnout. Explore how each option can align with your personal and professional goals.

Passive Income

Lifestyle businesses generate steady passive income by maintaining manageable operational demands and leveraging automated systems, ideal for entrepreneurs seeking freedom and flexibility. Tiny acquisitions involve purchasing small, profitable companies that offer immediate cash flow with minimal involvement, optimizing passive income streams. Explore strategies to maximize passive income through lifestyle businesses or tiny acquisitions for financial independence.

Micro-SaaS

Lifestyle businesses in the Micro-SaaS sector prioritize consistent cash flow and owner autonomy, often generating modest but stable monthly revenues under $10,000. Tiny acquisitions involve purchasing these small, recurring-revenue SaaS platforms to rapidly scale operations or diversify portfolios, frequently leveraging outsourced teams for efficiency. Explore the strategic benefits and operational nuances of Micro-SaaS lifestyle businesses versus tiny acquisitions to optimize your entrepreneurial approach.

Source and External Links

Lifestyle Business: Balancing Dreams With Real Life - A lifestyle business is designed primarily to provide a sustainable income for its owner and to support a personal lifestyle, often through specialized services like boutique agencies, consultancy, or wellness coaching.

Lifestyle Business Ideas for Entrepreneurial Success - Lifestyle businesses often leverage digital opportunities such as ecommerce, dropshipping, print-on-demand, and subscription boxes, offering flexibility and minimal upfront investment for the founder.

8 Lifestyle Business Ideas to Start in 2024 - Popular lifestyle business models include creating and selling digital products (e.g., templates, presets, online courses), freelancing, content creation, and running membership or blog websites.

dowidth.com

dowidth.com