Embedded finance integrates financial services directly into non-financial platforms, streamlining payment processing and lending for entrepreneurs within their existing workflows. Crowdfunding leverages a large pool of individual investors to raise capital, enabling startups to access funds without traditional banking channels. Explore how each financing model can accelerate your entrepreneurial journey.

Why it is important

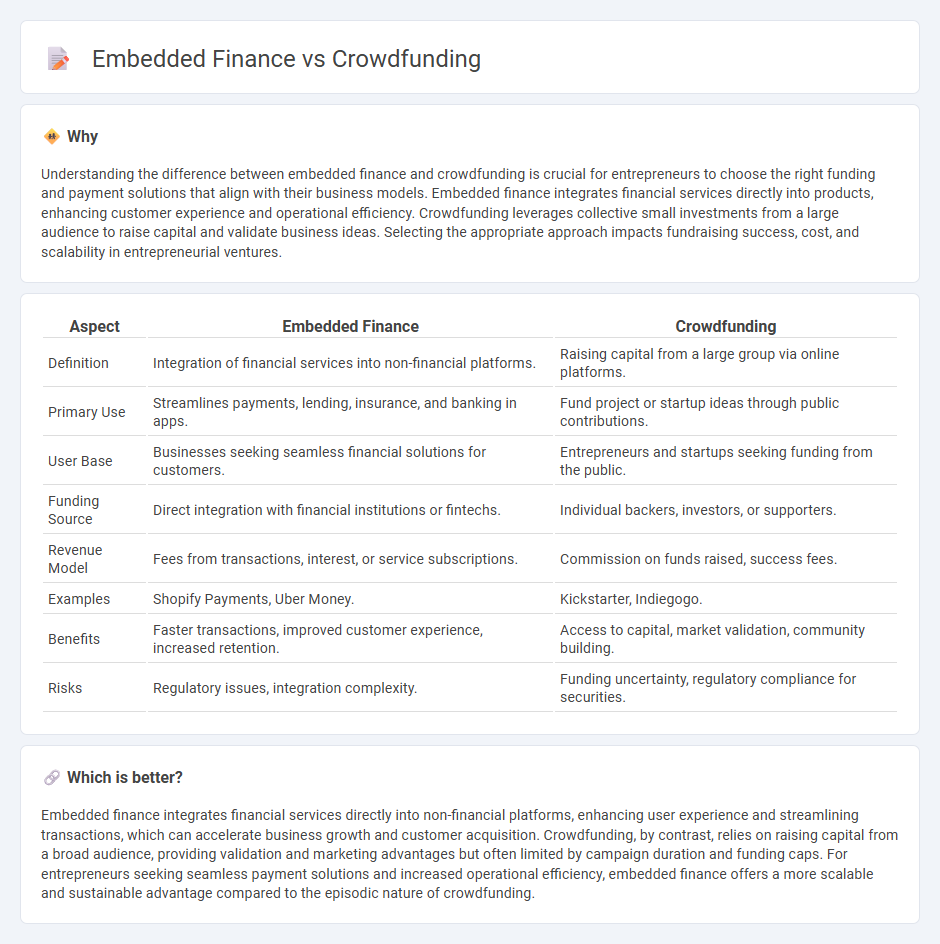

Understanding the difference between embedded finance and crowdfunding is crucial for entrepreneurs to choose the right funding and payment solutions that align with their business models. Embedded finance integrates financial services directly into products, enhancing customer experience and operational efficiency. Crowdfunding leverages collective small investments from a large audience to raise capital and validate business ideas. Selecting the appropriate approach impacts fundraising success, cost, and scalability in entrepreneurial ventures.

Comparison Table

| Aspect | Embedded Finance | Crowdfunding |

|---|---|---|

| Definition | Integration of financial services into non-financial platforms. | Raising capital from a large group via online platforms. |

| Primary Use | Streamlines payments, lending, insurance, and banking in apps. | Fund project or startup ideas through public contributions. |

| User Base | Businesses seeking seamless financial solutions for customers. | Entrepreneurs and startups seeking funding from the public. |

| Funding Source | Direct integration with financial institutions or fintechs. | Individual backers, investors, or supporters. |

| Revenue Model | Fees from transactions, interest, or service subscriptions. | Commission on funds raised, success fees. |

| Examples | Shopify Payments, Uber Money. | Kickstarter, Indiegogo. |

| Benefits | Faster transactions, improved customer experience, increased retention. | Access to capital, market validation, community building. |

| Risks | Regulatory issues, integration complexity. | Funding uncertainty, regulatory compliance for securities. |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enhancing user experience and streamlining transactions, which can accelerate business growth and customer acquisition. Crowdfunding, by contrast, relies on raising capital from a broad audience, providing validation and marketing advantages but often limited by campaign duration and funding caps. For entrepreneurs seeking seamless payment solutions and increased operational efficiency, embedded finance offers a more scalable and sustainable advantage compared to the episodic nature of crowdfunding.

Connection

Embedded finance integrates financial services directly into non-financial platforms, enabling seamless access to funding options for entrepreneurs. Crowdfunding leverages these embedded finance tools by providing a streamlined channel for startups to raise capital from a broad base of individual investors. This synergy accelerates entrepreneurial growth by simplifying investment processes and expanding access to diverse funding sources.

Key Terms

**Crowdfunding:**

Crowdfunding leverages online platforms to pool capital from a large number of individuals, supporting projects, startups, or causes without traditional financial intermediaries. It democratizes access to funding by enabling entrepreneurs and innovators to connect directly with potential backers worldwide, often resulting in increased community engagement and market validation. Explore how crowdfunding models can transform your funding strategy and drive innovation.

Backers

Backers in crowdfunding engage directly by pledging funds to projects, gaining rewards or early access, while embedded finance integrates payment and financing options seamlessly within platforms to enhance convenience and trust. Crowdfunding relies on community-driven support and transparency, whereas embedded finance offers streamlined financial services like instant credit or payment solutions to backers. Explore the differences further to understand how each model impacts backer experience and project success.

Reward-based

Reward-based crowdfunding enables individuals to fund projects in exchange for non-monetary rewards, fostering community engagement and early product validation. Embedded finance integrates financial services directly into platforms, streamlining transactions and enhancing user experience without traditional banking channels. Explore the transformative impact of reward-based crowdfunding and embedded finance on modern funding landscapes.

Source and External Links

Crowdfunding - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, and is a form of alternative finance that bypasses traditional financial intermediaries.

What is crowdfunding? Here are four types to know - Crowdfunding allows startups and projects to raise funds collectively from individuals online, leveraging wide networks and social media, as an alternative to traditional financing methods involving small groups or institutions.

Small Business Financing: A Resource Guide: Crowdfunding - Crowdfunding uses online platforms to collect small contributions from many individuals and includes models such as donation-based, reward-based, and equity-based crowdfunding, the latter allowing investors to gain ownership stakes in businesses.

dowidth.com

dowidth.com