Embedded finance integrates financial services directly into non-financial platforms, streamlining user experiences and expanding market reach for entrepreneurs. Fintech SaaS delivers cloud-based financial tools and applications, enhancing operational efficiency and scalability for startups and established businesses. Discover how these technologies transform entrepreneurial ventures by exploring their unique advantages and applications.

Why it is important

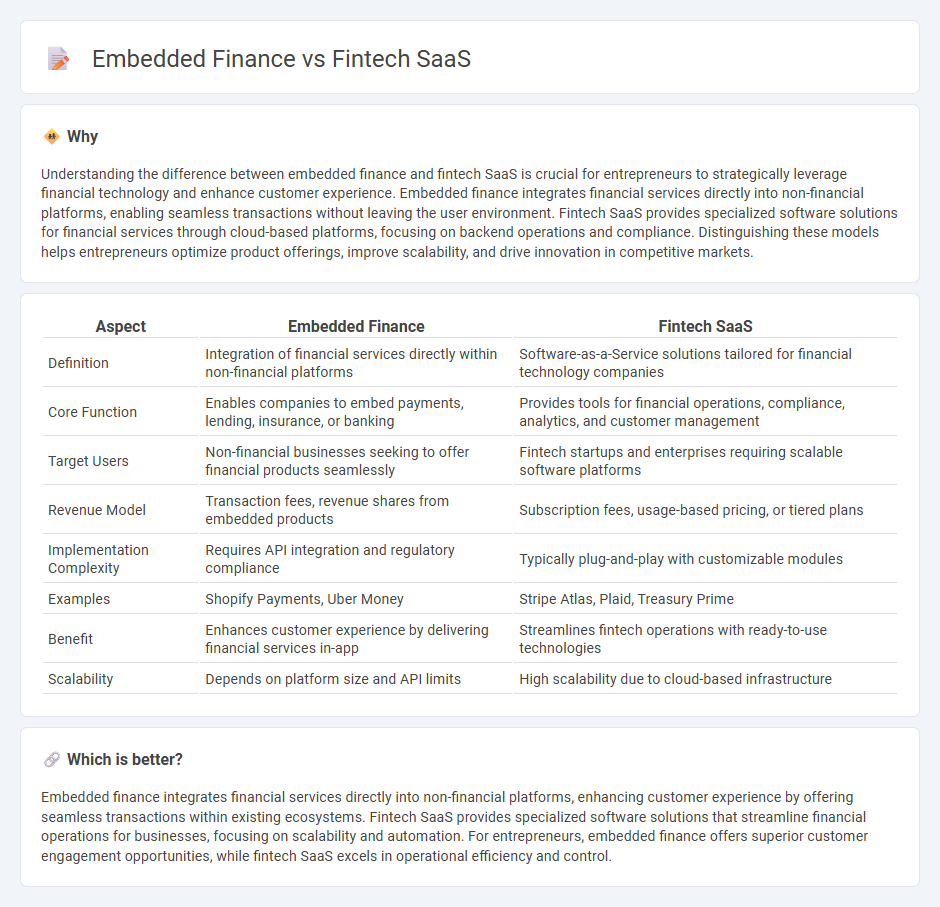

Understanding the difference between embedded finance and fintech SaaS is crucial for entrepreneurs to strategically leverage financial technology and enhance customer experience. Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions without leaving the user environment. Fintech SaaS provides specialized software solutions for financial services through cloud-based platforms, focusing on backend operations and compliance. Distinguishing these models helps entrepreneurs optimize product offerings, improve scalability, and drive innovation in competitive markets.

Comparison Table

| Aspect | Embedded Finance | Fintech SaaS |

|---|---|---|

| Definition | Integration of financial services directly within non-financial platforms | Software-as-a-Service solutions tailored for financial technology companies |

| Core Function | Enables companies to embed payments, lending, insurance, or banking | Provides tools for financial operations, compliance, analytics, and customer management |

| Target Users | Non-financial businesses seeking to offer financial products seamlessly | Fintech startups and enterprises requiring scalable software platforms |

| Revenue Model | Transaction fees, revenue shares from embedded products | Subscription fees, usage-based pricing, or tiered plans |

| Implementation Complexity | Requires API integration and regulatory compliance | Typically plug-and-play with customizable modules |

| Examples | Shopify Payments, Uber Money | Stripe Atlas, Plaid, Treasury Prime |

| Benefit | Enhances customer experience by delivering financial services in-app | Streamlines fintech operations with ready-to-use technologies |

| Scalability | Depends on platform size and API limits | High scalability due to cloud-based infrastructure |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience by offering seamless transactions within existing ecosystems. Fintech SaaS provides specialized software solutions that streamline financial operations for businesses, focusing on scalability and automation. For entrepreneurs, embedded finance offers superior customer engagement opportunities, while fintech SaaS excels in operational efficiency and control.

Connection

Embedded finance integrates banking services directly into non-financial platforms, enhancing user experiences and streamlining transactions for entrepreneurs. Fintech SaaS provides scalable software solutions that support embedded finance by enabling seamless payment processing, lending, and compliance management within entrepreneurial ecosystems. This synergy accelerates business growth by reducing operational friction and expanding access to financial products.

Key Terms

API integration

Fintech SaaS platforms offer standalone financial software solutions with robust API integration for seamless data exchange and user experience across multiple applications. Embedded finance integrates financial services directly into non-financial apps through APIs, enabling businesses to offer banking, lending, or payment solutions without leaving their platforms. Explore how API integration optimizes customer engagement and operational efficiency in these models.

Revenue models

Fintech SaaS revenue models primarily rely on subscription fees, usage-based pricing, and tiered plans tailored to business needs, ensuring predictable recurring income. Embedded finance generates revenue through transaction fees, revenue sharing with partners, and cost-per-activation models that seamlessly integrate financial services within non-financial platforms. Explore the nuances of these models to optimize growth strategies in digital finance ecosystems.

Customer journey

Fintech SaaS platforms provide standalone financial software solutions that customers actively engage with, enabling tailored user experiences through dashboards, analytics, and direct interactions. Embedded finance integrates financial services seamlessly into non-financial platforms, allowing users to access payments, lending, or insurance within familiar apps without switching interfaces, enhancing convenience and reducing friction in the customer journey. Explore how these approaches transform user engagement and retention to optimize your financial service delivery.

Source and External Links

Fintech SaaS Solutions in 2025 [Custom vs. Off-the-Shelf] - Fintech SaaS delivers financial technology applications as cloud-based services enabling online payment processing, accounting, wealth management, compliance, and trading platforms on a subscription basis without local installation.

'Best SaaS for FinTech' Award - Fintech SaaS solutions empower financial institutions with tools such as digital account management, mobile banking, payment processing with fraud detection, loan origination automation, regulatory compliance, and AI-driven investment recommendations.

How fintech SaaS is generating companies multi-million dollar savings - SaaS fintech has driven market innovation and enabled rapid growth in financial services by offering cost-effective, secure, and customizable solutions that meet changing customer expectations.

dowidth.com

dowidth.com