Marketplace flipping involves purchasing undervalued goods or assets and reselling them at a higher price to generate profit, leveraging market inefficiencies and demand fluctuations. Crowdfunding enables entrepreneurs to raise capital by collecting small amounts of money from a large number of people through online platforms, facilitating product launches and business growth without traditional financing. Explore these funding strategies to determine the best method for accelerating your entrepreneurial venture.

Why it is important

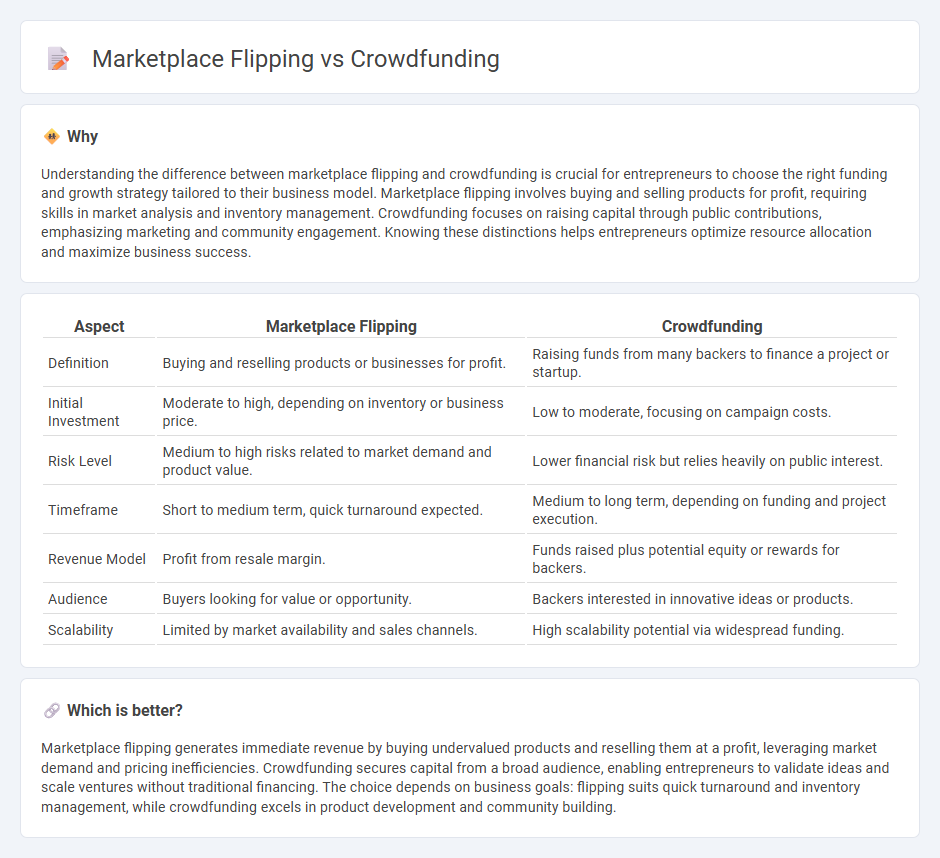

Understanding the difference between marketplace flipping and crowdfunding is crucial for entrepreneurs to choose the right funding and growth strategy tailored to their business model. Marketplace flipping involves buying and selling products for profit, requiring skills in market analysis and inventory management. Crowdfunding focuses on raising capital through public contributions, emphasizing marketing and community engagement. Knowing these distinctions helps entrepreneurs optimize resource allocation and maximize business success.

Comparison Table

| Aspect | Marketplace Flipping | Crowdfunding |

|---|---|---|

| Definition | Buying and reselling products or businesses for profit. | Raising funds from many backers to finance a project or startup. |

| Initial Investment | Moderate to high, depending on inventory or business price. | Low to moderate, focusing on campaign costs. |

| Risk Level | Medium to high risks related to market demand and product value. | Lower financial risk but relies heavily on public interest. |

| Timeframe | Short to medium term, quick turnaround expected. | Medium to long term, depending on funding and project execution. |

| Revenue Model | Profit from resale margin. | Funds raised plus potential equity or rewards for backers. |

| Audience | Buyers looking for value or opportunity. | Backers interested in innovative ideas or products. |

| Scalability | Limited by market availability and sales channels. | High scalability potential via widespread funding. |

Which is better?

Marketplace flipping generates immediate revenue by buying undervalued products and reselling them at a profit, leveraging market demand and pricing inefficiencies. Crowdfunding secures capital from a broad audience, enabling entrepreneurs to validate ideas and scale ventures without traditional financing. The choice depends on business goals: flipping suits quick turnaround and inventory management, while crowdfunding excels in product development and community building.

Connection

Marketplace flipping relies on identifying undervalued assets or products and reselling them at a profit, while crowdfunding provides the capital necessary to acquire or scale these assets. Entrepreneurs use crowdfunding platforms to gather financial support from a broad audience, enabling quicker access to inventory or resources needed for flipping ventures. Both strategies harness market dynamics and community engagement to maximize returns and accelerate business growth.

Key Terms

Capital Raising

Crowdfunding enables startups and entrepreneurs to raise capital directly from a large pool of individual investors through online platforms, often exchanging equity or rewards. Marketplace flipping involves purchasing undervalued assets or products and reselling them at a profit, generating immediate cash flow but typically lacking long-term capital growth opportunities. Explore detailed strategies to optimize your capital raising potential with these models.

Product Sourcing

Crowdfunding harnesses early consumer interest to validate and fund innovative product ideas, reducing upfront inventory risks while marketplace flipping relies on sourcing undervalued goods to resell at a profit, emphasizing speed and market demand trends. Both methods require strategic product sourcing: crowdfunding focuses on unique, scalable prototypes with pre-validated demand, whereas flipping demands keen market analysis to spot price discrepancies and emerging trends. Explore detailed strategies and tools to optimize your product sourcing in each method for better profitability.

Arbitrage

Crowdfunding enables investors to participate early in innovative projects, capitalizing on pre-market valuations, while marketplace flipping involves buying undervalued goods or assets and reselling for profit, leveraging pricing inefficiencies. Arbitrage in crowdfunding occurs through investing in undervalued startups or products before they gain market traction, whereas marketplace flipping exploits discrepancies between local and global market prices for physical or digital items. Explore the nuances and strategies behind these arbitrage opportunities to maximize investment returns.

Source and External Links

Crowdfunding - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people via the internet, often involving three main actors: the project initiator, supporters, and a platform facilitating the process.

What is crowdfunding? Here are four types to know - Crowdfunding is a way to finance projects by pooling small contributions from many people, typically online, offering an alternative to traditional funding methods for startups and projects.

Small Business Financing: A Resource Guide: Crowdfunding - Crowdfunding can take forms such as donation, rewards, or equity-based funding, enabling individuals and businesses to raise needed capital through online platforms with different return models for contributors.

dowidth.com

dowidth.com