Entrepreneurship encompasses diverse revenue models, with passive income streams generated from automated business processes or investments requiring minimal daily effort. Royalty income, a form of passive income, specifically arises from licensing intellectual property such as patents, trademarks, or creative works to third parties. Explore the distinctions and advantages of each income type to optimize your entrepreneurial strategy.

Why it is important

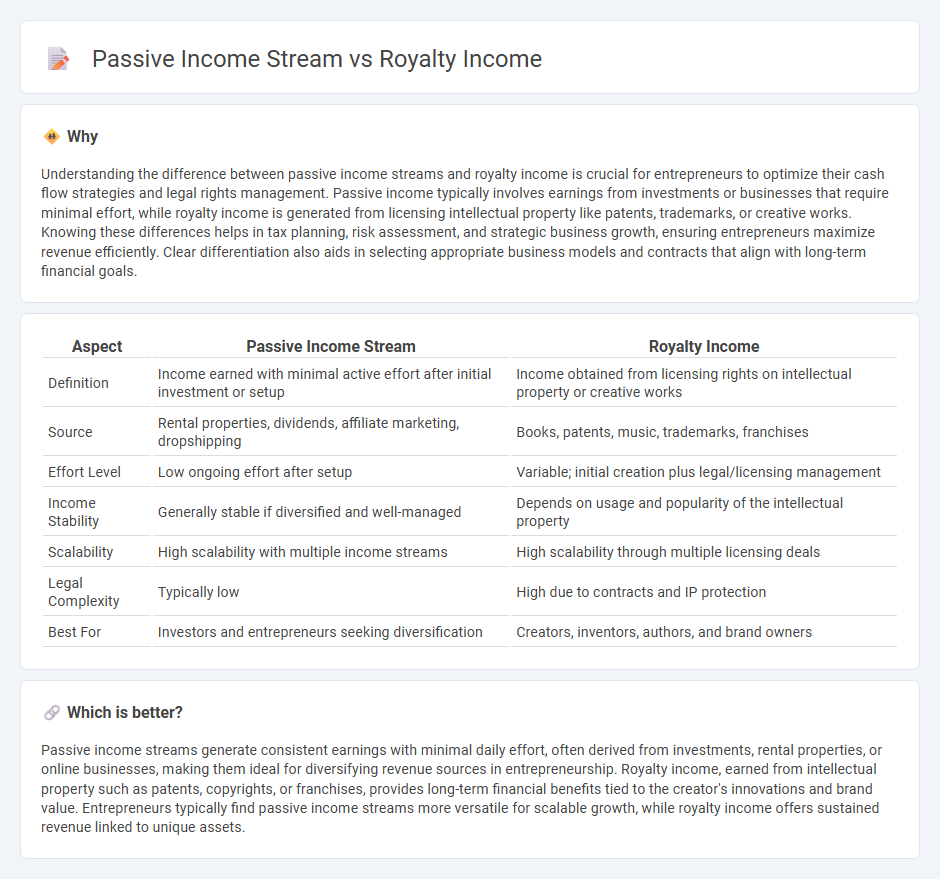

Understanding the difference between passive income streams and royalty income is crucial for entrepreneurs to optimize their cash flow strategies and legal rights management. Passive income typically involves earnings from investments or businesses that require minimal effort, while royalty income is generated from licensing intellectual property like patents, trademarks, or creative works. Knowing these differences helps in tax planning, risk assessment, and strategic business growth, ensuring entrepreneurs maximize revenue efficiently. Clear differentiation also aids in selecting appropriate business models and contracts that align with long-term financial goals.

Comparison Table

| Aspect | Passive Income Stream | Royalty Income |

|---|---|---|

| Definition | Income earned with minimal active effort after initial investment or setup | Income obtained from licensing rights on intellectual property or creative works |

| Source | Rental properties, dividends, affiliate marketing, dropshipping | Books, patents, music, trademarks, franchises |

| Effort Level | Low ongoing effort after setup | Variable; initial creation plus legal/licensing management |

| Income Stability | Generally stable if diversified and well-managed | Depends on usage and popularity of the intellectual property |

| Scalability | High scalability with multiple income streams | High scalability through multiple licensing deals |

| Legal Complexity | Typically low | High due to contracts and IP protection |

| Best For | Investors and entrepreneurs seeking diversification | Creators, inventors, authors, and brand owners |

Which is better?

Passive income streams generate consistent earnings with minimal daily effort, often derived from investments, rental properties, or online businesses, making them ideal for diversifying revenue sources in entrepreneurship. Royalty income, earned from intellectual property such as patents, copyrights, or franchises, provides long-term financial benefits tied to the creator's innovations and brand value. Entrepreneurs typically find passive income streams more versatile for scalable growth, while royalty income offers sustained revenue linked to unique assets.

Connection

Passive income streams generate earnings with minimal active involvement, often through investments or intellectual property. Royalty income is a specific type of passive income earned from licensing rights to intellectual property such as books, music, patents, or trademarks. Entrepreneurs leverage both passive income streams and royalties to diversify revenue sources and enhance long-term financial stability.

Key Terms

Licensing

Royalty income from licensing agreements generates ongoing revenue by allowing others to use intellectual property such as patents, trademarks, or copyrighted material in exchange for periodic payments. Unlike traditional passive income streams that may arise from investments or rental properties, licensing provides a scalable model that leverages creative assets without active involvement in daily operations. Explore the advantages of royalty income and how licensing can enhance your financial portfolio.

Residual Earnings

Royalty income represents a form of residual earnings generated from intellectual property such as patents, copyrights, or trademarks, providing ongoing payments without active involvement. Passive income streams encompass a broader range of earnings, including rental income, dividends, or interest, that require minimal effort to maintain but may not always be residual. Explore more about optimizing residual earnings through strategic royalty income management and diversified passive income sources.

Asset Ownership

Royalty income stems from ownership of intellectual property or natural resources, generating earnings through licensing or usage rights without active involvement. Passive income streams can originate from various assets like rental properties, dividend stocks, or peer-to-peer lending, requiring some initial effort but minimal ongoing management. Explore further to understand how different asset ownership types impact financial growth.

Source and External Links

How to Invest in Royalty Income - SmartAsset - Royalty income is payments made for the use of intellectual property or natural resources and is considered passive income taxed at capital gains rates, providing investors with steady and diversified income streams.

What are royalties and how are they reported? - TaxSlayer Support - Royalties are payments received for the use of property, commonly copyrights, patents, trademarks, or natural resource extraction, and are typically reported on Schedule E unless self-employed, in which case Schedule C is used.

Royalty payment - Wikipedia - A royalty payment is made to an asset owner for ongoing use of the asset, often based on revenue percentages or fixed per-unit fees, and the royalty interest represents the right to receive future royalty payments.

dowidth.com

dowidth.com