Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience by offering seamless transactions within everyday applications. Insurtech leverages technology to innovate insurance processes, focusing on personalized risk assessment, streamlined claims, and improved policy management. Explore how these evolving sectors reshape entrepreneurship and create new market opportunities.

Why it is important

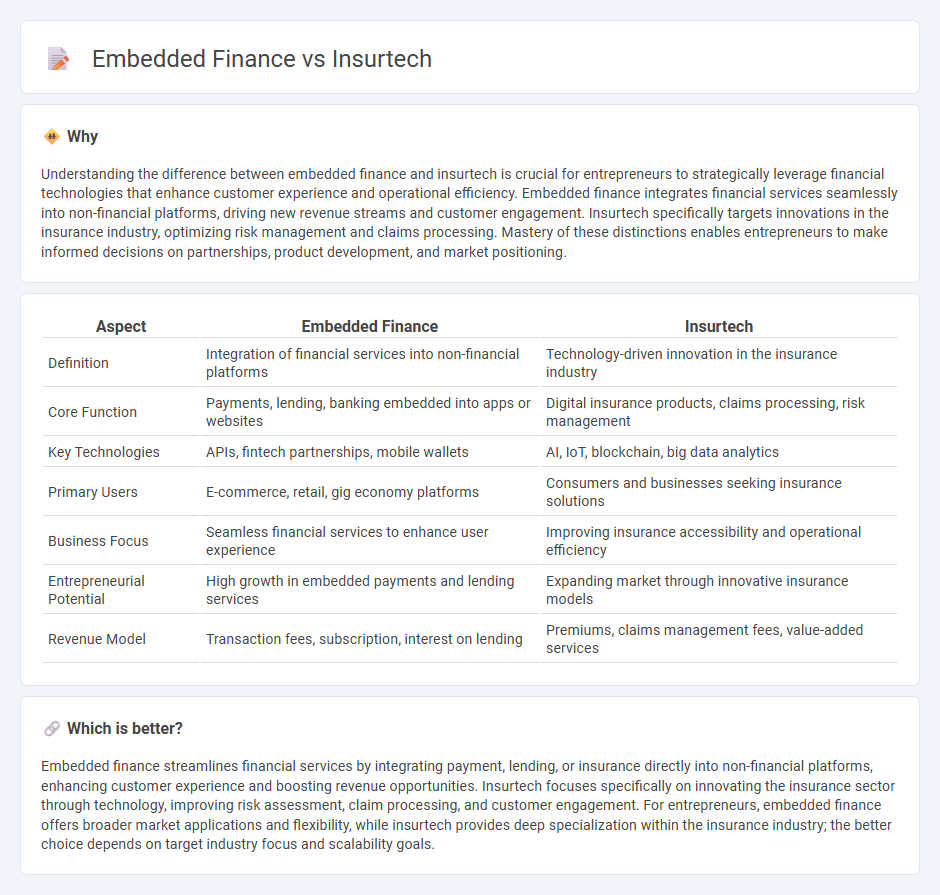

Understanding the difference between embedded finance and insurtech is crucial for entrepreneurs to strategically leverage financial technologies that enhance customer experience and operational efficiency. Embedded finance integrates financial services seamlessly into non-financial platforms, driving new revenue streams and customer engagement. Insurtech specifically targets innovations in the insurance industry, optimizing risk management and claims processing. Mastery of these distinctions enables entrepreneurs to make informed decisions on partnerships, product development, and market positioning.

Comparison Table

| Aspect | Embedded Finance | Insurtech |

|---|---|---|

| Definition | Integration of financial services into non-financial platforms | Technology-driven innovation in the insurance industry |

| Core Function | Payments, lending, banking embedded into apps or websites | Digital insurance products, claims processing, risk management |

| Key Technologies | APIs, fintech partnerships, mobile wallets | AI, IoT, blockchain, big data analytics |

| Primary Users | E-commerce, retail, gig economy platforms | Consumers and businesses seeking insurance solutions |

| Business Focus | Seamless financial services to enhance user experience | Improving insurance accessibility and operational efficiency |

| Entrepreneurial Potential | High growth in embedded payments and lending services | Expanding market through innovative insurance models |

| Revenue Model | Transaction fees, subscription, interest on lending | Premiums, claims management fees, value-added services |

Which is better?

Embedded finance streamlines financial services by integrating payment, lending, or insurance directly into non-financial platforms, enhancing customer experience and boosting revenue opportunities. Insurtech focuses specifically on innovating the insurance sector through technology, improving risk assessment, claim processing, and customer engagement. For entrepreneurs, embedded finance offers broader market applications and flexibility, while insurtech provides deep specialization within the insurance industry; the better choice depends on target industry focus and scalability goals.

Connection

Embedded finance integrates financial services directly into non-financial platforms, streamlining payment, lending, and insurance processes for entrepreneurial ventures. Insurtech leverages technology to innovate insurance delivery, making policies more accessible and customizable within embedded finance frameworks. This synergy accelerates startup growth by providing seamless, on-demand financial and insurance products tailored to business needs.

Key Terms

Digital Insurance Platforms

Digital insurance platforms revolutionize risk management by integrating insurtech solutions that leverage AI and big data analytics for personalized policy offerings. Embedded finance enhances this model by seamlessly incorporating insurance services within non-insurance digital ecosystems, enabling real-time coverage and streamlined customer experiences. Explore how combining these technologies transforms insurance accessibility and efficiency in modern financial services.

API Integration

Insurtech leverages API integration to streamline insurance services by connecting policy management, claims processing, and customer data in real-time, enhancing efficiency and customer experience. Embedded finance uses APIs to seamlessly integrate financial services such as payments, lending, and insurance within non-financial platforms, enabling frictionless transactions and personalized offerings. Explore the latest innovations in API integration to understand how both sectors are transforming digital ecosystems.

Customer Experience

Insurtech leverages cutting-edge technology like AI-driven claims processing and personalized policy recommendations to streamline customer interactions and reduce friction in insurance services. Embedded finance integrates financial products such as insurance seamlessly into non-financial platforms, enhancing user convenience by providing instant access to services within familiar digital environments like e-commerce or mobility apps. Explore how these innovations transform customer experience and drive greater engagement in financial services.

Source and External Links

What Is Insurtech? A Guide For Brokers and Carriers - Insurtech updates aging insurance systems with digital innovation, using AI, automation, and mobile apps to improve underwriting, policy management, and claims processing for carriers, brokers, and policyholders.

Insurtech | Insights - A comprehensive resource on insurtech industry players including investors, startups, and carriers that covers regulatory issues, partnerships, and operational strategies critical to entering or investing in insurtech.

Insurtech Insights | World's Largest Insurtech Community - Insurtech Insights hosts leading global events, rankings, and networking opportunities for entrepreneurs, investors, and insurance incumbents to explore AI-driven automation and digital transformation trends in insurance.

dowidth.com

dowidth.com