Side hustle stacks combine multiple income streams through small businesses or freelance projects, offering flexible, scalable ways to build wealth with relatively low risk. Angel investing involves providing capital to startups in exchange for equity, creating opportunities for high returns but with increased risk and need for financial expertise. Explore the unique benefits and challenges of each approach to determine the best fit for your entrepreneurial goals.

Why it is important

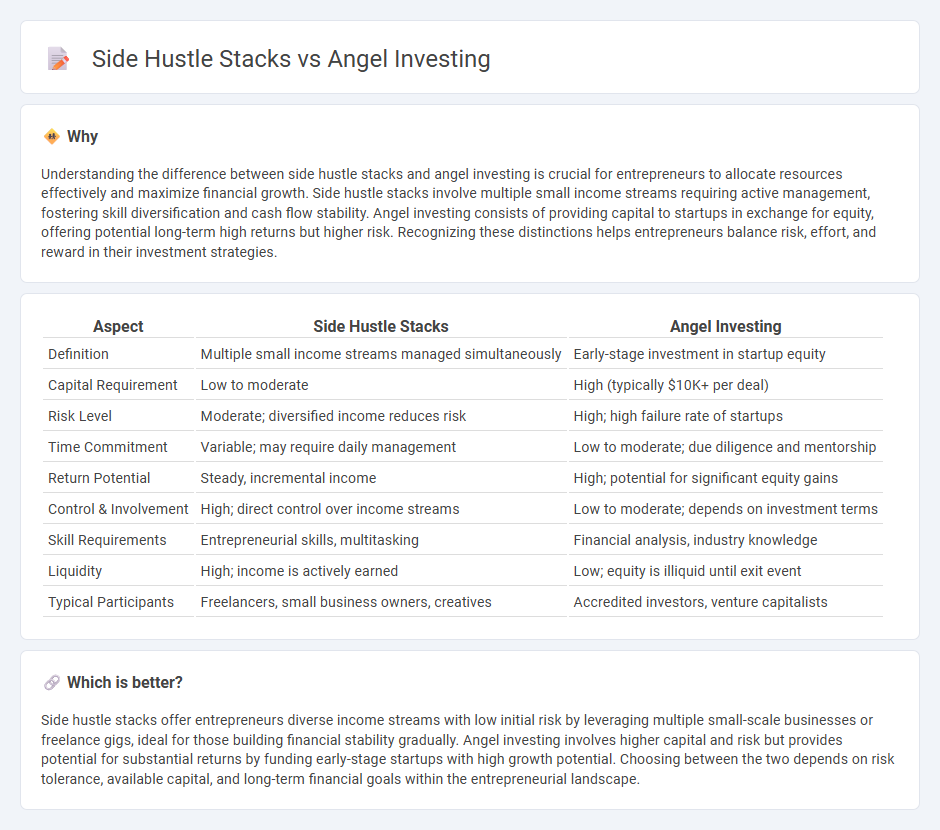

Understanding the difference between side hustle stacks and angel investing is crucial for entrepreneurs to allocate resources effectively and maximize financial growth. Side hustle stacks involve multiple small income streams requiring active management, fostering skill diversification and cash flow stability. Angel investing consists of providing capital to startups in exchange for equity, offering potential long-term high returns but higher risk. Recognizing these distinctions helps entrepreneurs balance risk, effort, and reward in their investment strategies.

Comparison Table

| Aspect | Side Hustle Stacks | Angel Investing |

|---|---|---|

| Definition | Multiple small income streams managed simultaneously | Early-stage investment in startup equity |

| Capital Requirement | Low to moderate | High (typically $10K+ per deal) |

| Risk Level | Moderate; diversified income reduces risk | High; high failure rate of startups |

| Time Commitment | Variable; may require daily management | Low to moderate; due diligence and mentorship |

| Return Potential | Steady, incremental income | High; potential for significant equity gains |

| Control & Involvement | High; direct control over income streams | Low to moderate; depends on investment terms |

| Skill Requirements | Entrepreneurial skills, multitasking | Financial analysis, industry knowledge |

| Liquidity | High; income is actively earned | Low; equity is illiquid until exit event |

| Typical Participants | Freelancers, small business owners, creatives | Accredited investors, venture capitalists |

Which is better?

Side hustle stacks offer entrepreneurs diverse income streams with low initial risk by leveraging multiple small-scale businesses or freelance gigs, ideal for those building financial stability gradually. Angel investing involves higher capital and risk but provides potential for substantial returns by funding early-stage startups with high growth potential. Choosing between the two depends on risk tolerance, available capital, and long-term financial goals within the entrepreneurial landscape.

Connection

Side hustle stacks enable entrepreneurs to generate diverse income streams while developing skills that attract angel investors. Angel investing provides crucial capital and mentorship to scalable side hustles with proven market traction. The synergy between these elements accelerates startup growth and increases the potential for successful venture exits.

Key Terms

Seed Funding

Angel investing involves providing early-stage capital to startups in exchange for equity, targeting high-growth potential ventures during seed funding rounds. Side hustle stacks typically generate income through scalable, low-cost projects but usually lack the substantial capital infusion required for seed-stage startups. Explore more to understand the distinct advantages and risks associated with seed funding through angel investments compared to side hustle strategies.

Passive Income

Angel investing provides opportunities to generate passive income by funding startups with high growth potential, offering equity stakes that can yield substantial returns over time. Side hustle stacks, combining multiple income streams such as freelancing, rental properties, and dividend investments, diversify revenue sources and enhance financial stability. Explore strategies to optimize your passive income portfolio and balance risks effectively.

Risk Diversification

Angel investing offers high potential returns by funding early-stage startups but carries significant risk due to market volatility and startup failure rates. Side hustle stacks diversify income streams by combining multiple lower-risk, smaller-scale ventures to balance financial stability. Explore the differences in risk diversification strategies to determine which approach aligns best with your investment goals.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investing involves individuals who provide capital to startups in exchange for equity or convertible debt, helping founders move from early funding by family and friends to professional rounds, while also offering mentorship, industry expertise, and access to networks essential for early business growth.

Angel investor - Wikipedia - Angel investors are private individuals who invest their personal funds in early-stage companies; in the UK, they typically invest amounts around PS42,000 and achieve average returns of over twice the invested capital within a few years, often supporting impactful business ventures.

15 best angel investing platforms [2025 update] - Waveup - Angel investing platforms aggregate early-stage investors, offering startups access to funding, mentorship, and strategic connections, with prominent angel investors like Marc Andressen and Naval Ravikant known for their successful investment exits and influence in the startup ecosystem.

dowidth.com

dowidth.com