Bootstrapper communities emphasize self-funding, resourcefulness, and organic growth, allowing entrepreneurs to maintain full control and equity in their ventures. Venture capital communities focus on external funding, rapid scaling, and market disruption, often trading equity for capital infusion and strategic partnerships. Explore deeper to understand which approach aligns best with your entrepreneurial goals.

Why it is important

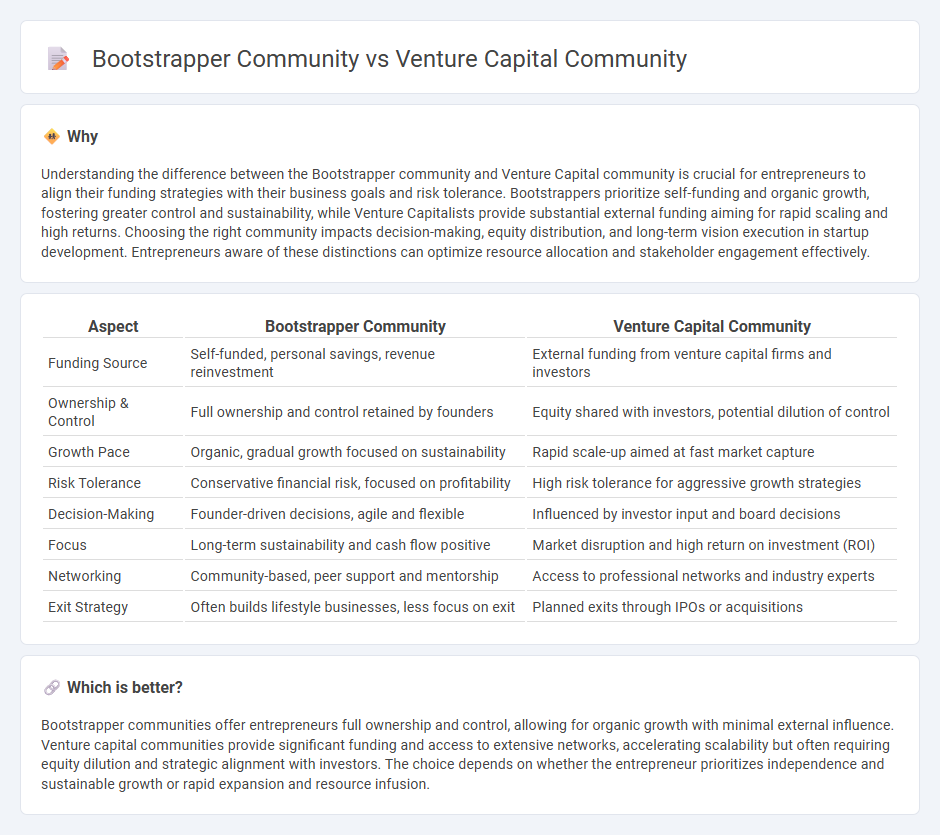

Understanding the difference between the Bootstrapper community and Venture Capital community is crucial for entrepreneurs to align their funding strategies with their business goals and risk tolerance. Bootstrappers prioritize self-funding and organic growth, fostering greater control and sustainability, while Venture Capitalists provide substantial external funding aiming for rapid scaling and high returns. Choosing the right community impacts decision-making, equity distribution, and long-term vision execution in startup development. Entrepreneurs aware of these distinctions can optimize resource allocation and stakeholder engagement effectively.

Comparison Table

| Aspect | Bootstrapper Community | Venture Capital Community |

|---|---|---|

| Funding Source | Self-funded, personal savings, revenue reinvestment | External funding from venture capital firms and investors |

| Ownership & Control | Full ownership and control retained by founders | Equity shared with investors, potential dilution of control |

| Growth Pace | Organic, gradual growth focused on sustainability | Rapid scale-up aimed at fast market capture |

| Risk Tolerance | Conservative financial risk, focused on profitability | High risk tolerance for aggressive growth strategies |

| Decision-Making | Founder-driven decisions, agile and flexible | Influenced by investor input and board decisions |

| Focus | Long-term sustainability and cash flow positive | Market disruption and high return on investment (ROI) |

| Networking | Community-based, peer support and mentorship | Access to professional networks and industry experts |

| Exit Strategy | Often builds lifestyle businesses, less focus on exit | Planned exits through IPOs or acquisitions |

Which is better?

Bootstrapper communities offer entrepreneurs full ownership and control, allowing for organic growth with minimal external influence. Venture capital communities provide significant funding and access to extensive networks, accelerating scalability but often requiring equity dilution and strategic alignment with investors. The choice depends on whether the entrepreneur prioritizes independence and sustainable growth or rapid expansion and resource infusion.

Connection

The Bootstrapper community and Venture Capital community are connected through their shared focus on business growth and innovation, where bootstrappers validate market demand with minimal resources, attracting attention from venture capitalists seeking scalable startups. Bootstrappers provide proof of concept and early customer traction, lowering investment risk for venture capitalists who offer capital infusion to accelerate expansion. This symbiotic relationship fuels a dynamic ecosystem that supports entrepreneurial success from initial idea validation to rapid market penetration.

Key Terms

**Venture Capital Community:**

The venture capital community centers on high-growth startups with scalable business models, often targeting technology and innovation sectors that promise significant returns on investment. Its members include institutional investors, angel investors, and venture capital firms that provide not only capital but also strategic guidance and industry connections to accelerate company growth. Explore how these investors shape startup ecosystems and drive innovation to understand the dynamics of the venture capital world.

Equity Investment

The venture capital community primarily focuses on equity investment by providing significant capital in exchange for ownership stakes, aiming for high-growth startups with scalable business models. In contrast, the bootstrapper community relies on self-funding and reinvested profits, maintaining full ownership without external equity dilution. Explore more about how these funding approaches impact startup growth strategies and investor relations.

Scalability

Venture capital communities prioritize rapid scalability by injecting significant financial resources and strategic guidance to accelerate growth and market penetration. Bootstrapper communities emphasize organic growth, relying on reinvested profits and lean operations to achieve sustainable scalability without external funding. Explore the distinct advantages and challenges of each approach to scalability in entrepreneurial ecosystems.

Source and External Links

How to create a VC community to expand your portfolio - Bundl - A VC community brings value beyond funding by fostering knowledge sharing, networking, and expert advice, helping both VC firms and corporate VC units differentiate themselves and grow their portfolios effectively.

VC Platform - VC Platform is a large community of 2,400+ operational venture capital professionals focused on building relationships, supporting founders, and developing tools to improve fund performance and networking within the venture capital ecosystem.

Why All the Big VC's are Starting to Focus on Community - CMX Hub - Leading venture capital firms increasingly invest in community-building efforts to offer startups mentorship, events, networking, and more, enhancing value beyond just financial support.

dowidth.com

dowidth.com