Solopreneurship involves a single individual managing all aspects of a business, offering agility and full control but limited scalability compared to corporations. Corporations benefit from structured management, greater resource access, and liability protection but face complex regulations and slower decision-making processes. Explore the distinct advantages and challenges of solopreneurship versus corporation to determine the best entrepreneurial path for your goals.

Why it is important

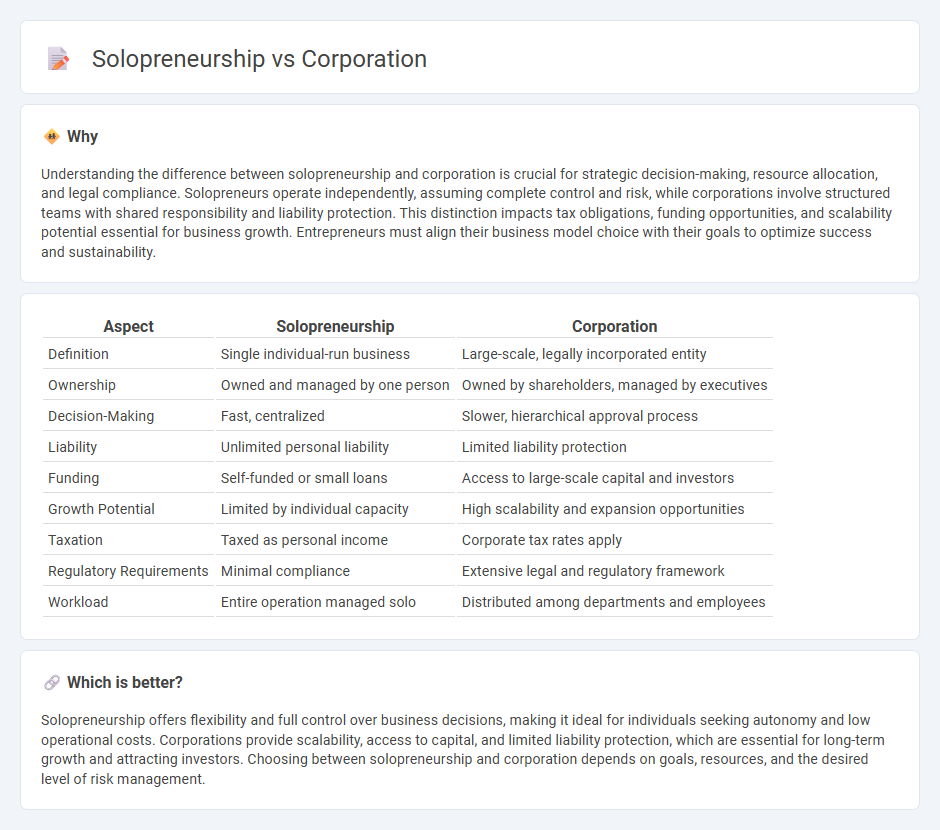

Understanding the difference between solopreneurship and corporation is crucial for strategic decision-making, resource allocation, and legal compliance. Solopreneurs operate independently, assuming complete control and risk, while corporations involve structured teams with shared responsibility and liability protection. This distinction impacts tax obligations, funding opportunities, and scalability potential essential for business growth. Entrepreneurs must align their business model choice with their goals to optimize success and sustainability.

Comparison Table

| Aspect | Solopreneurship | Corporation |

|---|---|---|

| Definition | Single individual-run business | Large-scale, legally incorporated entity |

| Ownership | Owned and managed by one person | Owned by shareholders, managed by executives |

| Decision-Making | Fast, centralized | Slower, hierarchical approval process |

| Liability | Unlimited personal liability | Limited liability protection |

| Funding | Self-funded or small loans | Access to large-scale capital and investors |

| Growth Potential | Limited by individual capacity | High scalability and expansion opportunities |

| Taxation | Taxed as personal income | Corporate tax rates apply |

| Regulatory Requirements | Minimal compliance | Extensive legal and regulatory framework |

| Workload | Entire operation managed solo | Distributed among departments and employees |

Which is better?

Solopreneurship offers flexibility and full control over business decisions, making it ideal for individuals seeking autonomy and low operational costs. Corporations provide scalability, access to capital, and limited liability protection, which are essential for long-term growth and attracting investors. Choosing between solopreneurship and corporation depends on goals, resources, and the desired level of risk management.

Connection

Solopreneurship and corporations are connected through the entrepreneurial ecosystem, where solopreneurs often serve as innovation drivers or agile market testers that corporations later scale. Many corporations adopt intrapreneurship models inspired by solopreneur approaches, fostering internal entrepreneurship to enhance competitiveness. This dynamic creates a symbiotic relationship, accelerating business growth and innovation across both individual and corporate levels.

Key Terms

Liability

Corporations offer limited liability protection, safeguarding personal assets of shareholders from business debts and legal actions. In contrast, solopreneurs face unlimited personal liability, making them personally responsible for all business obligations and risks. Explore comprehensive comparisons to understand how liability impacts your business structure choices.

Scalability

Corporations benefit from scalable business models through structured teams and robust resource allocation, enabling exponential growth and market expansion. Solopreneurs face limitations in scalability due to dependence on individual capacity and time constraints, often requiring strategic outsourcing for growth. Explore detailed strategies to maximize your business scalability effectively.

Decision-making

Corporations centralize decision-making through hierarchical structures, enhancing control and consistency across departments but potentially slowing responsiveness. Solopreneurs retain full autonomy, enabling swift, flexible decisions aligned directly with their vision and market needs. Discover more about how decision-making impacts business growth and agility.

Source and External Links

Guide to Corporations: Definition and Types - A corporation is a business treated as a legal person, owned by shareholders and managed by a board, offering limited liability which protects shareholders from personal responsibility for corporate debts or legal actions.

Corporation | Definition, History, & Facts | Britannica Money - A corporation is a state-chartered legal entity distinguished by limited liability, transferability of shares, juridical personality, and indefinite duration, commonly used for raising large capital and conducting business.

What is a Corporation? - Various Types and Reasons ... - A corporation is a legal entity created through incorporation to operate for profit or non-profit, allowed to enter contracts and own assets, with shareholders protected from personal liability beyond their investment.

dowidth.com

dowidth.com