Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience by offering seamless payments, lending, or insurance options within apps or websites. Buy Now, Pay Later (BNPL) allows consumers to split purchases into interest-free installments, boosting purchasing power and conversion rates for businesses. Discover how these innovative financial solutions are transforming entrepreneurship and consumer behavior.

Why it is important

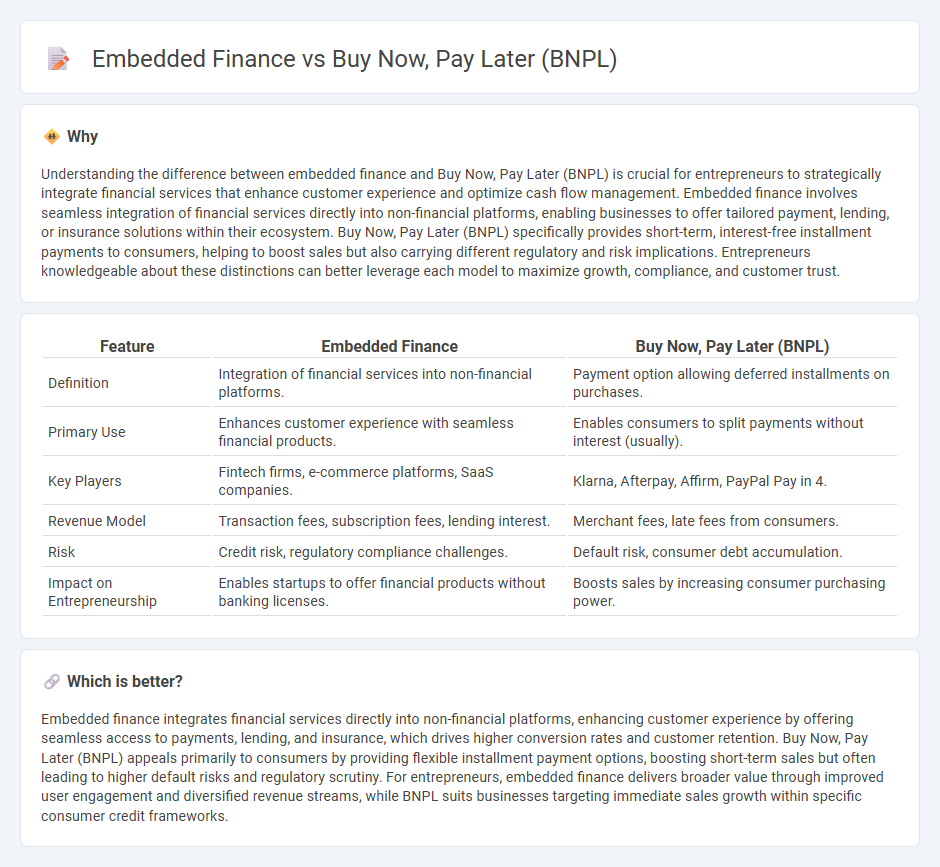

Understanding the difference between embedded finance and Buy Now, Pay Later (BNPL) is crucial for entrepreneurs to strategically integrate financial services that enhance customer experience and optimize cash flow management. Embedded finance involves seamless integration of financial services directly into non-financial platforms, enabling businesses to offer tailored payment, lending, or insurance solutions within their ecosystem. Buy Now, Pay Later (BNPL) specifically provides short-term, interest-free installment payments to consumers, helping to boost sales but also carrying different regulatory and risk implications. Entrepreneurs knowledgeable about these distinctions can better leverage each model to maximize growth, compliance, and customer trust.

Comparison Table

| Feature | Embedded Finance | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Definition | Integration of financial services into non-financial platforms. | Payment option allowing deferred installments on purchases. |

| Primary Use | Enhances customer experience with seamless financial products. | Enables consumers to split payments without interest (usually). |

| Key Players | Fintech firms, e-commerce platforms, SaaS companies. | Klarna, Afterpay, Affirm, PayPal Pay in 4. |

| Revenue Model | Transaction fees, subscription fees, lending interest. | Merchant fees, late fees from consumers. |

| Risk | Credit risk, regulatory compliance challenges. | Default risk, consumer debt accumulation. |

| Impact on Entrepreneurship | Enables startups to offer financial products without banking licenses. | Boosts sales by increasing consumer purchasing power. |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience by offering seamless access to payments, lending, and insurance, which drives higher conversion rates and customer retention. Buy Now, Pay Later (BNPL) appeals primarily to consumers by providing flexible installment payment options, boosting short-term sales but often leading to higher default risks and regulatory scrutiny. For entrepreneurs, embedded finance delivers broader value through improved user engagement and diversified revenue streams, while BNPL suits businesses targeting immediate sales growth within specific consumer credit frameworks.

Connection

Embedded finance integrates financial services like payments, lending, and insurance directly into non-financial platforms, enabling seamless transactions within entrepreneurial ecosystems. Buy Now, Pay Later (BNPL) leverages this integration by offering flexible payment options embedded within e-commerce and service platforms, boosting consumer purchasing power and driving sales growth. This connection empowers entrepreneurs to enhance customer experience, increase conversion rates, and access new revenue streams through innovative financial solutions.

Key Terms

Credit Risk

Buy Now, Pay Later (BNPL) services primarily assess credit risk through short-term consumer behavior and alternative data points to enable quick approval and flexible payment options. Embedded finance integrates credit offerings directly within platforms, leveraging comprehensive transactional and behavioral data to perform deeper credit risk analysis, often resulting in more accurate risk assessments and personalized credit limits. Explore how evolving credit risk models impact the future of BNPL and embedded finance solutions.

Integration APIs

Buy Now, Pay Later (BNPL) solutions leverage Integration APIs to seamlessly connect payment options within e-commerce platforms, enhancing consumer flexibility and conversion rates. Embedded finance uses these APIs to integrate banking services directly into non-financial applications, streamlining user experience by embedding credit, insurance, or investment options. Explore the latest trends in Integration APIs to understand how BNPL and embedded finance reshape digital commerce.

Customer Acquisition

Buy Now, Pay Later (BNPL) accelerates customer acquisition by offering flexible payment options that enhance purchasing power and reduce cart abandonment rates. Embedded finance integrates BNPL seamlessly within platforms, creating frictionless user experiences that increase conversion and drive loyalty. Explore how these financial innovations can transform customer acquisition strategies in your business.

Source and External Links

Buy now, pay later - Buy Now, Pay Later (BNPL) is a short-term financing method allowing consumers to purchase goods by paying initially only a portion of the cost and then repaying the remainder in installments over time, typically involving merchants, financiers, and consumers.

What Is Buy Now, Pay Later? - BNPL divides a purchase into equal payments, often four installments due biweekly, with the first payment at checkout, usually without interest but possibly with fees for late or rescheduled payments.

What is a Buy Now, Pay Later (BNPL) loan? - BNPL loans allow immediate purchase with little or no upfront payment and repayment over four or fewer payments, commonly interest-free, but can charge late fees, with applications requiring basic personal information and generally avoiding hard credit inquiries.

dowidth.com

dowidth.com