Indie hacking emphasizes bootstrapping a startup through personal skills and minimal external funding, focusing on rapid product development and user feedback to achieve sustainable growth. Business acquisition involves purchasing an existing company to leverage its established customer base, cash flow, and operational infrastructure, often requiring significant capital and due diligence. Explore the distinct pathways and strategic benefits of indie hacking versus business acquisition to determine the best entrepreneurial approach for your goals.

Why it is important

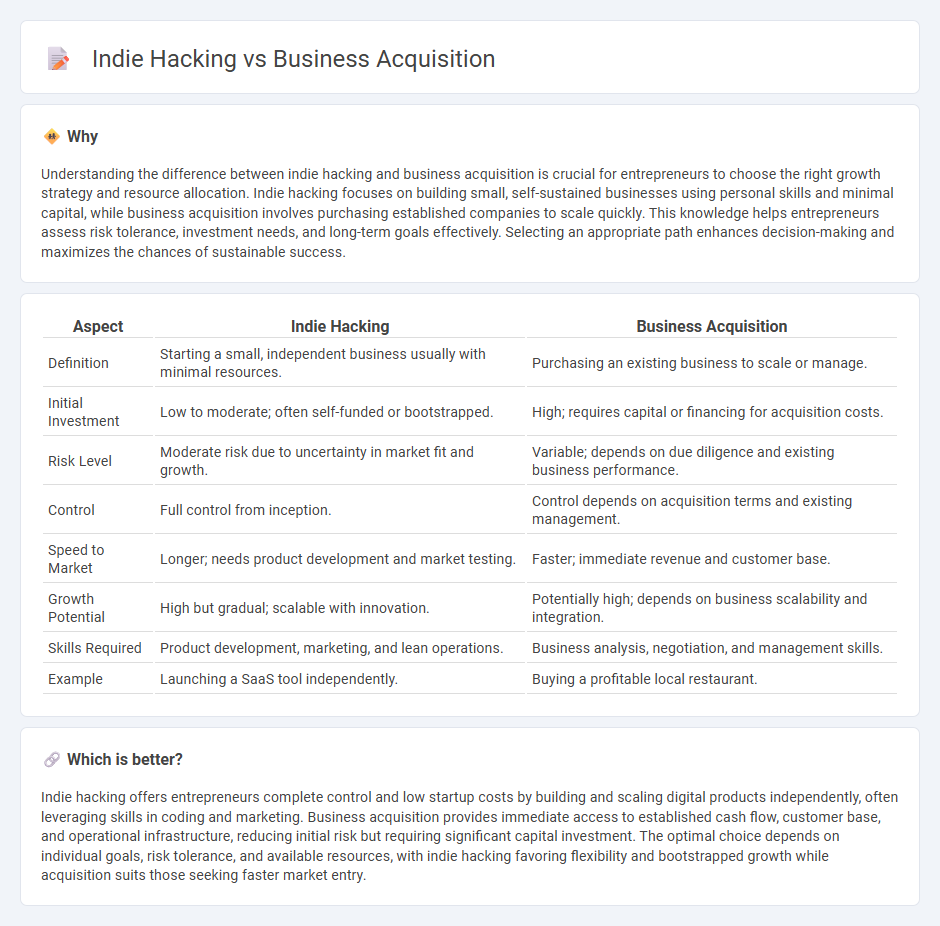

Understanding the difference between indie hacking and business acquisition is crucial for entrepreneurs to choose the right growth strategy and resource allocation. Indie hacking focuses on building small, self-sustained businesses using personal skills and minimal capital, while business acquisition involves purchasing established companies to scale quickly. This knowledge helps entrepreneurs assess risk tolerance, investment needs, and long-term goals effectively. Selecting an appropriate path enhances decision-making and maximizes the chances of sustainable success.

Comparison Table

| Aspect | Indie Hacking | Business Acquisition |

|---|---|---|

| Definition | Starting a small, independent business usually with minimal resources. | Purchasing an existing business to scale or manage. |

| Initial Investment | Low to moderate; often self-funded or bootstrapped. | High; requires capital or financing for acquisition costs. |

| Risk Level | Moderate risk due to uncertainty in market fit and growth. | Variable; depends on due diligence and existing business performance. |

| Control | Full control from inception. | Control depends on acquisition terms and existing management. |

| Speed to Market | Longer; needs product development and market testing. | Faster; immediate revenue and customer base. |

| Growth Potential | High but gradual; scalable with innovation. | Potentially high; depends on business scalability and integration. |

| Skills Required | Product development, marketing, and lean operations. | Business analysis, negotiation, and management skills. |

| Example | Launching a SaaS tool independently. | Buying a profitable local restaurant. |

Which is better?

Indie hacking offers entrepreneurs complete control and low startup costs by building and scaling digital products independently, often leveraging skills in coding and marketing. Business acquisition provides immediate access to established cash flow, customer base, and operational infrastructure, reducing initial risk but requiring significant capital investment. The optimal choice depends on individual goals, risk tolerance, and available resources, with indie hacking favoring flexibility and bootstrapped growth while acquisition suits those seeking faster market entry.

Connection

Indie hacking and business acquisition intersect as viable paths for entrepreneurs seeking autonomy and scalable growth. Indie hackers often develop digital products independently, building valuable assets that attract potential buyers, facilitating business acquisition as a strategic exit or growth option. Business acquisitions leverage these self-sustained ventures, enabling entrepreneurs to expand portfolios or pivot markets with established revenue streams.

Key Terms

**Business Acquisition:**

Business acquisition involves purchasing an existing company to leverage its established customer base, revenue streams, and operational infrastructure, often accelerating growth and reducing startup risks. This strategy typically requires significant capital investment and careful due diligence to ensure the target business aligns with the buyer's goals and market positioning. Explore our comprehensive guide to understand how business acquisition can transform your entrepreneurial journey.

Due Diligence

Due diligence in business acquisition involves thorough financial, legal, and operational evaluations to mitigate risks and ensure accurate valuation. Indie hacking requires self-led due diligence, focusing on market validation, product feasibility, and financial sustainability with limited external oversight. Explore detailed strategies to master due diligence in both paths for informed decision-making.

Valuation

Business acquisition often hinges on valuation metrics such as EBITDA multiples, revenue growth, and market position to determine purchase price, reflecting the established entity's financial health and scalability. Indie hacking valuation typically centers on cash flow consistency, user engagement, and the potential for organic growth without significant external investment. Explore deeper insights into valuation strategies to optimize your entrepreneurial path.

Source and External Links

What Is an Acquisition? Definition, Types, and Examples - A business acquisition is when one company purchases and gains control over another company by buying most or all of its shares to take over its assets and operations, which can be friendly or hostile transactions.

Business acquisitions | EBSCO Research Starters - Business acquisitions involve one company taking control of another, typically by obtaining a majority of its equity shares, leading to the acquired company ceasing to exist as a separate entity, and are pursued to increase shareholder value, enter new markets, or eliminate competition.

The Acquisition Timeline: How Long Does It Really Take? - The acquisition process includes research, due diligence lasting one to three months, and planning integration, with total timelines ranging from several months to several years depending on deal complexity and integration scope.

dowidth.com

dowidth.com