Exit as a Service (EaaS) offers entrepreneurs a streamlined and flexible alternative to traditional management buyouts by facilitating faster liquidity events through specialized platforms and expert support. Management buyouts involve the existing management team acquiring a significant stake, often requiring extensive negotiations and financial structuring. Explore how these distinct exit strategies can impact your business growth and investor relations.

Why it is important

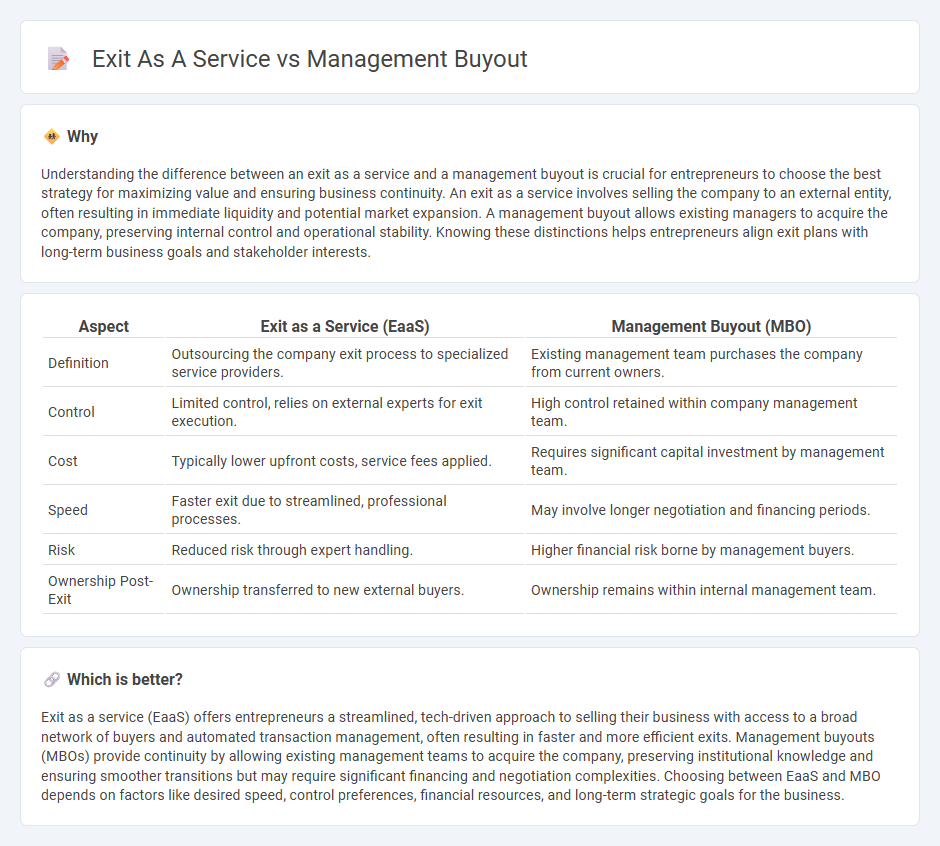

Understanding the difference between an exit as a service and a management buyout is crucial for entrepreneurs to choose the best strategy for maximizing value and ensuring business continuity. An exit as a service involves selling the company to an external entity, often resulting in immediate liquidity and potential market expansion. A management buyout allows existing managers to acquire the company, preserving internal control and operational stability. Knowing these distinctions helps entrepreneurs align exit plans with long-term business goals and stakeholder interests.

Comparison Table

| Aspect | Exit as a Service (EaaS) | Management Buyout (MBO) |

|---|---|---|

| Definition | Outsourcing the company exit process to specialized service providers. | Existing management team purchases the company from current owners. |

| Control | Limited control, relies on external experts for exit execution. | High control retained within company management team. |

| Cost | Typically lower upfront costs, service fees applied. | Requires significant capital investment by management team. |

| Speed | Faster exit due to streamlined, professional processes. | May involve longer negotiation and financing periods. |

| Risk | Reduced risk through expert handling. | Higher financial risk borne by management buyers. |

| Ownership Post-Exit | Ownership transferred to new external buyers. | Ownership remains within internal management team. |

Which is better?

Exit as a service (EaaS) offers entrepreneurs a streamlined, tech-driven approach to selling their business with access to a broad network of buyers and automated transaction management, often resulting in faster and more efficient exits. Management buyouts (MBOs) provide continuity by allowing existing management teams to acquire the company, preserving institutional knowledge and ensuring smoother transitions but may require significant financing and negotiation complexities. Choosing between EaaS and MBO depends on factors like desired speed, control preferences, financial resources, and long-term strategic goals for the business.

Connection

Exit as a Service (EaaS) and Management Buyout (MBO) are interconnected strategies enabling entrepreneurs and business owners to transition ownership smoothly. EaaS provides a structured approach and expert guidance throughout the exit process, which can include facilitating MBOs where existing management acquires the company. This synergy helps maximize value extraction while ensuring continuity and operational stability during ownership change.

Key Terms

Ownership transfer

Management buyout (MBO) involves the existing management team acquiring ownership, ensuring continuity and control within the company. Exit as a service (EaaS) provides a structured platform for owners to transfer ownership smoothly to external buyers, often accelerating liquidity without operational disruption. Explore detailed strategies and implications of ownership transfer in both methods to determine the best fit for your business transition.

Valuation

Management buyout (MBO) typically results in a higher valuation due to insider knowledge and aligned incentives, enabling management to unlock hidden value within the company. Exit as a service platforms offer data-driven valuation tools and streamlined processes, providing objective market-based valuation metrics that attract external buyers. Explore how each approach impacts your company's valuation strategies and outcomes for a tailored exit plan.

Strategic exit

A management buyout (MBO) involves the company's existing management team acquiring the business to retain control and drive future growth, often leveraging internal expertise and operational continuity. Exit as a Service (EaaS) provides a strategic exit framework, offering flexible, technology-driven solutions that streamline divestment processes and maximize valuation for stakeholders. Explore how these strategic exit options align with your business goals to optimize value and transition success.

Source and External Links

Management Buyout (MBO) | Transaction Structure + Examples - A management buyout (MBO) is a leveraged buyout where the company's existing management team acquires a significant equity stake, financing the purchase primarily with debt and equity, including contributions from both management and financial sponsors.

Key considerations when choosing a management buy-in or buyout - An MBO involves the existing management team purchasing the company they run, with a typical process involving feasibility assessment, advisors, tax planning, fundraising, due diligence, and legal steps to complete the deal.

Management Buyout (MBO) - Corporate Finance Institute - An MBO is a corporate finance transaction in which the management team borrows money to buy out the existing owners, often when the owner-founder retires or shareholders want to exit, maintaining continuity of operations and ownership expertise.

dowidth.com

dowidth.com