Tiny acquisitions offer entrepreneurs a faster path to market by acquiring established micro-businesses with proven revenue streams, minimizing the risks associated with building from scratch. Startup studios focus on building multiple ventures simultaneously by providing shared resources, mentorship, and operational support to increase the success rate of new startups. Explore the strategic differences and benefits of tiny acquisitions versus startup studios to determine the best fit for your entrepreneurial goals.

Why it is important

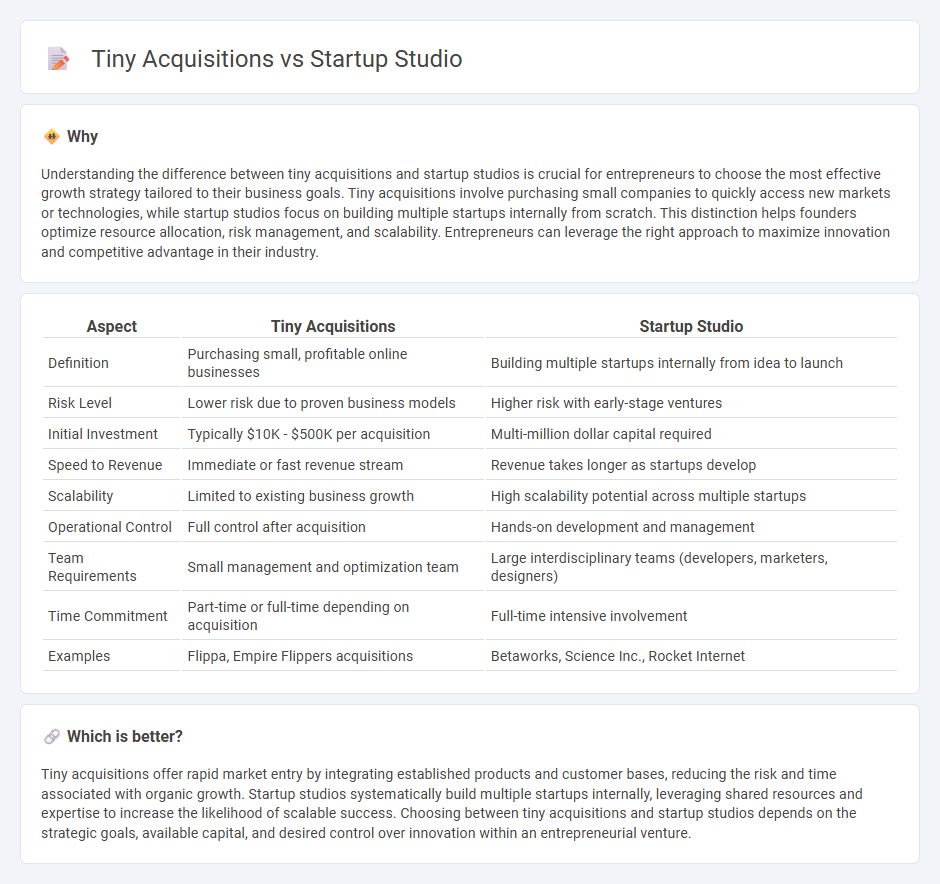

Understanding the difference between tiny acquisitions and startup studios is crucial for entrepreneurs to choose the most effective growth strategy tailored to their business goals. Tiny acquisitions involve purchasing small companies to quickly access new markets or technologies, while startup studios focus on building multiple startups internally from scratch. This distinction helps founders optimize resource allocation, risk management, and scalability. Entrepreneurs can leverage the right approach to maximize innovation and competitive advantage in their industry.

Comparison Table

| Aspect | Tiny Acquisitions | Startup Studio |

|---|---|---|

| Definition | Purchasing small, profitable online businesses | Building multiple startups internally from idea to launch |

| Risk Level | Lower risk due to proven business models | Higher risk with early-stage ventures |

| Initial Investment | Typically $10K - $500K per acquisition | Multi-million dollar capital required |

| Speed to Revenue | Immediate or fast revenue stream | Revenue takes longer as startups develop |

| Scalability | Limited to existing business growth | High scalability potential across multiple startups |

| Operational Control | Full control after acquisition | Hands-on development and management |

| Team Requirements | Small management and optimization team | Large interdisciplinary teams (developers, marketers, designers) |

| Time Commitment | Part-time or full-time depending on acquisition | Full-time intensive involvement |

| Examples | Flippa, Empire Flippers acquisitions | Betaworks, Science Inc., Rocket Internet |

Which is better?

Tiny acquisitions offer rapid market entry by integrating established products and customer bases, reducing the risk and time associated with organic growth. Startup studios systematically build multiple startups internally, leveraging shared resources and expertise to increase the likelihood of scalable success. Choosing between tiny acquisitions and startup studios depends on the strategic goals, available capital, and desired control over innovation within an entrepreneurial venture.

Connection

Tiny acquisitions serve as strategic tools within startup studios to rapidly expand product offerings and acquire innovative technologies, accelerating market entry. Startup studios systematically build and scale multiple startups by leveraging these small acquisitions to fill capability gaps and enhance competitive advantage. This synergy optimizes resource allocation and fosters an agile innovation ecosystem, driving sustainable entrepreneurship growth.

Key Terms

Venture Building

Startup studios systematically build multiple ventures by providing shared resources, expertise, and funding, accelerating early-stage development. Tiny acquisitions involve acquiring small companies mainly for integration or market expansion rather than organic growth, which contrasts with the venture-building model of startup studios. Explore how startup studios drive innovation and scalable growth by blending entrepreneurship with structured support.

Micro-acquisition

Micro-acquisitions emphasize the purchase of small, profitable startups with immediate cash flow, offering efficient market entry and risk mitigation. Startup studios build companies from the ground up by providing resources, mentorship, and operational support to multiple startups simultaneously. Explore how micro-acquisitions can accelerate your business growth with minimal overhead and strategic advantage.

Portfolio Approach

Startup studios build diversified portfolios by internally launching multiple startups simultaneously, leveraging shared resources and expertise to optimize growth trajectories. Tiny acquisitions enhance portfolio value through strategic integration of small, innovative companies, accelerating market expansion without extensive development time. Explore our detailed analysis to understand which portfolio approach best suits your investment strategy.

Source and External Links

What is a startup studio and what are its advantages? - A startup studio (aka venture builder or startup factory) actively creates and develops new businesses with in-house teams, providing shared resources and strategic support to increase the chance of success for emerging startups.

Startup studio - Startup studios are companies that build multiple startups in parallel by generating ideas internally and assigning teams to develop them, distinct from incubators or accelerators; there are over 780 globally as of 2022.

Top Startup Studios - Examples of notable startup studios include Colab, Coplex, and Devland, which partner with corporations or focus on innovation to design and scale startups from idea to launch.

dowidth.com

dowidth.com