Digital collectibles represent unique, limited-edition virtual items often tied to gaming or art communities, while blockchain assets encompass a broader range of tokenized digital properties secured by decentralized ledgers. Entrepreneurs leverage blockchain assets to create transparent, tradable, and verifiable ownership models that extend beyond traditional collectibles. Discover how these innovations are transforming digital ownership and entrepreneurial opportunities.

Why it is important

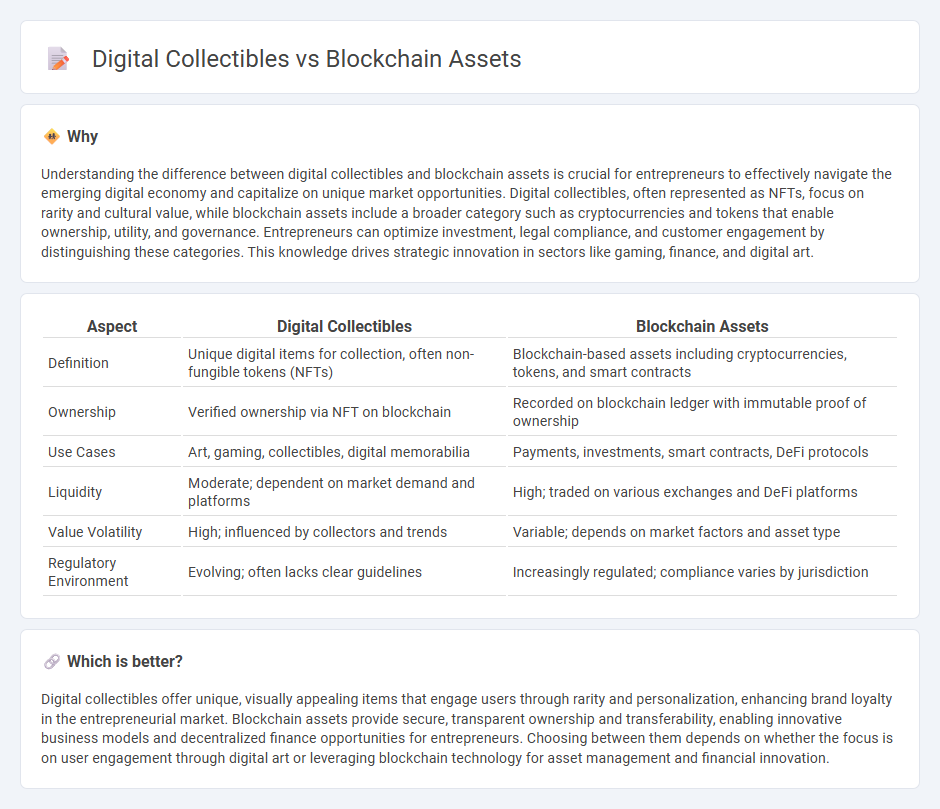

Understanding the difference between digital collectibles and blockchain assets is crucial for entrepreneurs to effectively navigate the emerging digital economy and capitalize on unique market opportunities. Digital collectibles, often represented as NFTs, focus on rarity and cultural value, while blockchain assets include a broader category such as cryptocurrencies and tokens that enable ownership, utility, and governance. Entrepreneurs can optimize investment, legal compliance, and customer engagement by distinguishing these categories. This knowledge drives strategic innovation in sectors like gaming, finance, and digital art.

Comparison Table

| Aspect | Digital Collectibles | Blockchain Assets |

|---|---|---|

| Definition | Unique digital items for collection, often non-fungible tokens (NFTs) | Blockchain-based assets including cryptocurrencies, tokens, and smart contracts |

| Ownership | Verified ownership via NFT on blockchain | Recorded on blockchain ledger with immutable proof of ownership |

| Use Cases | Art, gaming, collectibles, digital memorabilia | Payments, investments, smart contracts, DeFi protocols |

| Liquidity | Moderate; dependent on market demand and platforms | High; traded on various exchanges and DeFi platforms |

| Value Volatility | High; influenced by collectors and trends | Variable; depends on market factors and asset type |

| Regulatory Environment | Evolving; often lacks clear guidelines | Increasingly regulated; compliance varies by jurisdiction |

Which is better?

Digital collectibles offer unique, visually appealing items that engage users through rarity and personalization, enhancing brand loyalty in the entrepreneurial market. Blockchain assets provide secure, transparent ownership and transferability, enabling innovative business models and decentralized finance opportunities for entrepreneurs. Choosing between them depends on whether the focus is on user engagement through digital art or leveraging blockchain technology for asset management and financial innovation.

Connection

Digital collectibles leverage blockchain technology to ensure transparent ownership, provenance, and scarcity, which are crucial for validating unique entrepreneurial assets. Blockchain assets create decentralized marketplaces that empower entrepreneurs to monetize and trade digital goods securely without intermediaries. This union enhances trust, opens new revenue streams, and fosters innovation in digital entrepreneurship ecosystems.

Key Terms

Tokenization

Tokenization transforms physical and digital assets into blockchain-based tokens, enabling secure, transparent ownership and transfer. Blockchain assets often represent real-world value, such as property or stocks, while digital collectibles are unique, non-fungible tokens (NFTs) tied to artwork or virtual items. Explore the distinct benefits and use cases of tokenization by diving deeper into blockchain asset classes.

Ownership Verification

Blockchain assets provide immutable ownership verification through decentralized ledgers, ensuring transparent and tamper-proof records. Digital collectibles, often represented as NFTs, utilize blockchain technology to authenticate uniqueness and grant exclusive ownership rights. Explore the differences in ownership verification methodologies to understand how each leverages blockchain for asset security and provenance.

Smart Contracts

Blockchain assets represent a broad category of digital tokens secured and managed by smart contracts, enabling automated, trustless transactions on decentralized networks. Digital collectibles, often known as NFTs (Non-Fungible Tokens), are unique blockchain assets defined by smart contracts that ensure rarity, provenance, and ownership authenticity. Explore how smart contracts empower the distinct functions and value of blockchain assets and digital collectibles.

Source and External Links

8 Examples of Digital Assets on Blockchain - Kaleido - Blockchain assets include cryptocurrencies, tokenized securities, NFTs, DeFi assets, tokenized commodities, intellectual property rights tokens, and tokenized real estate, representing diverse digital ownership and financial instruments recorded on blockchains.

What is a blockchain asset? - Knowledge Base - Exodus - Blockchain assets are digital tokens created, stored, and transferred on blockchain networks and can be accessed and managed securely via wallets like Exodus that handle private keys enabling interaction with multiple blockchain assets.

Digital Assets, Blockchain Technology, and Cryptocurrencies - Digital assets broadly encompass virtually anything of value held digitally such as cryptocurrencies, NFTs, software code, and media clips, all enabled by blockchain technology, which also supports applications beyond assets like supply chain management and data protection.

dowidth.com

dowidth.com