Sweat equity marketplaces enable entrepreneurs to trade time and skills for ownership stakes, fostering resource-efficient startup growth without immediate cash outlays. Angel investment involves affluent individuals providing capital to early-stage ventures in exchange for equity, accelerating development with financial support and mentorship. Explore how each approach uniquely drives business success and funding strategies.

Why it is important

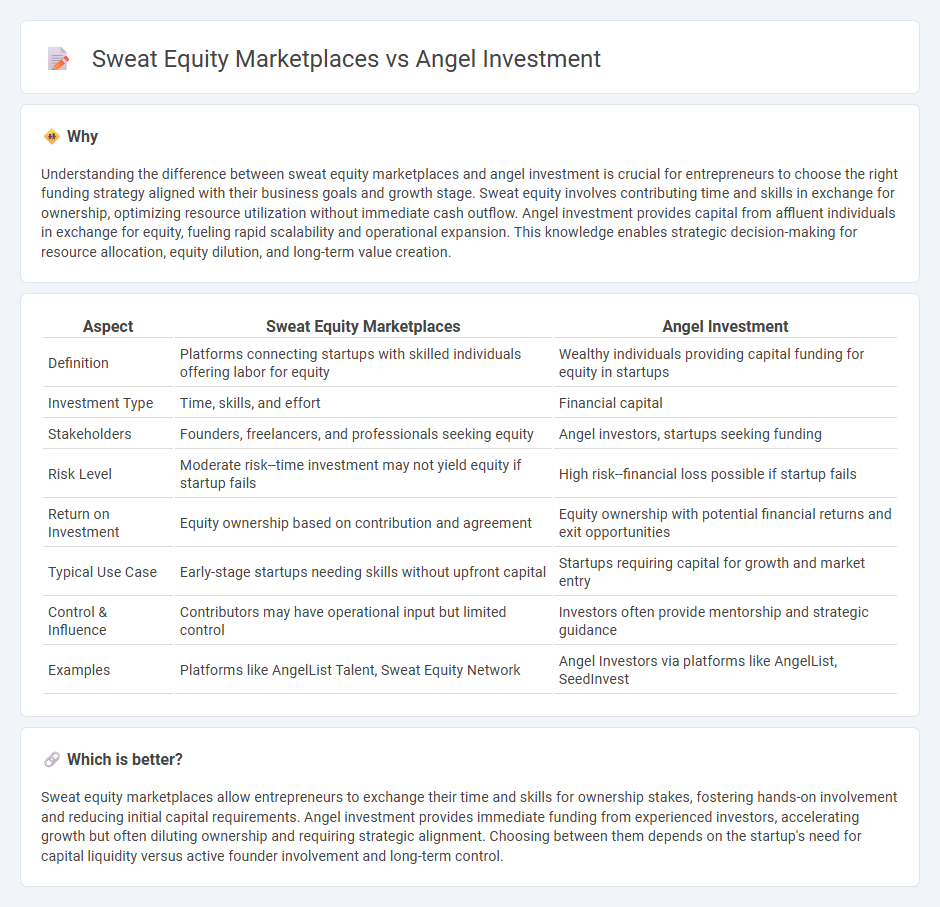

Understanding the difference between sweat equity marketplaces and angel investment is crucial for entrepreneurs to choose the right funding strategy aligned with their business goals and growth stage. Sweat equity involves contributing time and skills in exchange for ownership, optimizing resource utilization without immediate cash outflow. Angel investment provides capital from affluent individuals in exchange for equity, fueling rapid scalability and operational expansion. This knowledge enables strategic decision-making for resource allocation, equity dilution, and long-term value creation.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Angel Investment |

|---|---|---|

| Definition | Platforms connecting startups with skilled individuals offering labor for equity | Wealthy individuals providing capital funding for equity in startups |

| Investment Type | Time, skills, and effort | Financial capital |

| Stakeholders | Founders, freelancers, and professionals seeking equity | Angel investors, startups seeking funding |

| Risk Level | Moderate risk--time investment may not yield equity if startup fails | High risk--financial loss possible if startup fails |

| Return on Investment | Equity ownership based on contribution and agreement | Equity ownership with potential financial returns and exit opportunities |

| Typical Use Case | Early-stage startups needing skills without upfront capital | Startups requiring capital for growth and market entry |

| Control & Influence | Contributors may have operational input but limited control | Investors often provide mentorship and strategic guidance |

| Examples | Platforms like AngelList Talent, Sweat Equity Network | Angel Investors via platforms like AngelList, SeedInvest |

Which is better?

Sweat equity marketplaces allow entrepreneurs to exchange their time and skills for ownership stakes, fostering hands-on involvement and reducing initial capital requirements. Angel investment provides immediate funding from experienced investors, accelerating growth but often diluting ownership and requiring strategic alignment. Choosing between them depends on the startup's need for capital liquidity versus active founder involvement and long-term control.

Connection

Sweat equity marketplaces enable entrepreneurs to trade their skills and labor for ownership stakes in startups, creating valuable opportunities to build initial business value without immediate cash investment. Angel investors often look for startups with demonstrated founder commitment and tangible progress, which sweat equity contributions help showcase by increasing company traction. This synergy enhances funding prospects by aligning founders' efforts with investor expectations, ultimately bridging early-stage resource gaps in entrepreneurship.

Key Terms

Capital Investment

Angel investment marketplaces connect startups with high-net-worth individuals who provide capital in exchange for equity, accelerating business growth through financial resources. Sweat equity marketplaces enable founders and contributors to earn ownership by investing time and effort rather than money, fostering collaboration without immediate cash input. Explore the differences in funding strategies and how each impacts capital investment in startups.

Equity Ownership

Angel investment marketplaces connect startups with high-net-worth individuals who provide capital in exchange for equity ownership, often valuing the company based on financial projections and market potential. Sweat equity marketplaces facilitate partnerships where founders or early employees contribute time and expertise to earn ownership stakes, aligning incentives with company growth without upfront cash investment. Explore these platforms to understand how different equity ownership models can impact your startup's capital structure and growth trajectory.

Startup Valuation

Angel investment marketplaces attract early-stage funding by connecting startups with high-net-worth individuals willing to exchange capital for equity, influencing startup valuation based on market potential and investor interest. Sweat equity marketplaces offer founders and contributors non-monetary stakes by valuing skills, time, and labor contribution, affecting valuation through the quality and impact of services rendered rather than cash input. Explore how these distinct equity models shape startup valuation dynamics and funding strategies to better position your venture.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investors provide capital to startups in exchange for equity or convertible debt, helping founders move beyond initial funding from family and friends toward their first professional investment round, often mentoring and offering strategic support along the way.

Angel Investors - The Hartford Insurance - Angel investors are wealthy private backers using their own net worth to fund small businesses, typically in earlier stages than venture capitalists, seeking equity and eventual profitable exit strategies while often offering mentorship and support.

Angel investor - Wikipedia - Angel investors, also called business angels or seed investors, provide early-stage capital to ventures in exchange for equity, with notable activity and returns documented in markets such as the UK, where their investments show significant growth and impact.

dowidth.com

dowidth.com