Micro private equity involves investing significant capital in established small businesses for equity stakes, focusing on long-term growth and operational improvements. Angel investing supports early-stage startups with smaller investments, often providing mentorship and valuable industry connections to foster innovation and scalability. Discover the key differences and benefits of each approach to decide which investment strategy aligns with your entrepreneurial goals.

Why it is important

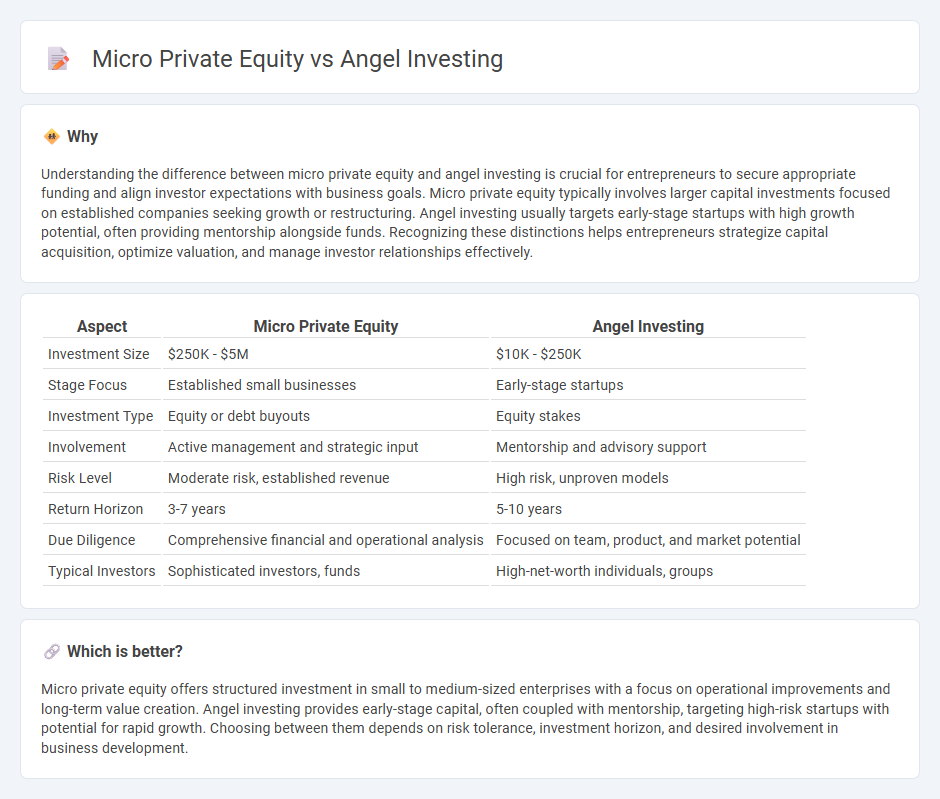

Understanding the difference between micro private equity and angel investing is crucial for entrepreneurs to secure appropriate funding and align investor expectations with business goals. Micro private equity typically involves larger capital investments focused on established companies seeking growth or restructuring. Angel investing usually targets early-stage startups with high growth potential, often providing mentorship alongside funds. Recognizing these distinctions helps entrepreneurs strategize capital acquisition, optimize valuation, and manage investor relationships effectively.

Comparison Table

| Aspect | Micro Private Equity | Angel Investing |

|---|---|---|

| Investment Size | $250K - $5M | $10K - $250K |

| Stage Focus | Established small businesses | Early-stage startups |

| Investment Type | Equity or debt buyouts | Equity stakes |

| Involvement | Active management and strategic input | Mentorship and advisory support |

| Risk Level | Moderate risk, established revenue | High risk, unproven models |

| Return Horizon | 3-7 years | 5-10 years |

| Due Diligence | Comprehensive financial and operational analysis | Focused on team, product, and market potential |

| Typical Investors | Sophisticated investors, funds | High-net-worth individuals, groups |

Which is better?

Micro private equity offers structured investment in small to medium-sized enterprises with a focus on operational improvements and long-term value creation. Angel investing provides early-stage capital, often coupled with mentorship, targeting high-risk startups with potential for rapid growth. Choosing between them depends on risk tolerance, investment horizon, and desired involvement in business development.

Connection

Micro private equity and angel investing intersect through their focus on early-stage companies seeking capital for growth, often filling the funding gap between seed funding and larger venture capital rounds. Both involve high-risk, high-reward investments typically driven by individual investors or small funds aiming to leverage expertise and networks to scale startups effectively. This synergy facilitates innovation and job creation by providing critical financial resources and strategic mentorship to emerging businesses.

Key Terms

Early-stage funding

Angel investing targets early-stage startups by providing seed capital and mentorship, typically involving individual high-net-worth investors who take equity stakes in exchange for ownership and influence. Micro private equity involves slightly larger funds investing in small to medium-sized enterprises (SMEs) that have progressed beyond the startup phase but need capital for expansion, often focusing on more structured deals with potential operational improvements. Explore deeper insights into early-stage funding strategies and the nuances between angel investing and micro private equity for optimized growth opportunities.

Business acquisition

Angel investing involves individuals providing early-stage capital to startups, often in exchange for equity and active advisory roles, with a focus on high-growth potential ventures. Micro private equity targets acquiring established small to medium-sized businesses, emphasizing operational improvements and cash flow generation rather than just equity stakes. Explore the nuances of angel investing versus micro private equity in business acquisitions to determine which strategy aligns best with your investment goals.

Ownership structure

Angel investing typically involves individual investors acquiring minority ownership stakes in early-stage startups, providing capital in exchange for equity without demanding control. Micro private equity funds usually take larger, more controlling ownership positions in small to mid-sized companies to influence strategic decisions and drive growth. Explore the nuances of ownership structures in both investment types to understand their impact on control and value creation.

Source and External Links

Understanding angel financing and investing - Angel investors are individuals who invest their own money in startups in exchange for equity or convertible debt, offering crucial early-stage funding, mentorship, and industry expertise to help founders develop their business and reach milestones before attracting institutional investors.

Angel Investors - Angel investors are wealthy private individuals providing capital to startups for equity, often expecting a return on investment around 30%, and typically offering smaller amounts and longer patience than venture capitalists in exchange for eventual exits like acquisitions or public offerings.

Angel investor - Wikipedia - Angel investors are individual private investors who fund early-stage ventures, with studies showing they generally acquire ownership stakes averaging around 8% per investment and generate returns averaging 2.2 times the invested capital over a few years, while often also contributing strategic value beyond just financing.

dowidth.com

dowidth.com