Active income streams require continuous effort and time investment, typically involving regular work hours or project completion. Passive income streams generate revenue with minimal ongoing involvement, often through investments, royalties, or automated businesses. Explore the key differences and strategies to balance both for financial growth.

Why it is important

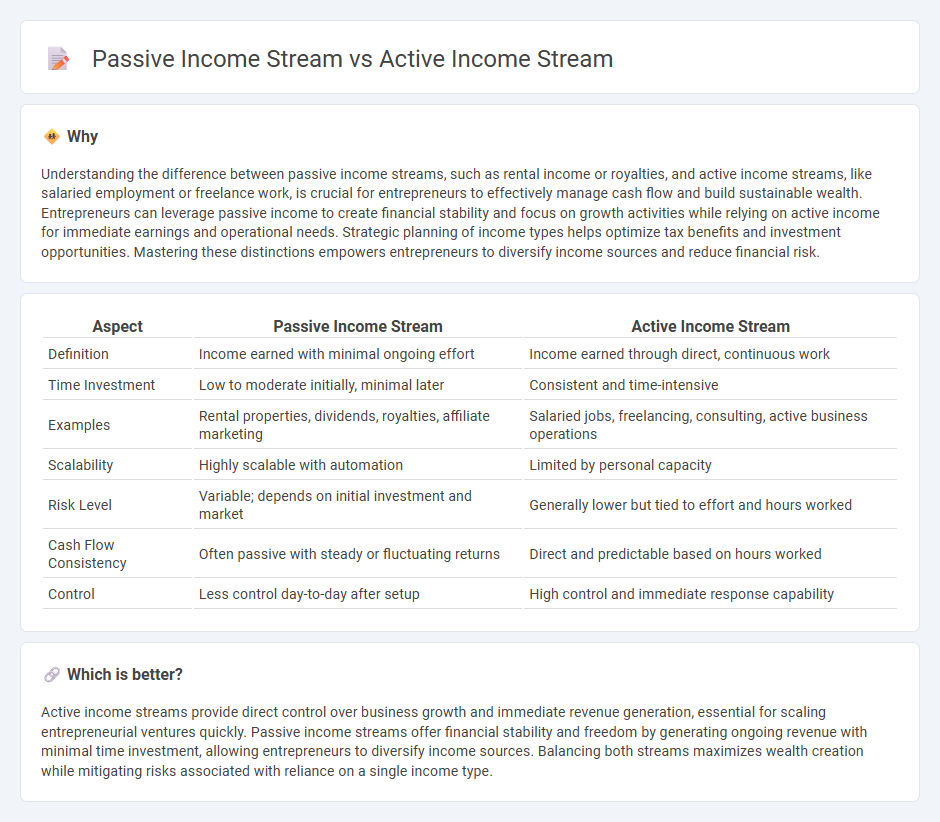

Understanding the difference between passive income streams, such as rental income or royalties, and active income streams, like salaried employment or freelance work, is crucial for entrepreneurs to effectively manage cash flow and build sustainable wealth. Entrepreneurs can leverage passive income to create financial stability and focus on growth activities while relying on active income for immediate earnings and operational needs. Strategic planning of income types helps optimize tax benefits and investment opportunities. Mastering these distinctions empowers entrepreneurs to diversify income sources and reduce financial risk.

Comparison Table

| Aspect | Passive Income Stream | Active Income Stream |

|---|---|---|

| Definition | Income earned with minimal ongoing effort | Income earned through direct, continuous work |

| Time Investment | Low to moderate initially, minimal later | Consistent and time-intensive |

| Examples | Rental properties, dividends, royalties, affiliate marketing | Salaried jobs, freelancing, consulting, active business operations |

| Scalability | Highly scalable with automation | Limited by personal capacity |

| Risk Level | Variable; depends on initial investment and market | Generally lower but tied to effort and hours worked |

| Cash Flow Consistency | Often passive with steady or fluctuating returns | Direct and predictable based on hours worked |

| Control | Less control day-to-day after setup | High control and immediate response capability |

Which is better?

Active income streams provide direct control over business growth and immediate revenue generation, essential for scaling entrepreneurial ventures quickly. Passive income streams offer financial stability and freedom by generating ongoing revenue with minimal time investment, allowing entrepreneurs to diversify income sources. Balancing both streams maximizes wealth creation while mitigating risks associated with reliance on a single income type.

Connection

Passive income streams complement active income streams by providing financial stability and diversification, reducing reliance on a single source of earnings. Entrepreneurs leverage active income from their primary business operations to invest in assets or ventures that generate passive income, creating a synergistic cycle of wealth growth. This strategic balance enhances cash flow management and long-term financial security.

Key Terms

Time Investment

Active income streams require continuous time investment, as earnings depend directly on hours worked or tasks completed, such as freelance projects or hourly jobs. Passive income streams generate revenue with minimal ongoing effort after initial setup, including options like rental properties, dividends, or royalties. Explore detailed comparisons to identify which income model aligns best with your time availability and financial goals.

Scalability

Active income streams rely heavily on direct time and effort investment, making scalability limited by available hours and personal capacity. Passive income streams, such as royalties, rental income, or online courses, offer greater scalability by generating revenue with minimal ongoing input once established. Explore strategies to maximize income scalability through smart passive income opportunities.

Automation

Active income streams require continuous effort and time investment, such as hourly work or freelance projects, limiting scalability without increased workload. Passive income streams leverage automation through tools like affiliate marketing platforms, online courses, or rental management software, generating revenue with minimal ongoing input. Explore automated strategies to transform your income sources and achieve financial freedom.

Source and External Links

Passive vs. Active Income: Key Insights for Investors - Active income is earned through direct involvement and continuous effort, typically from employment, self-employment, or active business management such as salaries, wages, freelancing, consulting, or day trading.

Blending Passive and Active Income Streams: The Key to ... - Active income requires direct participation or effort, including earnings from jobs, salaries, hourly wages, or business management, and is often viewed as the traditional way to earn a living.

Understanding Passive and Active Income: Meaning and ... - Active income is generated by working or trading time for compensation and requires ongoing effort, such as contract work or hourly jobs, usually received regularly like weekly or monthly payments.

dowidth.com

dowidth.com