Digital nomad visas offer remote workers the flexibility to live and work legally in a foreign country without establishing a local business, ideal for professionals employed by companies abroad. Self-employment visas require applicants to prove business viability and contribute economically by launching a local enterprise, catering to entrepreneurs and freelancers who plan on active market participation. Explore the key differences and eligibility criteria to determine which visa aligns best with your employment goals.

Why it is important

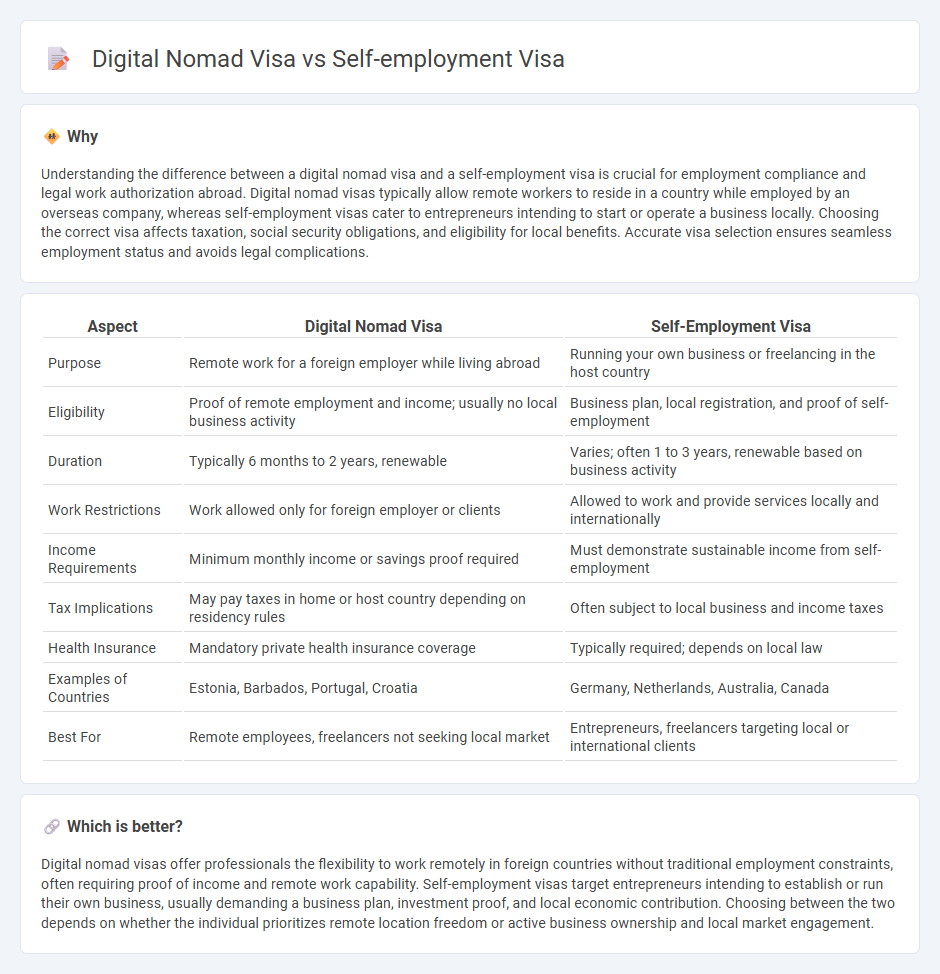

Understanding the difference between a digital nomad visa and a self-employment visa is crucial for employment compliance and legal work authorization abroad. Digital nomad visas typically allow remote workers to reside in a country while employed by an overseas company, whereas self-employment visas cater to entrepreneurs intending to start or operate a business locally. Choosing the correct visa affects taxation, social security obligations, and eligibility for local benefits. Accurate visa selection ensures seamless employment status and avoids legal complications.

Comparison Table

| Aspect | Digital Nomad Visa | Self-Employment Visa |

|---|---|---|

| Purpose | Remote work for a foreign employer while living abroad | Running your own business or freelancing in the host country |

| Eligibility | Proof of remote employment and income; usually no local business activity | Business plan, local registration, and proof of self-employment |

| Duration | Typically 6 months to 2 years, renewable | Varies; often 1 to 3 years, renewable based on business activity |

| Work Restrictions | Work allowed only for foreign employer or clients | Allowed to work and provide services locally and internationally |

| Income Requirements | Minimum monthly income or savings proof required | Must demonstrate sustainable income from self-employment |

| Tax Implications | May pay taxes in home or host country depending on residency rules | Often subject to local business and income taxes |

| Health Insurance | Mandatory private health insurance coverage | Typically required; depends on local law |

| Examples of Countries | Estonia, Barbados, Portugal, Croatia | Germany, Netherlands, Australia, Canada |

| Best For | Remote employees, freelancers not seeking local market | Entrepreneurs, freelancers targeting local or international clients |

Which is better?

Digital nomad visas offer professionals the flexibility to work remotely in foreign countries without traditional employment constraints, often requiring proof of income and remote work capability. Self-employment visas target entrepreneurs intending to establish or run their own business, usually demanding a business plan, investment proof, and local economic contribution. Choosing between the two depends on whether the individual prioritizes remote location freedom or active business ownership and local market engagement.

Connection

Digital nomad visas and self-employment visas both enable remote work by granting legal residency for individuals generating income independently, often through online businesses or freelance projects. These visas facilitate compliance with tax and labor regulations while promoting flexible employment models outside traditional office-based roles. Countries offering these permits aim to attract global talent by supporting the growing digital economy and entrepreneurial workforce.

Key Terms

Work Authorization

Self-employment visas primarily grant work authorization to individuals establishing businesses or freelance careers within a specific country, requiring proof of viable economic activity and local tax compliance. Digital nomad visas offer temporary work authorization for remote professionals employed by foreign companies, emphasizing ease of stay without local labor market integration. Explore key differences and eligibility criteria to determine the best visa for your professional mobility.

Remote Work Eligibility

A self-employment visa typically requires proof of business ownership or freelance activity with local tax registration, while a digital nomad visa targets remote workers employed by foreign companies or clients without local employment. Remote work eligibility for self-employment visas often demands demonstrating economic contribution within the host country, whereas digital nomad visas emphasize maintaining income and employment abroad. Explore comprehensive eligibility criteria and benefits to determine the ideal visa option for your remote work lifestyle.

Local Business Registration

Self-employment visas typically require applicants to register a local business or prove active involvement in a business within the host country, ensuring compliance with local regulations and tax obligations. In contrast, digital nomad visas often allow remote work without mandating local business registration, enabling greater flexibility for foreign professionals working online for companies abroad. Explore detailed requirements and benefits of each visa type to determine which best suits your entrepreneurial or remote work goals.

Source and External Links

Self-employed Work Visa - Consular Section - To obtain a self-employed work visa for Spain, applicants must complete an initial residence and self-employed work permit, submit a valid passport, required activity permits/licences, proof of professional qualifications, and a business plan detailing investment, returns, and job creation.

Visa for self-employment - Make it in Germany - Germany offers a residence permit for self-employment for business founders or freelancers who meet economic interest criteria, can finance their business, and possibly have pension provision if over 45 years old.

Self-employed work visa (Spain, UK Consulate) - The visa requires a completed application form, passport with biometric data, photo, and a criminal record check certificate issued by the applicant's country of residence, all properly legalized and translated where needed.

dowidth.com

dowidth.com