Shrinkflation refers to the practice where product sizes or quantities are reduced while prices remain the same, effectively increasing the cost per unit for consumers. A credit crunch describes a sudden reduction in the availability of loans or credit from financial institutions, leading to tighter borrowing conditions and slower economic growth. Explore the detailed impacts of shrinkflation and credit crunch on consumer behavior and market stability.

Why it is important

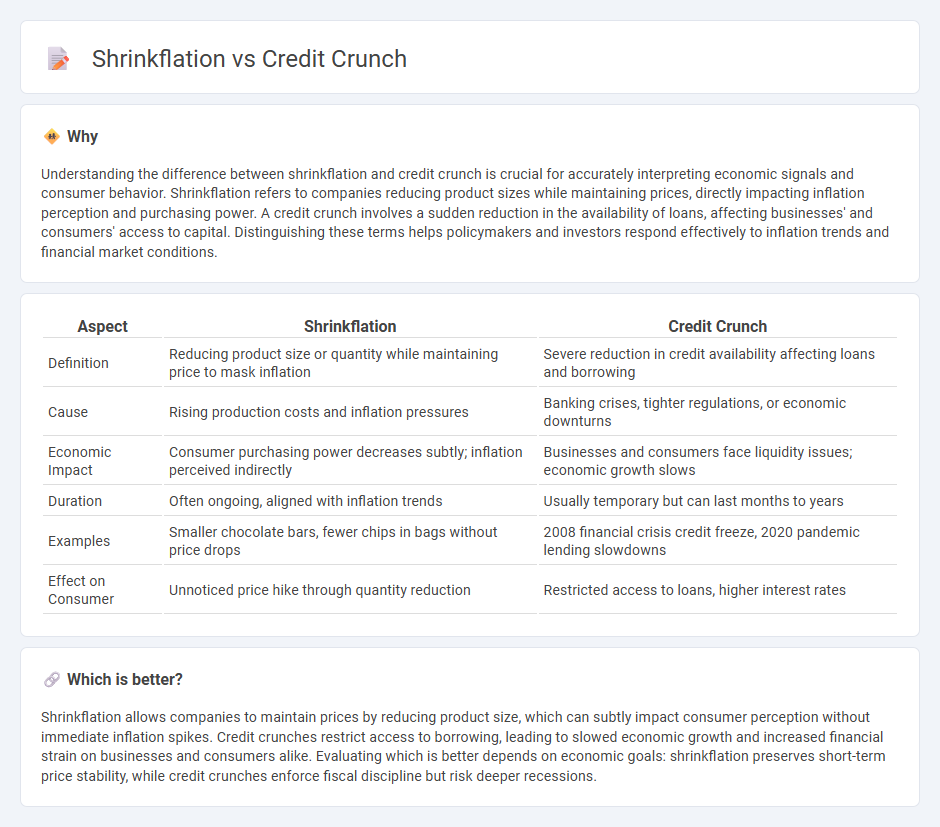

Understanding the difference between shrinkflation and credit crunch is crucial for accurately interpreting economic signals and consumer behavior. Shrinkflation refers to companies reducing product sizes while maintaining prices, directly impacting inflation perception and purchasing power. A credit crunch involves a sudden reduction in the availability of loans, affecting businesses' and consumers' access to capital. Distinguishing these terms helps policymakers and investors respond effectively to inflation trends and financial market conditions.

Comparison Table

| Aspect | Shrinkflation | Credit Crunch |

|---|---|---|

| Definition | Reducing product size or quantity while maintaining price to mask inflation | Severe reduction in credit availability affecting loans and borrowing |

| Cause | Rising production costs and inflation pressures | Banking crises, tighter regulations, or economic downturns |

| Economic Impact | Consumer purchasing power decreases subtly; inflation perceived indirectly | Businesses and consumers face liquidity issues; economic growth slows |

| Duration | Often ongoing, aligned with inflation trends | Usually temporary but can last months to years |

| Examples | Smaller chocolate bars, fewer chips in bags without price drops | 2008 financial crisis credit freeze, 2020 pandemic lending slowdowns |

| Effect on Consumer | Unnoticed price hike through quantity reduction | Restricted access to loans, higher interest rates |

Which is better?

Shrinkflation allows companies to maintain prices by reducing product size, which can subtly impact consumer perception without immediate inflation spikes. Credit crunches restrict access to borrowing, leading to slowed economic growth and increased financial strain on businesses and consumers alike. Evaluating which is better depends on economic goals: shrinkflation preserves short-term price stability, while credit crunches enforce fiscal discipline but risk deeper recessions.

Connection

Shrinkflation reduces product sizes while maintaining prices, effectively increasing consumer costs and lowering purchasing power. The decreased real income from shrinkflation leads consumers to rely more on credit, exacerbating the credit crunch as borrowing demand rises amid tighter lender standards. This interconnected dynamic intensifies economic strain by limiting consumer spending and restricting credit availability simultaneously.

Key Terms

**Credit Crunch:**

A credit crunch occurs when there is a sudden reduction in the availability of loans or credit from banks and lenders, leading to tighter borrowing conditions for businesses and consumers. This financial tightening can slow down economic growth and increase the cost of financing, causing disruptions across various sectors. Explore more about how credit crunches impact global markets and personal finances.

Liquidity

Credit crunch refers to a sudden reduction in the general availability of loans or credit from banks and financial institutions, causing liquidity to tighten in the economy. Shrinkflation, by contrast, involves reducing product sizes or quantities while maintaining prices, indirectly impacting consumer liquidity through decreased purchasing power. Explore deeper insights into how these phenomena influence financial liquidity and consumer behavior.

Lending standards

Lending standards tighten significantly during a credit crunch, restricting access to loans and increasing underwriting scrutiny, which directly impacts borrowing capacity for individuals and businesses. In contrast, shrinkflation does not influence lending standards but reflects manufacturers' strategy to reduce product size while maintaining price, indirectly affecting consumer purchasing power. Discover how these distinct economic phenomena shape financial decision-making and market dynamics.

Source and External Links

Credit crunch - A credit crunch is a sudden reduction in the general availability of loans or a tightening of lending conditions by banks, often independent of interest rate rises, leading to credit rationing and reduced credit access.

Credit Crunch Definition, Causes & Consequences - A credit crunch occurs when banks become reluctant to lend money, often due to economic slowdown, loss of confidence in the financial system, or increased borrower defaults, causing serious economic effects like increased interest rates and higher unemployment.

Explaining the Credit Crunch - The credit crunch was driven by deterioration in loan quality, housing market collapse, and tightening lending standards, which led to liquidity spirals that forced financial institutions to reduce leverage and caused broader financial market stress.

dowidth.com

dowidth.com