A liquidity crunch occurs when financial institutions or markets face a sudden shortage of cash or liquid assets, hindering their ability to meet short-term obligations. A bank run happens when a large number of customers withdraw their deposits simultaneously due to fears of the bank's insolvency, intensifying the liquidity strain. Explore deeper insights to understand how these phenomena impact financial stability and economic health.

Why it is important

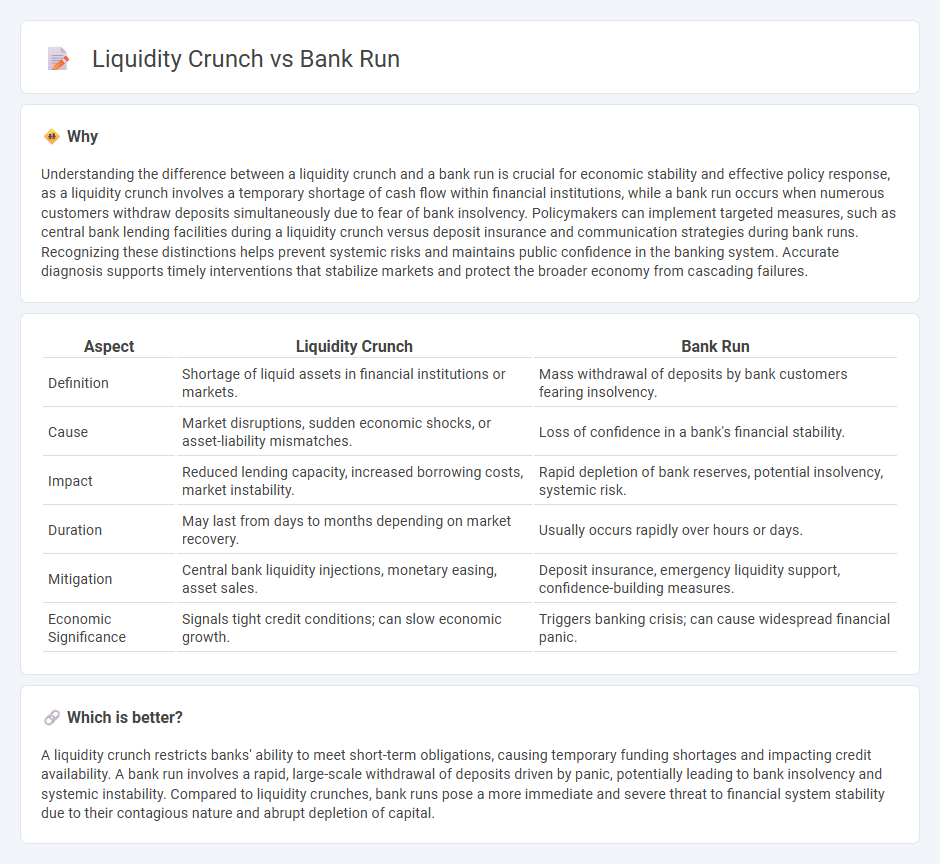

Understanding the difference between a liquidity crunch and a bank run is crucial for economic stability and effective policy response, as a liquidity crunch involves a temporary shortage of cash flow within financial institutions, while a bank run occurs when numerous customers withdraw deposits simultaneously due to fear of bank insolvency. Policymakers can implement targeted measures, such as central bank lending facilities during a liquidity crunch versus deposit insurance and communication strategies during bank runs. Recognizing these distinctions helps prevent systemic risks and maintains public confidence in the banking system. Accurate diagnosis supports timely interventions that stabilize markets and protect the broader economy from cascading failures.

Comparison Table

| Aspect | Liquidity Crunch | Bank Run |

|---|---|---|

| Definition | Shortage of liquid assets in financial institutions or markets. | Mass withdrawal of deposits by bank customers fearing insolvency. |

| Cause | Market disruptions, sudden economic shocks, or asset-liability mismatches. | Loss of confidence in a bank's financial stability. |

| Impact | Reduced lending capacity, increased borrowing costs, market instability. | Rapid depletion of bank reserves, potential insolvency, systemic risk. |

| Duration | May last from days to months depending on market recovery. | Usually occurs rapidly over hours or days. |

| Mitigation | Central bank liquidity injections, monetary easing, asset sales. | Deposit insurance, emergency liquidity support, confidence-building measures. |

| Economic Significance | Signals tight credit conditions; can slow economic growth. | Triggers banking crisis; can cause widespread financial panic. |

Which is better?

A liquidity crunch restricts banks' ability to meet short-term obligations, causing temporary funding shortages and impacting credit availability. A bank run involves a rapid, large-scale withdrawal of deposits driven by panic, potentially leading to bank insolvency and systemic instability. Compared to liquidity crunches, bank runs pose a more immediate and severe threat to financial system stability due to their contagious nature and abrupt depletion of capital.

Connection

A liquidity crunch occurs when banks or financial institutions face a shortage of liquid assets to meet immediate withdrawal demands, leading to reduced lending and tightened credit conditions. A bank run happens when a large number of depositors withdraw their funds simultaneously due to fears of a bank's insolvency, exacerbating the liquidity crunch. This cycle of panic withdrawal and asset selling can destabilize the banking sector, potentially triggering broader economic downturns.

Key Terms

Depositor Panic

A bank run occurs when depositors rush to withdraw their funds simultaneously due to fear of the bank's insolvency, causing immediate liquidity strain. A liquidity crunch, however, refers more broadly to a situation where banks face difficulties meeting short-term obligations due to reduced access to liquid assets or external funding. Understanding the dynamics of depositor panic helps clarify the differences and impacts of these financial stress events--explore further for a comprehensive analysis.

Solvency

Bank runs occur when a large number of depositors withdraw funds simultaneously due to fears of the bank's insolvency, directly impacting its liquidity but often signaling deeper solvency issues. Liquidity crunches arise when institutions face temporary difficulties in meeting short-term obligations despite having sufficient long-term assets, highlighting a mismatch rather than true insolvency. Explore more about how solvency influences the stability and risk management of financial institutions.

Credit Freeze

A bank run occurs when a large number of customers withdraw their deposits simultaneously due to fears of a bank's insolvency, leading to a credit freeze where lending slows drastically as banks conserve liquidity. A liquidity crunch, on the other hand, refers to a broader shortage of available funds in the financial system, restricting borrowing capacity across multiple sectors and causing a credit freeze that hampers economic activity. Explore the dynamics of credit freezes to better understand their impact on financial stability and lending practices.

Source and External Links

What Is A Bank Run? Definition, Causes and Examples | Bankrate - A bank run happens when many customers rush to withdraw their money from a bank at once, fearing it may fail, often triggered by rumors or negative news about the bank's health.

Bank Run - Defined, Causes, Avoid, Recover, History - Panic among customers leads to withdrawals exceeding the bank's available cash, potentially leading to default if the bank cannot quickly convert assets to meet demand.

Bank Runs - Econlib - Depositors, afraid their bank cannot repay them, all try to withdraw simultaneously, forcing the bank to sell assets hastily, which can worsen its financial position.

dowidth.com

dowidth.com