Zero-based budgeting requires justifying every expense from scratch, ensuring resource allocation aligns precisely with current priorities and operational needs. Top-down budgeting sets financial limits based on organizational goals, with higher management determining budgets that cascade down to departments. Explore how each budgeting approach influences financial control and organizational efficiency in consulting contexts.

Why it is important

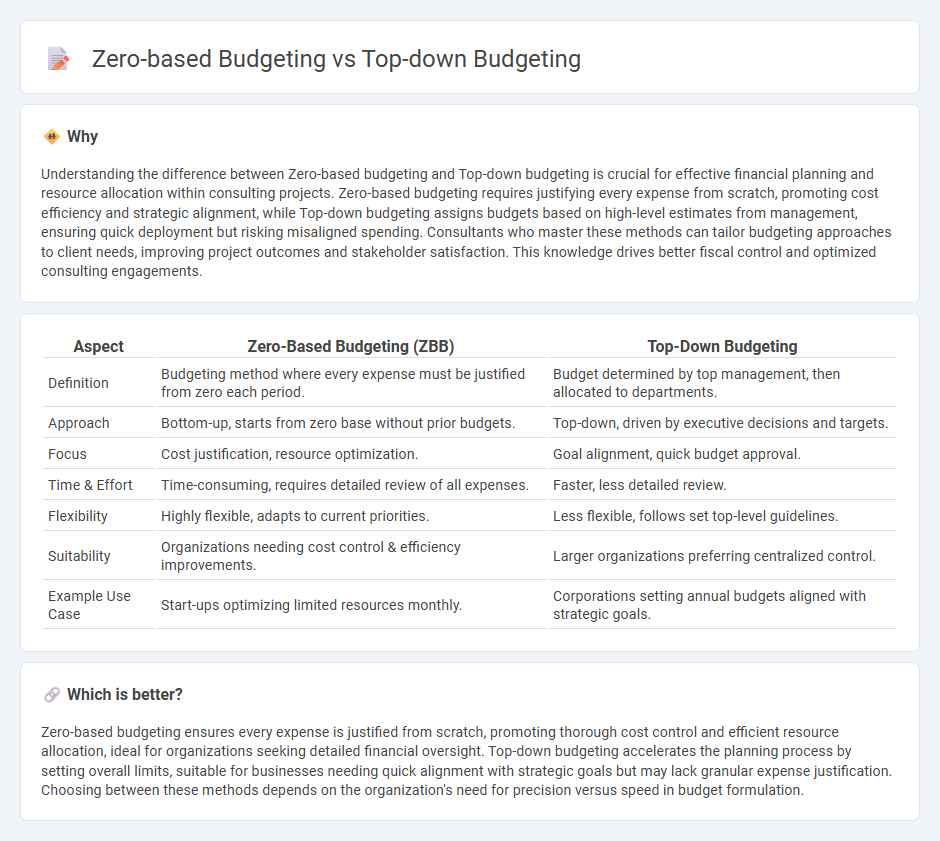

Understanding the difference between Zero-based budgeting and Top-down budgeting is crucial for effective financial planning and resource allocation within consulting projects. Zero-based budgeting requires justifying every expense from scratch, promoting cost efficiency and strategic alignment, while Top-down budgeting assigns budgets based on high-level estimates from management, ensuring quick deployment but risking misaligned spending. Consultants who master these methods can tailor budgeting approaches to client needs, improving project outcomes and stakeholder satisfaction. This knowledge drives better fiscal control and optimized consulting engagements.

Comparison Table

| Aspect | Zero-Based Budgeting (ZBB) | Top-Down Budgeting |

|---|---|---|

| Definition | Budgeting method where every expense must be justified from zero each period. | Budget determined by top management, then allocated to departments. |

| Approach | Bottom-up, starts from zero base without prior budgets. | Top-down, driven by executive decisions and targets. |

| Focus | Cost justification, resource optimization. | Goal alignment, quick budget approval. |

| Time & Effort | Time-consuming, requires detailed review of all expenses. | Faster, less detailed review. |

| Flexibility | Highly flexible, adapts to current priorities. | Less flexible, follows set top-level guidelines. |

| Suitability | Organizations needing cost control & efficiency improvements. | Larger organizations preferring centralized control. |

| Example Use Case | Start-ups optimizing limited resources monthly. | Corporations setting annual budgets aligned with strategic goals. |

Which is better?

Zero-based budgeting ensures every expense is justified from scratch, promoting thorough cost control and efficient resource allocation, ideal for organizations seeking detailed financial oversight. Top-down budgeting accelerates the planning process by setting overall limits, suitable for businesses needing quick alignment with strategic goals but may lack granular expense justification. Choosing between these methods depends on the organization's need for precision versus speed in budget formulation.

Connection

Zero-based budgeting and top-down budgeting both emphasize strategic allocation of resources by starting from a clean slate, ensuring every expense is justified based on current priorities. In consulting, these methods align to optimize financial planning, where top-down budgeting sets targets from senior management, and zero-based budgeting rigorously validates each expense to enhance cost-efficiency. This integration supports data-driven decision-making, improves budget control, and aligns expenditures with organizational goals.

Key Terms

Cost Allocation

Top-down budgeting allocates costs based on organizational priorities set by senior management, streamlining resource distribution but potentially overlooking granular expense details. Zero-based budgeting requires justifying every dollar spent from the ground up, enabling precise cost control by evaluating expenses against actual needs rather than historical data. Discover how these budgeting methods impact cost allocation strategies and financial efficiency in your business.

Justification of Expenses

Top-down budgeting assigns budget limits based on organizational goals set by upper management, often streamlining the allocation process without extensive justification for each expense. Zero-based budgeting demands detailed justification for every expense annually, starting from a "zero base" to ensure all expenditures align closely with actual needs and priorities. Discover how understanding these expense justification approaches can optimize your budgeting strategy.

Strategic Prioritization

Top-down budgeting relies on senior management setting overall budget targets aligned with strategic goals, ensuring resource allocation supports high-priority initiatives effectively. Zero-based budgeting requires each department to justify every expense from scratch, promoting efficient allocation by scrutinizing all costs relative to strategic priorities. Explore how these budgeting approaches impact strategic prioritization and resource optimization in your organization.

Source and External Links

Top-Down versus Bottom-Up Budgeting - Datarails - This webpage explains top-down budgeting as a method where upper management creates budgets and pushes them down to department managers for implementation.

Top-Down Budgeting - Definition, Example, Vs. Bottom Up - This resource defines top-down budgeting as a method where senior management prepares a high-level budget for the company and then allocates it to departments.

Top-down budgeting explained - Prophix - This blog post outlines an 8-step process for creating a top-down budget, focusing on setting objectives and allocating resources to align with business goals.

dowidth.com

dowidth.com