Greenwashing risk assessment consulting identifies and mitigates misleading environmental claims that jeopardize corporate reputation and regulatory compliance, focusing on transparency and authenticity in sustainability reporting. Climate risk advisory specializes in evaluating physical and transitional climate risks affecting asset valuation and operational resilience, aligning business strategy with evolving climate policies and market conditions. Discover how tailored consulting services can safeguard your company's integrity and future-proof operations against climate-related challenges.

Why it is important

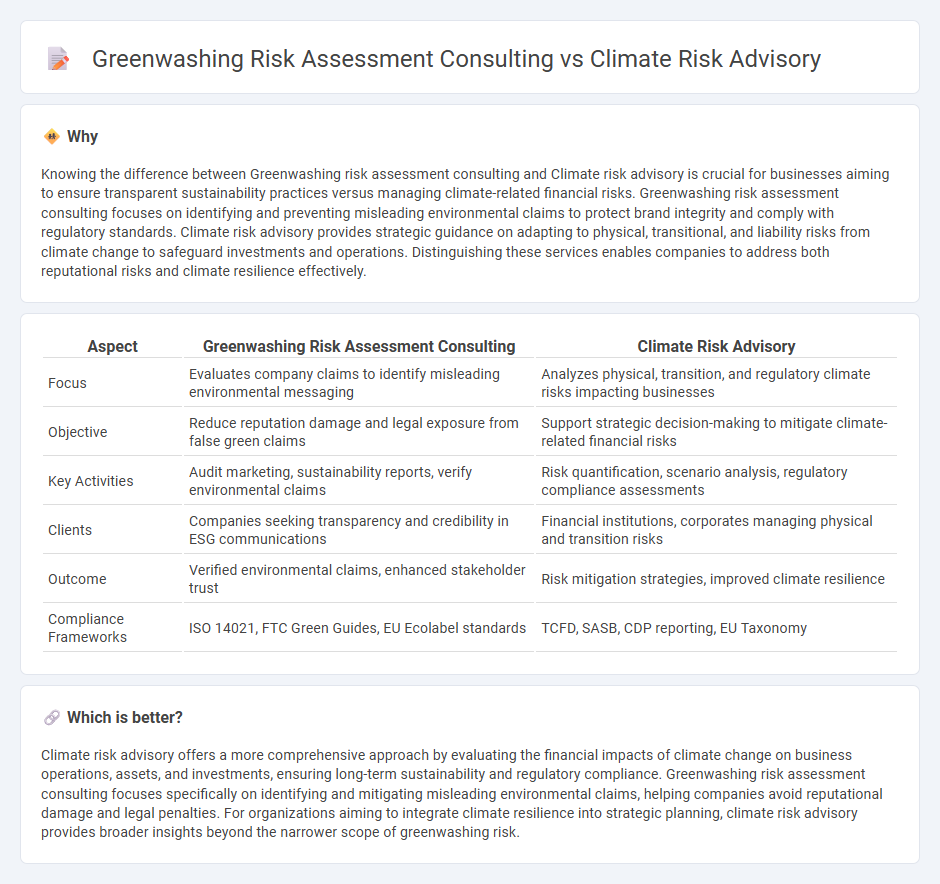

Knowing the difference between Greenwashing risk assessment consulting and Climate risk advisory is crucial for businesses aiming to ensure transparent sustainability practices versus managing climate-related financial risks. Greenwashing risk assessment consulting focuses on identifying and preventing misleading environmental claims to protect brand integrity and comply with regulatory standards. Climate risk advisory provides strategic guidance on adapting to physical, transitional, and liability risks from climate change to safeguard investments and operations. Distinguishing these services enables companies to address both reputational risks and climate resilience effectively.

Comparison Table

| Aspect | Greenwashing Risk Assessment Consulting | Climate Risk Advisory |

|---|---|---|

| Focus | Evaluates company claims to identify misleading environmental messaging | Analyzes physical, transition, and regulatory climate risks impacting businesses |

| Objective | Reduce reputation damage and legal exposure from false green claims | Support strategic decision-making to mitigate climate-related financial risks |

| Key Activities | Audit marketing, sustainability reports, verify environmental claims | Risk quantification, scenario analysis, regulatory compliance assessments |

| Clients | Companies seeking transparency and credibility in ESG communications | Financial institutions, corporates managing physical and transition risks |

| Outcome | Verified environmental claims, enhanced stakeholder trust | Risk mitigation strategies, improved climate resilience |

| Compliance Frameworks | ISO 14021, FTC Green Guides, EU Ecolabel standards | TCFD, SASB, CDP reporting, EU Taxonomy |

Which is better?

Climate risk advisory offers a more comprehensive approach by evaluating the financial impacts of climate change on business operations, assets, and investments, ensuring long-term sustainability and regulatory compliance. Greenwashing risk assessment consulting focuses specifically on identifying and mitigating misleading environmental claims, helping companies avoid reputational damage and legal penalties. For organizations aiming to integrate climate resilience into strategic planning, climate risk advisory provides broader insights beyond the narrower scope of greenwashing risk.

Connection

Greenwashing risk assessment consulting and climate risk advisory are interconnected by their focus on ensuring corporate transparency and accountability in environmental claims. Both services help organizations identify, evaluate, and mitigate risks associated with misleading sustainability statements and climate-related financial impacts. This integrated approach supports compliance with evolving regulations, enhances stakeholder trust, and drives effective climate risk management strategies.

Key Terms

**Climate risk advisory:**

Climate risk advisory provides expert evaluation of environmental, financial, and regulatory impacts due to climate change, focusing on identifying and mitigating risks in corporate strategies and operations. This service leverages advanced climate models, scenario analysis, and compliance frameworks to ensure resilience and regulatory adherence. Discover how climate risk advisory can safeguard your organization's future and compliance.

Physical risk analysis

Climate risk advisory emphasizes comprehensive physical risk analysis by evaluating exposure to extreme weather events, sea-level rise, and temperature fluctuations affecting assets and operations. Greenwashing risk assessment consulting identifies and mitigates misleading environmental claims, ensuring transparent communication and genuine sustainability practices. Explore how specialized physical risk analysis safeguards business resilience and credibility in environmental reporting.

Transition risk modeling

Transition risk modeling plays a crucial role in climate risk advisory by quantifying financial risks arising from shifts to a low-carbon economy, including policy changes, technological advancements, and market demand shifts. In contrast, greenwashing risk assessment consulting evaluates the credibility of corporate sustainability claims to identify potential reputational and regulatory risks associated with misleading environmental statements. To explore how transition risk modeling integrates into comprehensive climate risk and greenwashing risk strategies, inquire today.

Source and External Links

Aon's Climate Risk Advisory team - News Releases | Aon - Aon's Climate Risk Advisory team provides physical risk diagnostics and advisory services for financial institutions, public sector entities, and real estate holders, helping them quantify, model, and manage climate-related financial risks using advanced analytics and global research partnerships.

Climate Risk, Adaptation, and Resilience Consulting | BCG - BCG works with both public and private sector clients to assess exposure to climate risks, develop adaptation and resilience strategies, embed risk considerations into planning, and mobilize funding to protect people, economies, and ecosystems.

Climate Risk Management | Climate Change | Focus Areas - BSR - BSR's Climate Risk Integration Framework guides companies through a regular, iterative process of identifying, assessing, and prioritizing climate risks, then integrating these risks into strategic planning, implementing responses, and monitoring effectiveness.

dowidth.com

dowidth.com