Due diligence deep dive involves a comprehensive assessment of financial, legal, and operational aspects to identify risks and opportunities before a transaction closes. Post-merger integration focuses on aligning cultures, systems, and processes to realize synergies and ensure smooth business continuity. Explore the critical differences and strategies that drive success in consulting engagements.

Why it is important

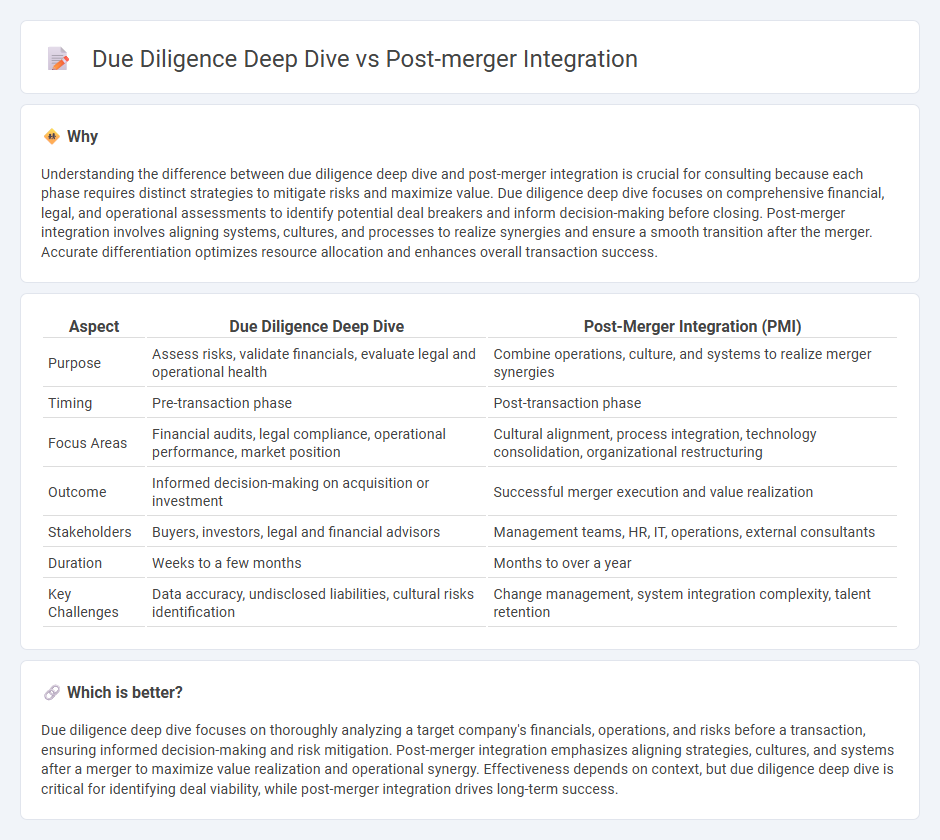

Understanding the difference between due diligence deep dive and post-merger integration is crucial for consulting because each phase requires distinct strategies to mitigate risks and maximize value. Due diligence deep dive focuses on comprehensive financial, legal, and operational assessments to identify potential deal breakers and inform decision-making before closing. Post-merger integration involves aligning systems, cultures, and processes to realize synergies and ensure a smooth transition after the merger. Accurate differentiation optimizes resource allocation and enhances overall transaction success.

Comparison Table

| Aspect | Due Diligence Deep Dive | Post-Merger Integration (PMI) |

|---|---|---|

| Purpose | Assess risks, validate financials, evaluate legal and operational health | Combine operations, culture, and systems to realize merger synergies |

| Timing | Pre-transaction phase | Post-transaction phase |

| Focus Areas | Financial audits, legal compliance, operational performance, market position | Cultural alignment, process integration, technology consolidation, organizational restructuring |

| Outcome | Informed decision-making on acquisition or investment | Successful merger execution and value realization |

| Stakeholders | Buyers, investors, legal and financial advisors | Management teams, HR, IT, operations, external consultants |

| Duration | Weeks to a few months | Months to over a year |

| Key Challenges | Data accuracy, undisclosed liabilities, cultural risks identification | Change management, system integration complexity, talent retention |

Which is better?

Due diligence deep dive focuses on thoroughly analyzing a target company's financials, operations, and risks before a transaction, ensuring informed decision-making and risk mitigation. Post-merger integration emphasizes aligning strategies, cultures, and systems after a merger to maximize value realization and operational synergy. Effectiveness depends on context, but due diligence deep dive is critical for identifying deal viability, while post-merger integration drives long-term success.

Connection

Due diligence deep dive provides comprehensive analysis of financial, operational, and legal aspects of a target company, ensuring informed decision-making in mergers and acquisitions. This detailed assessment identifies potential risks and synergies that directly shape the post-merger integration strategy. Effective alignment of due diligence insights with integration planning accelerates value realization and mitigates integration challenges.

Key Terms

**Post-Merger Integration:**

Post-Merger Integration (PMI) centers on uniting two companies after a merger to harmonize operations, cultures, and systems efficiently for maximum value realization. This includes aligning organizational structures, integrating IT infrastructure, and streamlining business processes to avoid disruption and retain key talent. Discover how PMI strategies drive successful mergers and create long-term competitive advantages.

Synergy Realization

Post-merger integration centers on executing strategies to achieve synergy realization by aligning operations, culture, and systems across merged entities. Due diligence deep dive emphasizes identifying potential synergies and risks prior to deal closure, focusing on financial, operational, and strategic assessments. Explore our comprehensive analysis to understand how effective synergy realization drives merger success.

Cultural Alignment

Post-merger integration emphasizes harmonizing organizational cultures to ensure seamless collaboration and employee retention, while due diligence deep dive centers on assessing cultural compatibility to mitigate risks early. Effective cultural alignment during integration drives smoother transitions and enhances overall merger success by fostering shared values and communication. Explore detailed strategies to master cultural alignment in mergers and acquisitions for optimal outcomes.

Source and External Links

Plan for a successful post-merger integration process - Post-merger integration is a complex process of joining two companies to maximize efficiency and typically follows a structured five-phase journey including preparation, Day One activities, first 30 days, and beyond to stabilize and align operations and culture.

The Complete Guide to Post Merger Integration Strategy - Allegrow - A post-merger integration strategy is a comprehensive plan that aligns operations, cultures, and resources to achieve merger objectives, deliver synergies, streamline operations, and enhance competitive position and customer experience.

Post Merger Integration: Checklist, Framework, Examples & More - Post-merger integration types include preservation, holding, symbiosis, and absorption, which vary in how much the acquired company is merged or allowed to retain independence after the deal closes.

dowidth.com

dowidth.com