Corporate venturing involves direct investment in startups to drive innovation and gain competitive advantage, while strategic alliances focus on collaboration between established companies to leverage shared resources and market access. Both approaches aim to accelerate growth and innovation but differ in risk exposure and control levels. Explore more to understand which strategy aligns best with your business goals.

Why it is important

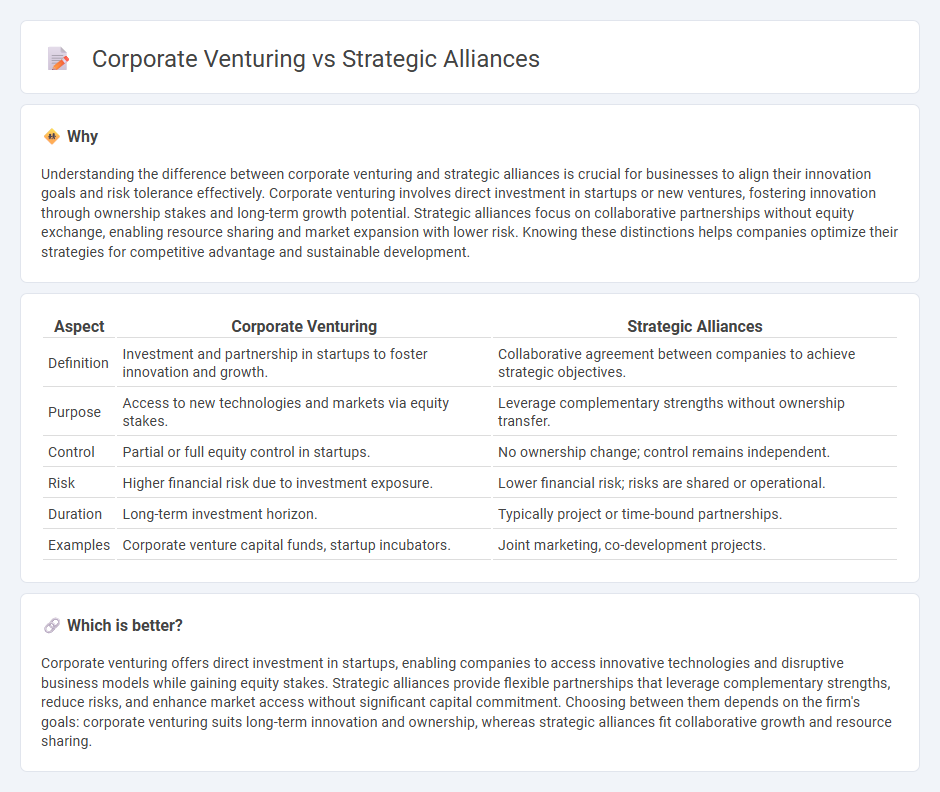

Understanding the difference between corporate venturing and strategic alliances is crucial for businesses to align their innovation goals and risk tolerance effectively. Corporate venturing involves direct investment in startups or new ventures, fostering innovation through ownership stakes and long-term growth potential. Strategic alliances focus on collaborative partnerships without equity exchange, enabling resource sharing and market expansion with lower risk. Knowing these distinctions helps companies optimize their strategies for competitive advantage and sustainable development.

Comparison Table

| Aspect | Corporate Venturing | Strategic Alliances |

|---|---|---|

| Definition | Investment and partnership in startups to foster innovation and growth. | Collaborative agreement between companies to achieve strategic objectives. |

| Purpose | Access to new technologies and markets via equity stakes. | Leverage complementary strengths without ownership transfer. |

| Control | Partial or full equity control in startups. | No ownership change; control remains independent. |

| Risk | Higher financial risk due to investment exposure. | Lower financial risk; risks are shared or operational. |

| Duration | Long-term investment horizon. | Typically project or time-bound partnerships. |

| Examples | Corporate venture capital funds, startup incubators. | Joint marketing, co-development projects. |

Which is better?

Corporate venturing offers direct investment in startups, enabling companies to access innovative technologies and disruptive business models while gaining equity stakes. Strategic alliances provide flexible partnerships that leverage complementary strengths, reduce risks, and enhance market access without significant capital commitment. Choosing between them depends on the firm's goals: corporate venturing suits long-term innovation and ownership, whereas strategic alliances fit collaborative growth and resource sharing.

Connection

Corporate venturing and strategic alliances share a symbiotic relationship, as both leverage external partnerships to drive innovation, market expansion, and competitive advantage. Corporate venturing typically involves investments or collaborations with startups to access emerging technologies, while strategic alliances encompass broader cooperative agreements between established firms to combine resources and capabilities. These interconnected approaches enable companies to rapidly adapt to market changes and accelerate growth through shared expertise and risk mitigation.

Key Terms

Joint Ventures

Joint ventures represent a strategic alliance where two or more companies create a new business entity to achieve shared objectives, combining resources and expertise for mutual benefit. Unlike corporate venturing, which involves investments in startups or emerging companies without forming a new entity, joint ventures provide direct control and collaboration in a dedicated operational structure. Explore the key differences and advantages of joint ventures in strategic partnerships to enhance your business growth.

Equity Investments

Strategic alliances and corporate venturing both involve equity investments that aim to enhance competitive advantage and foster innovation. Strategic alliances typically involve collaborative partnerships with shared equity stakes to leverage complementary strengths without full ownership, whereas corporate venturing often entails direct equity investments or acquisitions in startups to gain strategic control and access emerging technologies. Explore further insights on how these equity investment approaches can optimize growth and innovation in dynamic business environments.

Partner Synergy

Strategic alliances leverage complementary strengths of partnering firms to create value through shared resources and capabilities, enhancing market reach and innovation capacity. Corporate venturing involves direct investment in startups or new ventures, fostering innovation by integrating entrepreneurial talent and technologies within the corporate structure. Explore the benefits of each approach to optimize partner synergy and drive sustained competitive advantage.

Source and External Links

Strategic alliance - Wikipedia - A strategic alliance is an agreement between two or more independent organizations to pursue mutual benefits by sharing resources, knowledge, and capabilities, while remaining separate entities.

Types and Benefits of Strategic Alliances - Corporate Finance Institute - Strategic alliances can take forms such as joint ventures, equity strategic alliances, and non-equity strategic alliances, enabling companies to cooperate in manufacturing, development, or sales to achieve mutual goals.

Strategic Alliance: Definition, Motives, Types (+Example) - Strategic alliances involve legal agreements where companies commit resources toward shared objectives, often to access new markets or combine complementary strengths, and include forms like non-equity alliances, equity alliances, and joint ventures.

dowidth.com

dowidth.com