ESG due diligence evaluates environmental, social, and governance factors to assess sustainability risks and ethical impact, while operational due diligence focuses on a company's internal processes, systems, and performance efficiency. Understanding the distinctions and synergies between ESG and operational due diligence can enhance investment decision-making and risk management. Explore how integrating these approaches drives more comprehensive consulting outcomes.

Why it is important

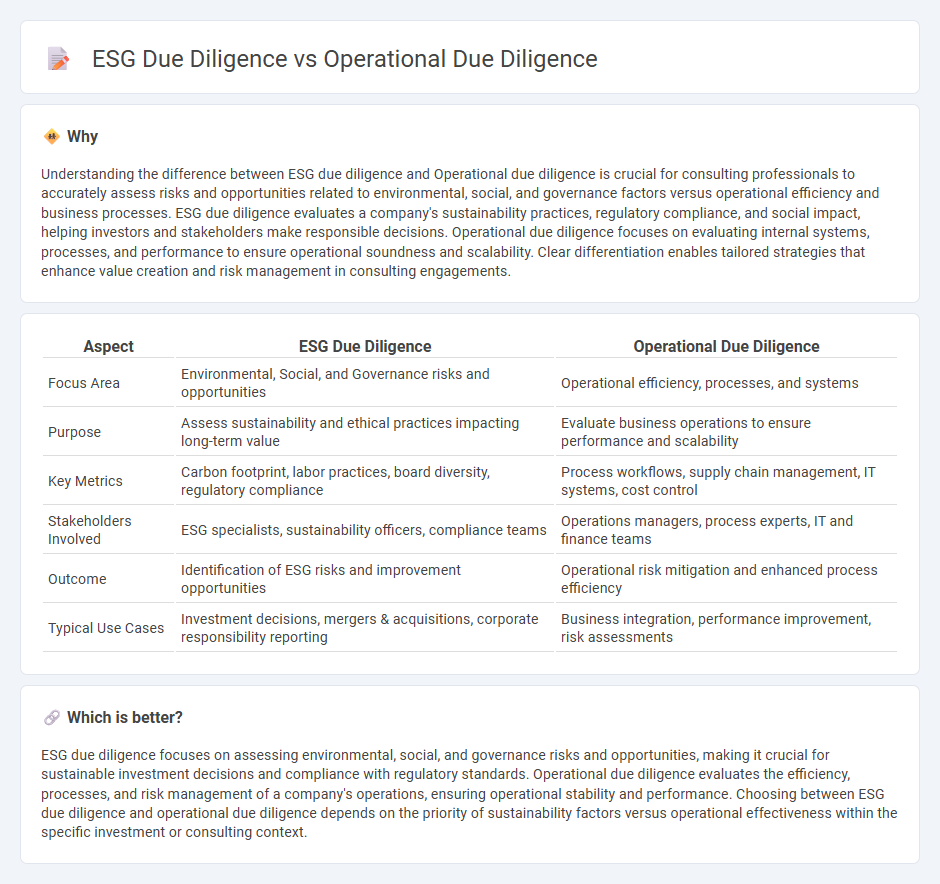

Understanding the difference between ESG due diligence and Operational due diligence is crucial for consulting professionals to accurately assess risks and opportunities related to environmental, social, and governance factors versus operational efficiency and business processes. ESG due diligence evaluates a company's sustainability practices, regulatory compliance, and social impact, helping investors and stakeholders make responsible decisions. Operational due diligence focuses on evaluating internal systems, processes, and performance to ensure operational soundness and scalability. Clear differentiation enables tailored strategies that enhance value creation and risk management in consulting engagements.

Comparison Table

| Aspect | ESG Due Diligence | Operational Due Diligence |

|---|---|---|

| Focus Area | Environmental, Social, and Governance risks and opportunities | Operational efficiency, processes, and systems |

| Purpose | Assess sustainability and ethical practices impacting long-term value | Evaluate business operations to ensure performance and scalability |

| Key Metrics | Carbon footprint, labor practices, board diversity, regulatory compliance | Process workflows, supply chain management, IT systems, cost control |

| Stakeholders Involved | ESG specialists, sustainability officers, compliance teams | Operations managers, process experts, IT and finance teams |

| Outcome | Identification of ESG risks and improvement opportunities | Operational risk mitigation and enhanced process efficiency |

| Typical Use Cases | Investment decisions, mergers & acquisitions, corporate responsibility reporting | Business integration, performance improvement, risk assessments |

Which is better?

ESG due diligence focuses on assessing environmental, social, and governance risks and opportunities, making it crucial for sustainable investment decisions and compliance with regulatory standards. Operational due diligence evaluates the efficiency, processes, and risk management of a company's operations, ensuring operational stability and performance. Choosing between ESG due diligence and operational due diligence depends on the priority of sustainability factors versus operational effectiveness within the specific investment or consulting context.

Connection

ESG due diligence evaluates environmental, social, and governance risks, while operational due diligence focuses on assessing business processes and operational efficiency. Both are interconnected as integrating ESG criteria into operational assessments helps identify sustainability risks that could impact long-term performance and compliance. Effective consulting combines these due diligences to enhance risk management, drive sustainable growth, and align operational practices with ESG standards.

Key Terms

Risk Assessment

Operational due diligence primarily evaluates a company's internal processes, systems, and management capabilities to identify operational risks, while ESG due diligence assesses environmental, social, and governance factors that may impact long-term sustainability and regulatory compliance. Risk assessment in operational due diligence focuses on efficiency, controls, and potential disruptions, whereas ESG risk assessment examines climate impact, social responsibility, and governance practices that could affect reputation and financial performance. Explore further insights to understand how integrating both due diligence approaches enhances comprehensive risk management strategies.

Compliance

Operational due diligence evaluates a company's internal processes, risk management, and regulatory compliance to ensure operational integrity and mitigate potential risks. ESG due diligence specifically examines environmental, social, and governance factors to assess sustainable practices and adherence to compliance standards related to social responsibility and environmental impact. Explore the key compliance criteria in both operational and ESG due diligence to enhance decision-making and risk assessment.

Value Creation

Operational due diligence evaluates business processes, operational efficiency, and risk management to enhance value creation and ensure sustainable performance. ESG due diligence assesses environmental, social, and governance factors, identifying risks and opportunities that impact long-term value and stakeholder trust. Discover how integrating both approaches drives comprehensive value creation and sustainable growth.

Source and External Links

Operational Due Diligence For M&A & Private Equity - Ansarada - Operational due diligence (ODD) is a process where a potential buyer reviews the operational aspects of a target company to ensure it fits their goals, assessing areas such as processes, supply chain, HR, technology, financial performance, risk management, and relationships to identify risks and opportunities before a merger, acquisition, or investment.

Operational due diligence - Wikipedia - ODD is the review of a target company's operational components during M&A or investments to validate the business plan feasibility, identify operational risks or value creation potential, and is often performed by third parties; it differs from other due diligence types like financial or commercial due diligence.

The Ultimate Guide to Operational Due Diligence (ODD) - ODD evaluates a target's operations including management team capability, operational processes, financial performance, technology systems, and customer/supplier relationships to identify bottlenecks, risks, and the ability to execute business plans during M&A or investment evaluations.

dowidth.com

dowidth.com