Digital forensics consulting specializes in investigating cybercrimes, analyzing digital evidence, and aiding legal proceedings with expert insights into data breaches and hacking incidents. Financial advisory consulting focuses on optimizing fiscal strategies, managing investments, and ensuring regulatory compliance to enhance corporate financial health. Discover how each consulting domain uniquely addresses critical business challenges and learn which expertise aligns with your organizational needs.

Why it is important

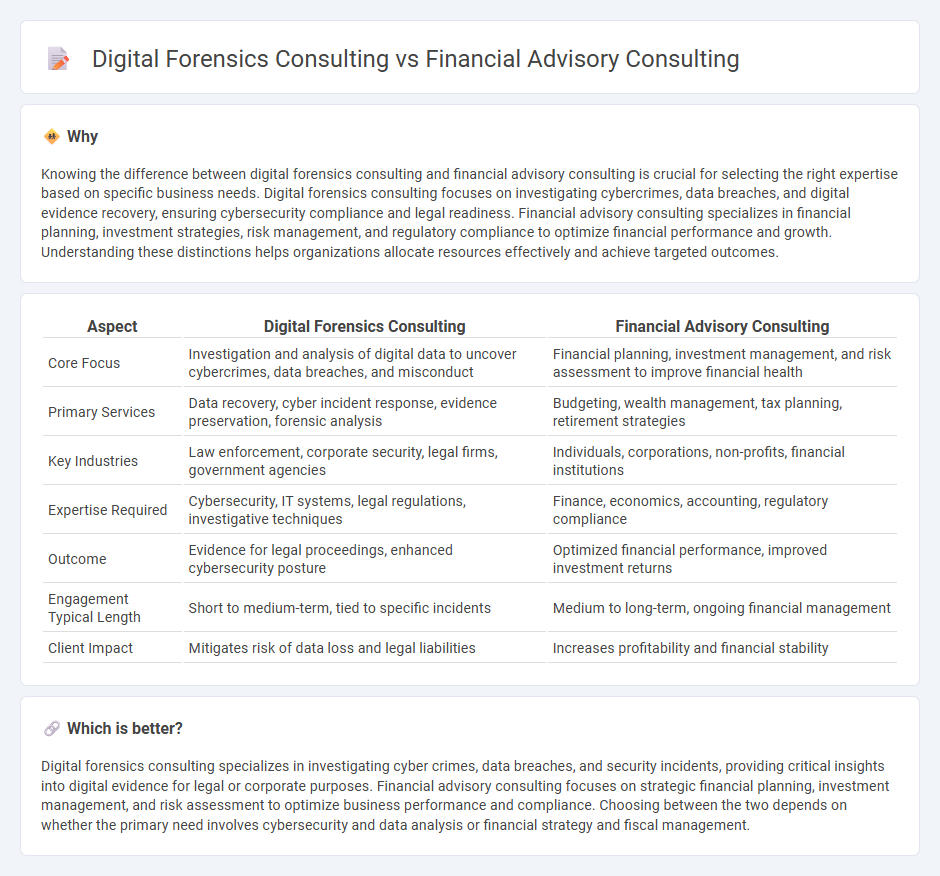

Knowing the difference between digital forensics consulting and financial advisory consulting is crucial for selecting the right expertise based on specific business needs. Digital forensics consulting focuses on investigating cybercrimes, data breaches, and digital evidence recovery, ensuring cybersecurity compliance and legal readiness. Financial advisory consulting specializes in financial planning, investment strategies, risk management, and regulatory compliance to optimize financial performance and growth. Understanding these distinctions helps organizations allocate resources effectively and achieve targeted outcomes.

Comparison Table

| Aspect | Digital Forensics Consulting | Financial Advisory Consulting |

|---|---|---|

| Core Focus | Investigation and analysis of digital data to uncover cybercrimes, data breaches, and misconduct | Financial planning, investment management, and risk assessment to improve financial health |

| Primary Services | Data recovery, cyber incident response, evidence preservation, forensic analysis | Budgeting, wealth management, tax planning, retirement strategies |

| Key Industries | Law enforcement, corporate security, legal firms, government agencies | Individuals, corporations, non-profits, financial institutions |

| Expertise Required | Cybersecurity, IT systems, legal regulations, investigative techniques | Finance, economics, accounting, regulatory compliance |

| Outcome | Evidence for legal proceedings, enhanced cybersecurity posture | Optimized financial performance, improved investment returns |

| Engagement Typical Length | Short to medium-term, tied to specific incidents | Medium to long-term, ongoing financial management |

| Client Impact | Mitigates risk of data loss and legal liabilities | Increases profitability and financial stability |

Which is better?

Digital forensics consulting specializes in investigating cyber crimes, data breaches, and security incidents, providing critical insights into digital evidence for legal or corporate purposes. Financial advisory consulting focuses on strategic financial planning, investment management, and risk assessment to optimize business performance and compliance. Choosing between the two depends on whether the primary need involves cybersecurity and data analysis or financial strategy and fiscal management.

Connection

Digital forensics consulting and financial advisory consulting intersect in investigating and analyzing financial crimes, including fraud and embezzlement, where digital evidence plays a critical role. Experts in digital forensics provide technical insights by recovering and interpreting electronic data, which supports financial advisors in reconstructing financial transactions and advising on risk mitigation. This collaboration enhances the accuracy of financial investigations and strengthens the overall integrity of financial advisory services.

Key Terms

**Financial advisory consulting:**

Financial advisory consulting specializes in providing expert guidance on investments, risk management, mergers and acquisitions, and financial planning to optimize business performance and profitability. This sector leverages quantitative analysis, market trends, and regulatory compliance to deliver tailored financial strategies. Explore more to understand how financial advisory consulting drives strategic growth and sustainable financial health.

Valuation

Financial advisory consulting specializes in valuation by analyzing market trends, financial statements, and risk factors to estimate the fair value of assets or businesses for mergers, acquisitions, or investment purposes. Digital forensics consulting involves valuation indirectly by assessing the financial impact of cyber incidents, data breaches, and intellectual property theft to support legal and insurance claims. Explore further to understand how valuation approaches differ significantly between financial advisory and digital forensics consulting.

Mergers & Acquisitions (M&A)

Financial advisory consulting in Mergers & Acquisitions (M&A) provides strategic insights, valuation analysis, and due diligence to ensure informed deal-making and risk mitigation. Digital forensics consulting in M&A focuses on uncovering digital evidence, detecting fraud, and securing electronic data integrity during transactions. Explore these specialized consulting services to enhance your M&A success.

Source and External Links

What Is a Financial Consultant and What Do They Do? - SmartAsset - Financial advisory consulting involves personalized financial planning, investment guidance, tax and estate planning, and wealth management tailored to help clients achieve goals like retirement or buying a home, often provided by specialists such as Certified Financial Planners or Chartered Financial Consultants.

Financial Advisory - Consulting.us - Financial advisory consulting focuses on offering expert advice in corporate finance, risk management, tax, compliance, and transaction services, typically supporting CFO functions with specialized financial and accounting expertise rather than general management consulting.

Financial Advisory | Consultancy.org - Financial advisory consulting encompasses a broad spectrum of services grounded in financial analytics, including transaction advisory, risk and tax consulting, real estate advisory, compliance, and employee benefits like pensions, often delivered by firms rooted in accounting and consulting.

dowidth.com

dowidth.com