Climate risk advisory focuses on identifying, assessing, and managing environmental risks that impact business operations and investment decisions, leveraging data on carbon emissions, regulatory compliance, and climate-related financial disclosures. M&A advisory centers on facilitating mergers and acquisitions by providing strategic guidance, due diligence, valuation analysis, and negotiation support to optimize deal outcomes and shareholder value. Discover how tailored consulting services can drive sustainable growth and strategic success in these critical areas.

Why it is important

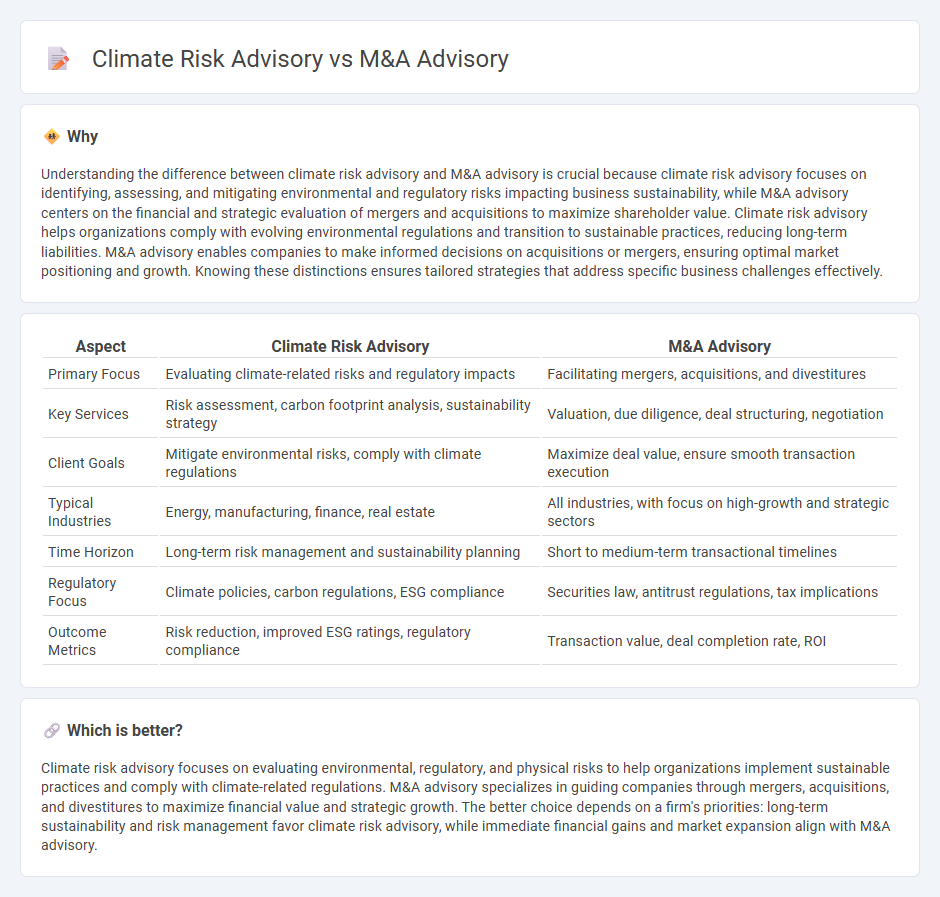

Understanding the difference between climate risk advisory and M&A advisory is crucial because climate risk advisory focuses on identifying, assessing, and mitigating environmental and regulatory risks impacting business sustainability, while M&A advisory centers on the financial and strategic evaluation of mergers and acquisitions to maximize shareholder value. Climate risk advisory helps organizations comply with evolving environmental regulations and transition to sustainable practices, reducing long-term liabilities. M&A advisory enables companies to make informed decisions on acquisitions or mergers, ensuring optimal market positioning and growth. Knowing these distinctions ensures tailored strategies that address specific business challenges effectively.

Comparison Table

| Aspect | Climate Risk Advisory | M&A Advisory |

|---|---|---|

| Primary Focus | Evaluating climate-related risks and regulatory impacts | Facilitating mergers, acquisitions, and divestitures |

| Key Services | Risk assessment, carbon footprint analysis, sustainability strategy | Valuation, due diligence, deal structuring, negotiation |

| Client Goals | Mitigate environmental risks, comply with climate regulations | Maximize deal value, ensure smooth transaction execution |

| Typical Industries | Energy, manufacturing, finance, real estate | All industries, with focus on high-growth and strategic sectors |

| Time Horizon | Long-term risk management and sustainability planning | Short to medium-term transactional timelines |

| Regulatory Focus | Climate policies, carbon regulations, ESG compliance | Securities law, antitrust regulations, tax implications |

| Outcome Metrics | Risk reduction, improved ESG ratings, regulatory compliance | Transaction value, deal completion rate, ROI |

Which is better?

Climate risk advisory focuses on evaluating environmental, regulatory, and physical risks to help organizations implement sustainable practices and comply with climate-related regulations. M&A advisory specializes in guiding companies through mergers, acquisitions, and divestitures to maximize financial value and strategic growth. The better choice depends on a firm's priorities: long-term sustainability and risk management favor climate risk advisory, while immediate financial gains and market expansion align with M&A advisory.

Connection

Climate risk advisory and M&A advisory intersect by evaluating environmental liabilities and regulatory risks during mergers and acquisitions, ensuring informed investment decisions. Integrating climate risk assessments into due diligence processes identifies potential financial exposures and compliance challenges that could impact transaction value. This alignment fosters sustainable deal structures and mitigates reputational risks for acquiring entities in evolving regulatory landscapes.

Key Terms

**M&A Advisory:**

M&A advisory specializes in guiding businesses through mergers, acquisitions, and divestitures to maximize transaction value and ensure regulatory compliance. Experts analyze financials, conduct due diligence, and develop strategies to optimize deal structures and integration processes. Explore the critical benefits and methodologies of M&A advisory to enhance your corporate growth strategy.

Due Diligence

M&A advisory due diligence emphasizes evaluating financial performance, legal liabilities, and operational risks to ensure accurate valuation and informed deal-making. Climate risk advisory due diligence focuses on assessing environmental impacts, regulatory compliance, and climate-related financial risks that may affect asset valuation and long-term sustainability. Explore how integrating both due diligence approaches can enhance decision-making in complex transactions.

Valuation

M&A advisory emphasizes valuation techniques that assess synergies, market positioning, and financial performance to determine deal value accurately. Climate risk advisory integrates valuation models that factor in environmental liabilities, regulatory impacts, and transition risks influencing asset worth and investment decisions. Explore our expert insights to understand how these valuation approaches shape strategic outcomes in both domains.

Source and External Links

What is M&A advisory? Key roles and their functions - M&A Community - M&A advisory involves third-party experts guiding companies through mergers, acquisitions, and capital raising by providing strategic planning, market analysis, valuation, deal structuring, due diligence, negotiation, financing, legal compliance, and integration planning.

Who are M&A Advisors and What Do They Do? - DealRoom.net - M&A advisory firms act as specialized intermediaries, advising both buyers and sellers on evaluating deals, negotiating terms, and managing the legal and financial complexities of M&A transactions, typically earning fees based on transaction value.

What Is a M&A Advisory Firm? - SmartAsset - M&A advisory firms serve as middlemen in the sale or purchase of businesses, offering expertise in deal structuring, financing, and succession planning, with clients often being private company owners seeking to sell all or part of their business.

dowidth.com

dowidth.com