Behavioral science consulting focuses on understanding human decision-making and behavior to improve organizational outcomes, leveraging insights from psychology, neuroscience, and social sciences. Financial consulting centers on optimizing financial performance, risk management, and strategic investment decisions using quantitative analysis and economic principles. Explore how each consulting domain drives value through distinct expertise and methodologies.

Why it is important

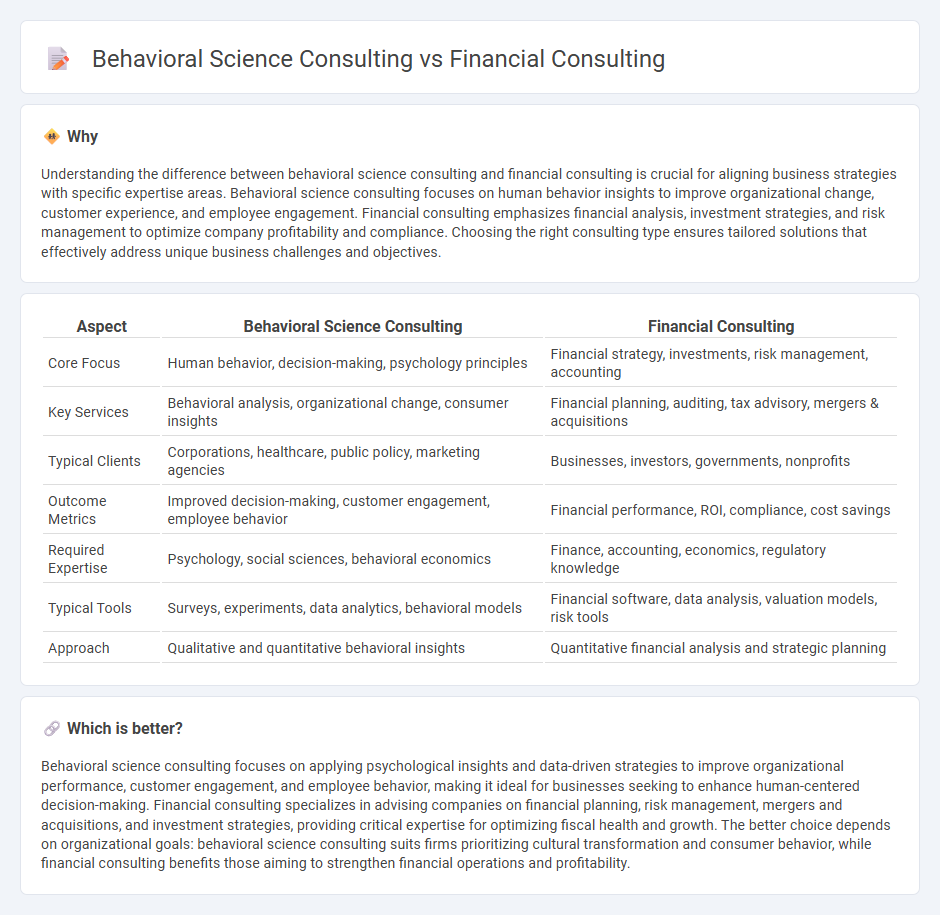

Understanding the difference between behavioral science consulting and financial consulting is crucial for aligning business strategies with specific expertise areas. Behavioral science consulting focuses on human behavior insights to improve organizational change, customer experience, and employee engagement. Financial consulting emphasizes financial analysis, investment strategies, and risk management to optimize company profitability and compliance. Choosing the right consulting type ensures tailored solutions that effectively address unique business challenges and objectives.

Comparison Table

| Aspect | Behavioral Science Consulting | Financial Consulting |

|---|---|---|

| Core Focus | Human behavior, decision-making, psychology principles | Financial strategy, investments, risk management, accounting |

| Key Services | Behavioral analysis, organizational change, consumer insights | Financial planning, auditing, tax advisory, mergers & acquisitions |

| Typical Clients | Corporations, healthcare, public policy, marketing agencies | Businesses, investors, governments, nonprofits |

| Outcome Metrics | Improved decision-making, customer engagement, employee behavior | Financial performance, ROI, compliance, cost savings |

| Required Expertise | Psychology, social sciences, behavioral economics | Finance, accounting, economics, regulatory knowledge |

| Typical Tools | Surveys, experiments, data analytics, behavioral models | Financial software, data analysis, valuation models, risk tools |

| Approach | Qualitative and quantitative behavioral insights | Quantitative financial analysis and strategic planning |

Which is better?

Behavioral science consulting focuses on applying psychological insights and data-driven strategies to improve organizational performance, customer engagement, and employee behavior, making it ideal for businesses seeking to enhance human-centered decision-making. Financial consulting specializes in advising companies on financial planning, risk management, mergers and acquisitions, and investment strategies, providing critical expertise for optimizing fiscal health and growth. The better choice depends on organizational goals: behavioral science consulting suits firms prioritizing cultural transformation and consumer behavior, while financial consulting benefits those aiming to strengthen financial operations and profitability.

Connection

Behavioral science consulting and financial consulting intersect by leveraging insights into human decision-making to improve financial strategies and client outcomes. Behavioral science helps identify cognitive biases and emotional factors influencing investor behavior, enhancing risk assessment and portfolio management in financial consulting. Integrating these disciplines leads to more effective financial advice tailored to real-world psychological drivers and market dynamics.

Key Terms

**Financial Consulting:**

Financial consulting centers on advising clients about investment strategies, risk management, and financial planning to maximize returns and ensure fiscal stability. It involves analyzing market trends, portfolio management, and regulatory compliance to help businesses and individuals optimize their financial outcomes. Explore more to understand how financial consulting can transform your economic decisions.

Risk Management

Financial consulting in risk management centers on quantitative analysis, portfolio optimization, and regulatory compliance to mitigate fiscal risks. Behavioral science consulting applies psychological insights to understand decision-making biases and improve risk perception and communication within organizations. Discover how combining these approaches enhances comprehensive risk management strategies.

Capital Structure

Financial consulting emphasizes optimizing capital structure through debt-equity ratios, cost of capital analysis, and risk management strategies to enhance firm value and shareholder returns. Behavioral science consulting examines how cognitive biases and group dynamics influence financial decisions, aiming to improve capital allocation by addressing irrational behaviors in executives and investors. Explore how integrating these disciplines can lead to more effective capital structure decisions and sustainable financial performance.

Source and External Links

Financial Consultants: What They Do And How To Find One Near You - Financial consulting involves developing comprehensive financial plans including retirement, estate planning, tax strategies, and debt management, helping clients align their assets and goals with tailored strategies.

What Is a Financial Consultant? - NerdWallet - A financial consultant audits your current financial situation and develops strategies to meet long-term goals like retirement savings, investment choices, and may hold credentials such as ChFC for specialized planning.

What Is a Financial Consultant and What Do They Do? - SmartAsset - Financial consultants provide personalized advice breaking down financial assets, expenses, and income to create plans for milestones like home buying, retirement, and education funding, with various specialties including financial planning and tax strategy.

dowidth.com

dowidth.com