Go-to-market acceleration focuses on swiftly enhancing sales strategies, customer engagement, and market penetration to rapidly increase revenue and competitive advantage. M&A integration involves the complex alignment of organizational structures, culture, and systems to ensure a seamless merger that maximizes synergies and operational efficiency. Explore our expert consulting services to optimize both growth initiatives and post-merger success.

Why it is important

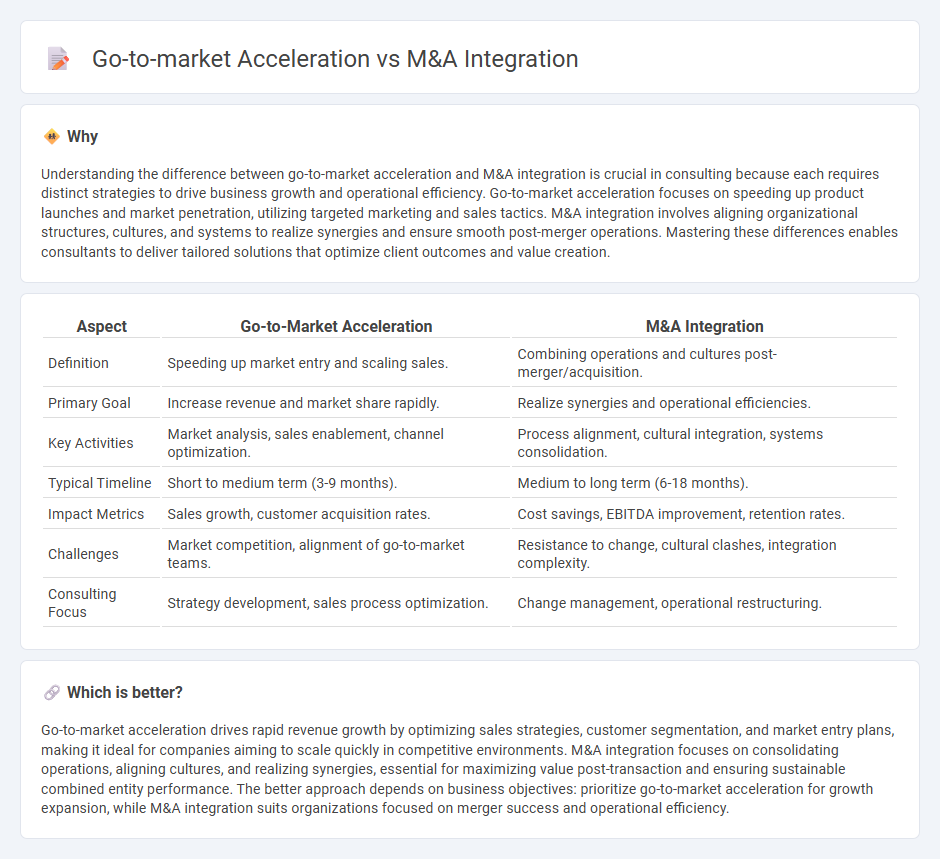

Understanding the difference between go-to-market acceleration and M&A integration is crucial in consulting because each requires distinct strategies to drive business growth and operational efficiency. Go-to-market acceleration focuses on speeding up product launches and market penetration, utilizing targeted marketing and sales tactics. M&A integration involves aligning organizational structures, cultures, and systems to realize synergies and ensure smooth post-merger operations. Mastering these differences enables consultants to deliver tailored solutions that optimize client outcomes and value creation.

Comparison Table

| Aspect | Go-to-Market Acceleration | M&A Integration |

|---|---|---|

| Definition | Speeding up market entry and scaling sales. | Combining operations and cultures post-merger/acquisition. |

| Primary Goal | Increase revenue and market share rapidly. | Realize synergies and operational efficiencies. |

| Key Activities | Market analysis, sales enablement, channel optimization. | Process alignment, cultural integration, systems consolidation. |

| Typical Timeline | Short to medium term (3-9 months). | Medium to long term (6-18 months). |

| Impact Metrics | Sales growth, customer acquisition rates. | Cost savings, EBITDA improvement, retention rates. |

| Challenges | Market competition, alignment of go-to-market teams. | Resistance to change, cultural clashes, integration complexity. |

| Consulting Focus | Strategy development, sales process optimization. | Change management, operational restructuring. |

Which is better?

Go-to-market acceleration drives rapid revenue growth by optimizing sales strategies, customer segmentation, and market entry plans, making it ideal for companies aiming to scale quickly in competitive environments. M&A integration focuses on consolidating operations, aligning cultures, and realizing synergies, essential for maximizing value post-transaction and ensuring sustainable combined entity performance. The better approach depends on business objectives: prioritize go-to-market acceleration for growth expansion, while M&A integration suits organizations focused on merger success and operational efficiency.

Connection

Go-to-market acceleration and M&A integration are interconnected through the rapid alignment of combined sales, marketing, and product strategies to capture market share efficiently. Effective M&A integration enhances go-to-market velocity by streamlining operations, consolidating customer bases, and leveraging cross-selling opportunities. Optimizing these processes drives revenue growth and maximizes the strategic value of mergers and acquisitions.

Key Terms

Synergy

M&A integration focuses on combining business operations to achieve cost-saving synergies and streamline workflows across merged entities. Go-to-market acceleration prioritizes revenue synergies by rapidly aligning sales, marketing, and product strategies to capture market share. Explore how optimizing synergy types can drive both operational efficiency and market growth.

Value Proposition

M&A integration centers on combining assets and operations to maximize synergies, streamline processes, and enhance the overall value proposition by leveraging complementary strengths. Go-to-market acceleration emphasizes rapid market entry, customer engagement, and revenue growth through targeted value proposition communication and optimized sales strategies. Explore how aligning these approaches can amplify your competitive advantage and drive sustainable business growth.

Change Management

Effective M&A integration requires robust change management strategies to align organizational cultures, processes, and systems rapidly, minimizing disruption. In contrast, go-to-market acceleration emphasizes agile change management to swiftly adapt sales, marketing, and customer engagement models for faster revenue growth. Explore how mastering change management can drive success in both M&A integration and go-to-market acceleration.

Source and External Links

Post Merger Integration: Checklist, Framework, Examples & ... - M&A integration, or Post-merger Integration (PMI), is the process of combining companies to maximize synergies, starting planning early in the deal lifecycle and involving cross-functional teams to manage dependencies and governance effectively.

What is Integration in M&A - M&A integration connects separate companies to operate together, with common strategies being Targeted Integration (light-touch), Full Integration (complete absorption), and Functional Integration where specific functions are merged to capture synergies.

The 10 Steps to Successful M&A Integration - Successful integration involves starting integration planning during due diligence, tracking financial value, and increasingly using digital tools and AI to streamline integration processes and accelerate value realization.

dowidth.com

dowidth.com