Sales enablement consulting focuses on optimizing sales processes, tools, and training to boost revenue generation, while financial consulting centers on managing budgets, investments, and financial strategies to enhance fiscal health. Both services tailor solutions to improve business performance but target distinct operational areas--sales growth versus financial stability. Discover how each consulting type can uniquely transform your organization's success.

Why it is important

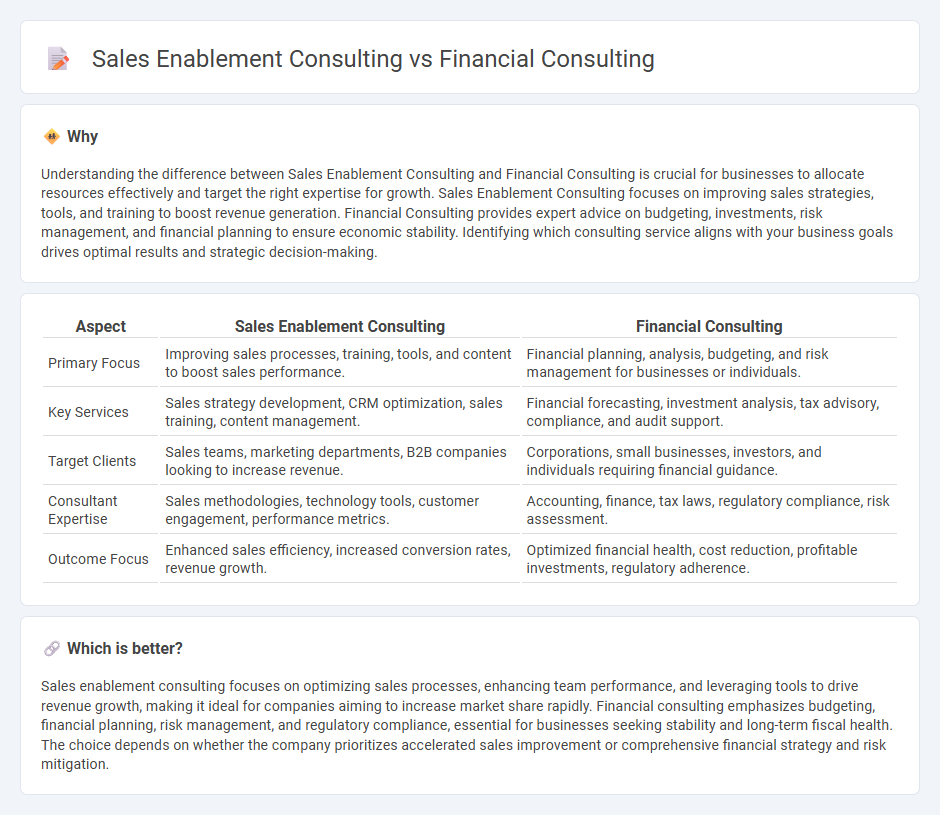

Understanding the difference between Sales Enablement Consulting and Financial Consulting is crucial for businesses to allocate resources effectively and target the right expertise for growth. Sales Enablement Consulting focuses on improving sales strategies, tools, and training to boost revenue generation. Financial Consulting provides expert advice on budgeting, investments, risk management, and financial planning to ensure economic stability. Identifying which consulting service aligns with your business goals drives optimal results and strategic decision-making.

Comparison Table

| Aspect | Sales Enablement Consulting | Financial Consulting |

|---|---|---|

| Primary Focus | Improving sales processes, training, tools, and content to boost sales performance. | Financial planning, analysis, budgeting, and risk management for businesses or individuals. |

| Key Services | Sales strategy development, CRM optimization, sales training, content management. | Financial forecasting, investment analysis, tax advisory, compliance, and audit support. |

| Target Clients | Sales teams, marketing departments, B2B companies looking to increase revenue. | Corporations, small businesses, investors, and individuals requiring financial guidance. |

| Consultant Expertise | Sales methodologies, technology tools, customer engagement, performance metrics. | Accounting, finance, tax laws, regulatory compliance, risk assessment. |

| Outcome Focus | Enhanced sales efficiency, increased conversion rates, revenue growth. | Optimized financial health, cost reduction, profitable investments, regulatory adherence. |

Which is better?

Sales enablement consulting focuses on optimizing sales processes, enhancing team performance, and leveraging tools to drive revenue growth, making it ideal for companies aiming to increase market share rapidly. Financial consulting emphasizes budgeting, financial planning, risk management, and regulatory compliance, essential for businesses seeking stability and long-term fiscal health. The choice depends on whether the company prioritizes accelerated sales improvement or comprehensive financial strategy and risk mitigation.

Connection

Sales enablement consulting and financial consulting intersect by driving revenue growth through strategic alignment of sales processes and financial planning. Financial consulting provides data-driven insights and budgeting frameworks that enhance sales enablement strategies, ensuring resource optimization and measurable ROI. This synergy improves forecasting accuracy and enables sales teams to target high-value opportunities with better financial accountability.

Key Terms

**Financial consulting:**

Financial consulting specializes in analyzing companies' financial health to optimize budgeting, forecasting, and risk management strategies, ensuring sustainable growth and compliance with regulatory standards. It involves detailed financial modeling, investment analysis, and strategic planning to improve profitability and operational efficiency. Explore how financial consulting can transform your business performance and unlock new growth opportunities.

Financial analysis

Financial consulting primarily emphasizes in-depth financial analysis to improve budgeting, forecasting, and investment strategies for businesses, ensuring optimal financial health and decision-making. Sales enablement consulting incorporates financial analysis to align sales strategies with revenue goals, optimizing resource allocation and performance metrics for increased profitability. Explore the detailed differences and benefits of each consulting type to enhance your business outcomes.

Risk management

Financial consulting emphasizes risk management by assessing financial risks, implementing controls, and optimizing capital allocation to protect assets and ensure regulatory compliance. Sales enablement consulting focuses on mitigating risks in sales processes through training, technology integration, and performance analytics to improve accuracy and reduce revenue loss. Explore more to understand how each consulting type uniquely addresses risk management challenges.

Source and External Links

Financial Consultants: What They Do And How To Find One Near You - Financial consulting involves developing comprehensive financial plans including retirement, estate planning, tax strategies, and debt management, helping clients meet short- and long-term goals based on their financial situation and risk tolerance.

What Is a Financial Consultant? - NerdWallet - A financial consultant audits your current finances and creates strategies to support long-term goals like retirement savings, tax preparation, and insurance, often holding certifications such as Chartered Financial Consultant (ChFC).

What Is a Financial Consultant and What Do They Do? - SmartAsset - Financial consultants analyze clients' finances, provide personalized planning for goals such as buying a home or retirement, and may specialize in areas including tax planning, estate planning, investing, or insurance, with roles ranging widely in services and certifications.

dowidth.com

dowidth.com